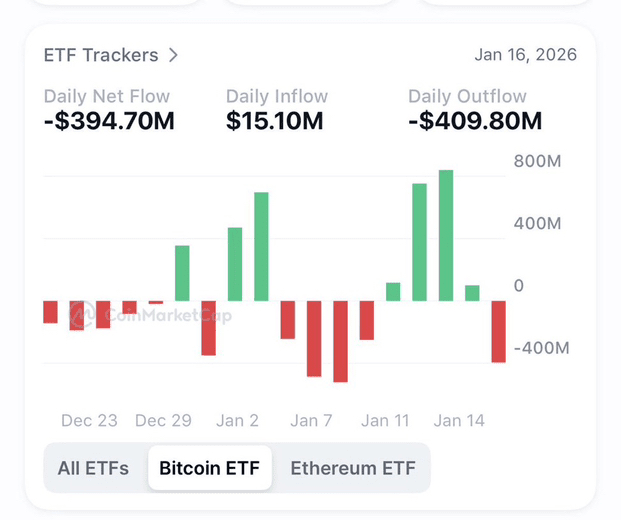

Bitcoin exchange-traded funds recorded net outflows of approximately 395 million dollars during a single trading session.

Bitcoin spot exchange-traded funds reflected sharp institutional caution instead of individual panic.

The cryptocurrency market's sentiment has shifted to caution as investors reduce short-term risks.

Outflows from Bitcoin ETFs may slow bullish momentum, but they do not weaken long-term adoption.

The spot ETFs in the United States experienced a sharp reversal on Friday after one of the largest single-day net capital outflows was recorded. Investors pulled around 1,106 Bitcoin from these funds, wiping out nearly $395 million in value. This sudden withdrawal surprised many traders who expected ETF fund flows to remain stable amid the recent consolidation.

The outflows from Bitcoin ETF funds sent a clear message to the markets as institutional players sharply reduced their exposure. This shift came after weeks of relatively balanced flows and indicated renewed caution among major investors. This move also raised broader questions about short-term confidence in the Bitcoin price direction.

Market participants are currently closely monitoring ETF fund data as it continues to influence price trends and market sentiment. Outflows from Bitcoin ETF funds often reflect institutional positioning before significant price movements. Friday's figures suggest that investors reassessed risks after recent volatility and overall uncertainty.

Why did the outflows from Bitcoin ETF funds jump so sharply?

Several factors are likely behind the intense outflows from ETF funds on Friday. Traders responded to mixed macro signals, including uncertainty around interest rate forecasts and global liquidity conditions. These pressures often prompt institutions to temporarily reduce high-risk assets.

Profit-taking also played a major role as Bitcoin struggled to regain recent levels. Many funds locked in gains after weeks of sideways movement. When momentum weakens, large players often reduce exposure instead of waiting for confirmation.

The outflows from Bitcoin ETF funds also reflected caution ahead of upcoming economic data. Institutions typically reduce their positions before major announcements to manage downside risk. This defensive approach was clearly seen in the withdrawal figures on Friday.

Spot Bitcoin funds bear the full brunt of investor caution.

Spot Bitcoin ETF funds in the United States bore the full impact of the sell-off. These funds track Bitcoin prices directly, making them sensitive to rapid shifts in market sentiment. When confidence weakens, spot products usually experience immediate redemption.

Spot Bitcoin funds had attracted billions of dollars during previous inflow periods. However, Friday's events decisively reversed this trend. The flow volumes indicated that institutions acted collectively rather than gradually.

Despite the capital outflow, spot Bitcoin ETF funds still hold significant assets under management. A single large outflow day does not erase long-term adoption progress. However, these moves highlight how quickly institutional positioning can change.

Institutional behavior indicates a state of short-term uncertainty.

Outflows from Bitcoin ETF funds often reveal institutional thinking more clearly than price charts. Large funds typically move early and decisively when risk conditions change. Friday's activities demonstrated a strategic repositioning rather than emotional selling.

Institutions may have responded to uncertain macro trends and slowing Bitcoin momentum. Rising bond yields and mixed stock performance also influenced decision-making. These factors often indirectly affect exposure to cryptocurrencies.

Outflows from Bitcoin ETF funds do not necessarily indicate a long-term bearish expectation. Institutions may return to enter again once conditions stabilize. Historical experiences show that ETF funds often experience sharp reversals after large outflow days.

The long-term outlook for Bitcoin ETF funds remains strong.

Despite Friday's event, the long-term case for spot ETF funds remains strong. These products continue to attract institutional investors seeking regulated exposure. One volatile session does not negate months of structural growth.

The outflows from BTC ETF funds reflect market cycles more than fundamental rejection. Institutions often adjust their exposure frequently based on short-term conditions. Long-term adoption trends still support ETFs as a preferred investment vehicle.

Market participants should consider this episode as part of natural capital rotation. Volatility remains inherent in emerging asset classes such as cryptocurrencies. ETF funds make these shifts more apparent.

#BTCETF #BinanceSquareBTC #BinanceSquareFamily #BinanceSquare #news