Plasma (XPL) consolidates its position as a key infrastructure in DeFi

@Plasma is rapidly positioning itself as one of the most relevant environments within the DeFi ecosystem, and recent data shared by Kairos Research reinforces this narrative.

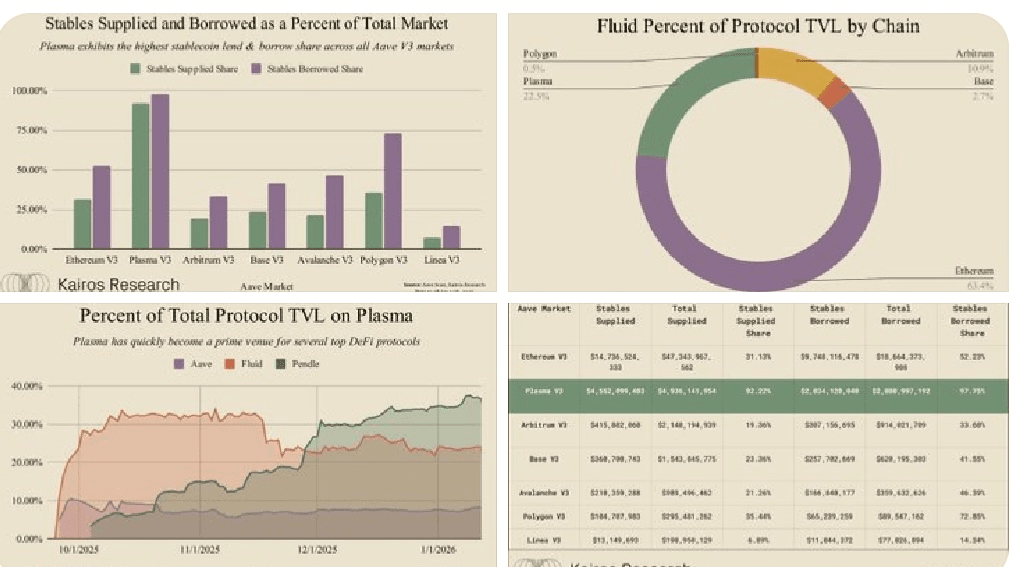

Plasma stands out for having the highest proportion of stablecoins supplied and borrowed within all Aave v3 markets, a key indicator of capital efficiency and real usage. This data not only reflects trust from users but also a sustained demand for stable liquidity within the network.

Another relevant point is that #plasma it is now positioned as the second blockchain with the highest TVL (Total Value Locked) among the main DeFi protocols, including Aave, Fluid, Pendle, and Ethena. This growth does not seem to be coincidental: metrics show a consistent trend of capital inflow, especially in lending protocols and yield strategies. In an environment where many chains compete for temporary liquidity, Plasma stands out for retaining it and putting it to work actively.

The image also highlights that Plasma hosts the largest on-chain liquidity pool for syrupUSDT, with approximately 200 million dollars, reinforcing its role as a hub for stablecoins. This type of liquidity concentration tends to attract both traders and protocols looking for market depth and low friction, creating a network effect that benefits the entire ecosystem.

At this point, the token $XPL is shaping up as a strategic piece, being directly linked to the growth of economic activity within the chain.

In broader terms, Plasma seems to be finding its niche: not competing for narrative, but for real use, efficient liquidity, and progressive institutional adoption. If these metrics hold or scale, XPL could consolidate as a representative asset of a mature DeFi infrastructure, focused more on sustainable performance than on short-term speculative cycles.