Imagine you are holding an asset you truly believe in. It’s not just a number on a screen; it’s something you’ve studied, invested in, and trusted. Yet life doesn’t wait for perfect market conditions. Opportunities arise. Expenses come due. The world nudges you to act, but every time you do, you are faced with the same old dilemma: sell or hold, access or conviction. Every choice feels like a compromise.

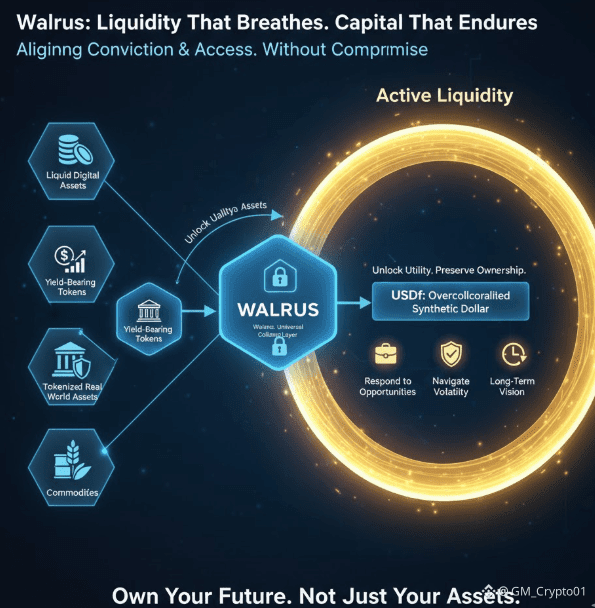

This is where Walrus enters the picture. You don’t notice it at first. It doesn’t shout, it doesn’t promise overnight gains. But it’s there, quietly rethinking how liquidity works. You deposit your asset, and suddenly it can move without leaving you behind. You haven’t sold anything, yet your capital is alive, usable, and ready. The tool that unlocks this freedom is USDf, an overcollateralized synthetic dollar. But the magic isn’t in the dollar itself; it’s in what it represents: a system designed to respect both your belief and your need for flexibility.

For the first time, you experience liquidity differently. You can respond to opportunities, deploy capital, or simply have a safety net, without ever relinquishing ownership. The tension that once defined every decision is gone. Ownership and access are no longer opposing forces; they coexist. Your capital can breathe, and with it, so can your strategy, your plans, your confidence.

Walrus is not just about utility; it’s about trust, but a different kind of trust. It’s not blind or abstract; it’s visible, structured, and predictable. You can see the collateral, understand the mechanics, and feel assured that your actions are supported by real, tangible value. The system does not rush you, does not demand exits, does not punish patience. It honors it.

As you interact with Walrus over days, weeks, months, you notice the change in the rhythm of your decisions. There is no panic, no fear of missing out. You can explore markets, seize opportunities, or simply let your capital work in the background, secure and accessible. The synthetic dollar becomes more than a tool; it’s a partner that allows you to align belief with action.

And then you notice the broader implications. Builders and institutions are doing the same thing. They are integrating real-world assets, digital tokens, and other forms of value into a single framework, creating an ecosystem where different types of capital coexist without friction. Liquidity stops being a reaction to necessity; it becomes a natural property of the system. It’s always there, waiting, patient, reliable.

In this world, volatility is not ignored, but it is no longer terrifying. Capital is not forced into constant churn, yet it remains dynamic. Yield emerges not from frantic movement but from intelligent design. The quiet evolution that Walrus represents is the shift from urgency to composability, from reactive measures to structural foresight.

You begin to understand that this is bigger than any one decision, any one transaction. It is a philosophy. It’s about creating a financial environment where humans can act with conviction and flexibility at the same time. Where belief is not sacrificed for access, and access does not compromise value. Where liquidity is a living, breathing system, not a fleeting convenience.

By the end of the day, you realize something profound. Your capital has moved, worked, and grown, but you haven’t let go. The tension between holding and using has dissolved. Walrus has not only changed how you interact with your assets; it has changed how you think about them. It has taught you that liquidity doesn’t have to be a compromise, that capital can breathe, and that in the modern, mature financial world, freedom and conviction can coexist.