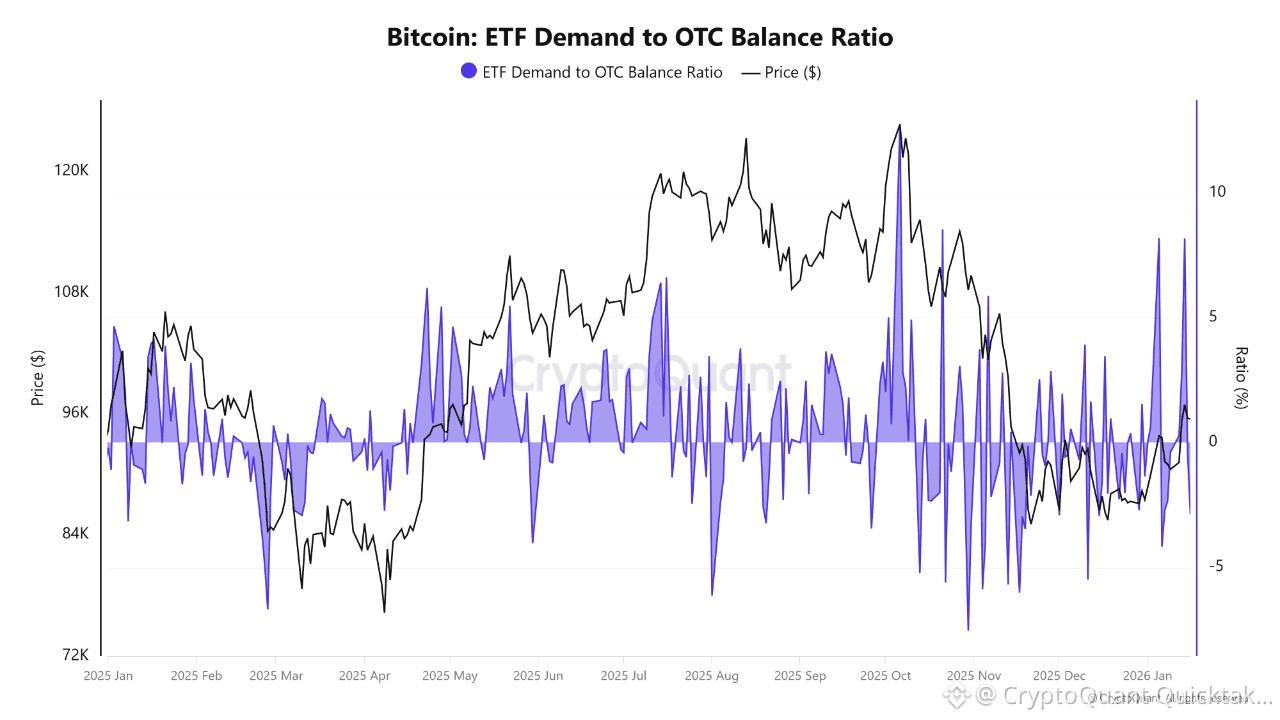

Recent data highlights a tightening relationship between ETF demand and OTC liquidity. The ETF Demand to OTC Balance Ratio has hovered around neutral but frequently prints sharp positive spikes. These moves indicate periods when ETF inflows absorb Bitcoin faster than OTC desks can replenish supply, pointing to structural liquidity tightening rather than short-lived noise.

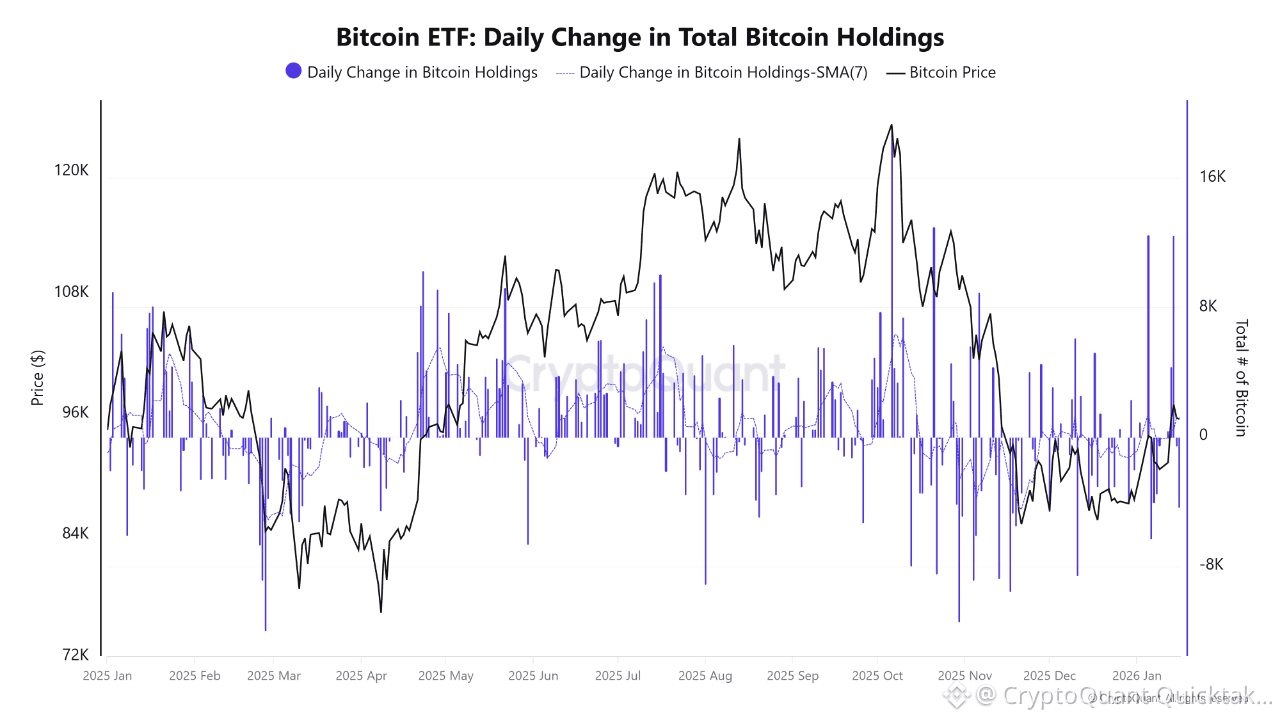

At the same time, the Daily Change in Total Bitcoin Holdings across ETFs reveals uneven, momentum-driven flows. Large inflow days often align with price expansions, while pronounced outflows tend to emerge near short-term tops or during corrective phases. This behavior suggests ETF activity is increasingly intertwined with price discovery, not merely passively tracking it.

The 7-day moving average adds important context by filtering out daily volatility. When it remains above zero, ETF demand consistently offsets circulating supply, supporting trend continuation. When it slips below zero, the market typically enters a rebalancing phase where price becomes more sensitive to marginal selling pressure.

From a macro on-chain perspective, ETFs have evolved into a dominant liquidity variable for Bitcoin. Price dynamics are now less about absolute inflows and more about the balance between ETF demand and available OTC supply. As long as this balance continues to register elevated or recurring positive spikes, localized supply constraints remain a key risk, keeping corrections relatively shallow compared with prior cycles.

Written by CryptoZeno