@Plasma If you live close to payments, you stop romanticizing “speed” pretty quickly. Speed is not the thrill of a fast confirmation in a calm market. Speed is what you need when someone’s rent is due, when a merchant is waiting with a crowded counter, when a payroll batch has to land before the weekend, when a business is converting balances across borders and one delay turns into a cascade of phone calls. Plasma reads like it was designed from that uncomfortable place where money is supposed to behave like electricity: present, boring, and non-negotiable. It positions itself as a stablecoin-native Layer 1 built specifically around USDT-style flows at scale, with the public story centered on near-instant settlement and fee expectations that don’t force users to “do crypto things” before they can simply pay.

What’s easy to miss is that payment-speed is not only about throughput. It’s about eliminating the little failure modes that make people feel foolish or unsafe: the transaction that technically went through but still looks pending, the transfer that fails because a wallet didn’t keep the right small balance, the moment when the network is “fine” but your user experience isn’t. Plasma’s recent launch framing keeps returning to that psychological reality: it treats stablecoins not as a side-asset riding on a general-purpose system, but as the main event. That decision changes what the chain prioritizes under stress, because the baseline user is not a trader tolerating quirks, it’s a person who just wants their digital dollars to move when life demands it.

The clearest snapshot of how Plasma wants to enter the world is not a whiteboard diagram, it’s the timeline of its own rollout. The project set an explicit moment for mainnet beta to go live—Thursday, September 25, 2025 at 8:00 AM ET—paired with the launch of its native token, XPL, and it did so while publicly anchoring expectations around day-one liquidity, not day-one narratives. It claimed $2B in stablecoins active from day one and described deployment across 100+ DeFi partners as a starting condition rather than a distant goal. That kind of launch posture is a choice: it says the chain wants to be judged immediately by whether money is actually there, moving, and useful.

But liquidity alone doesn’t buy trust. Trust is earned in the messy middle where people disagree about what happened, where dashboards lag, where rumors outrun blocks, and where support teams become the real interface to the chain. Plasma’s public communications put unusual emphasis on distribution mechanics—how deposits were gathered, how access was granted, how ownership was spread—because payment systems fail socially before they fail cryptographically. In its own recap, Plasma says more than $1B in stablecoin liquidity was committed to vaults in just over 30 minutes as part of a deposit campaign tied to public sale access, and that the public sale drew $373M in commitments despite a much smaller cap. The point isn’t the brag; it’s the signal that the chain is trying to manufacture a starting state where participation and liquidity are broad enough that the first crisis doesn’t become a single point of political failure.

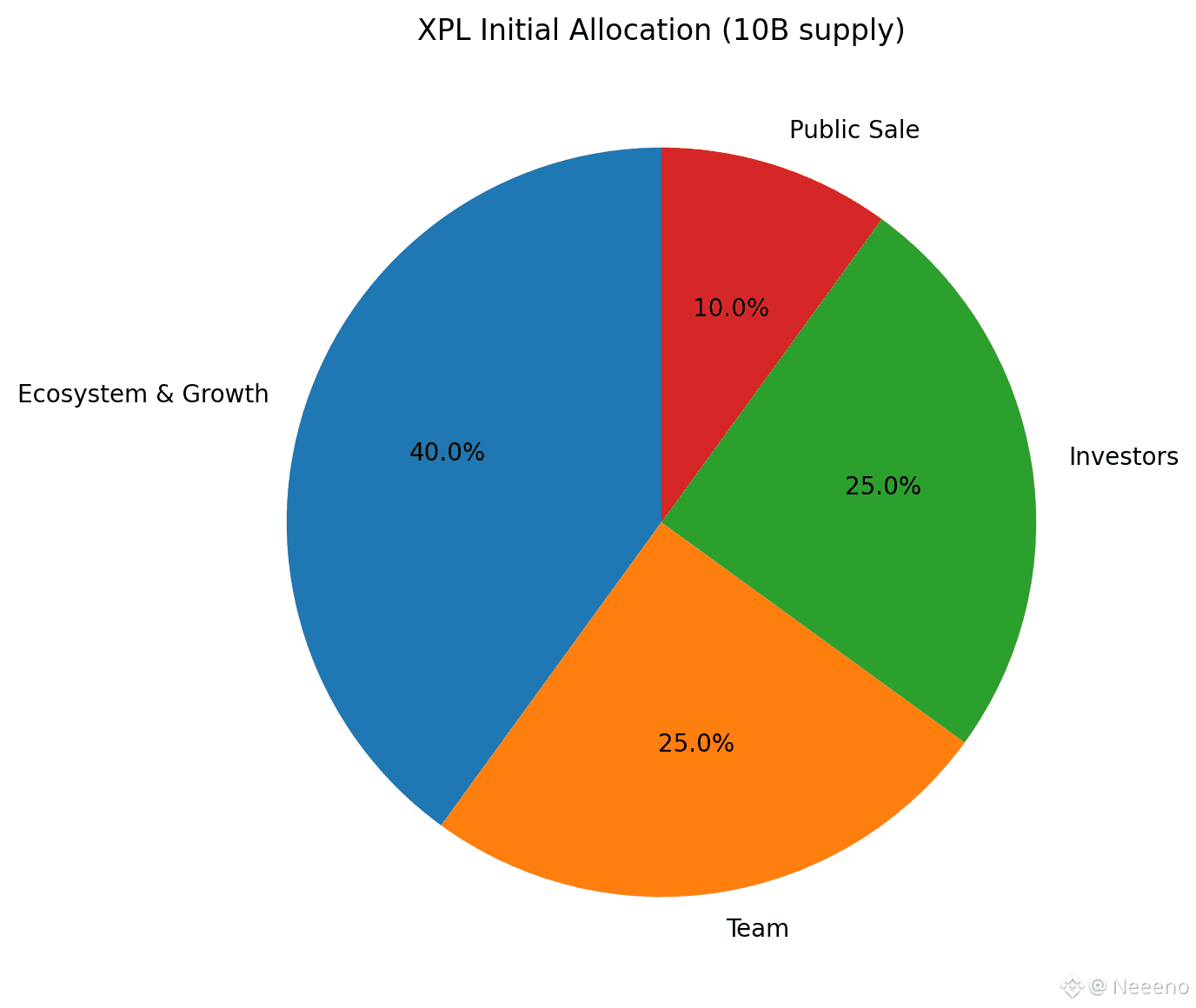

This is where XPL becomes more than “a token” in the abstract, because in payment rails the native asset is inevitably part of the governance of inconvenience—who gets subsidized, who pays when the system is stressed, who is incentivized to keep infrastructure honest when attention fades. Plasma’s own documentation describes an initial supply of 10,000,000,000 XPL at mainnet beta launch, while also acknowledging ongoing programmatic increases tied to the economics of validation over time. In other words, genesis supply is a starting line, not a permanent ceiling, and that is a sober admission: securing a fast settlement network costs something, and the bill has to be paid in a way that doesn’t turn every everyday user into collateral damage.

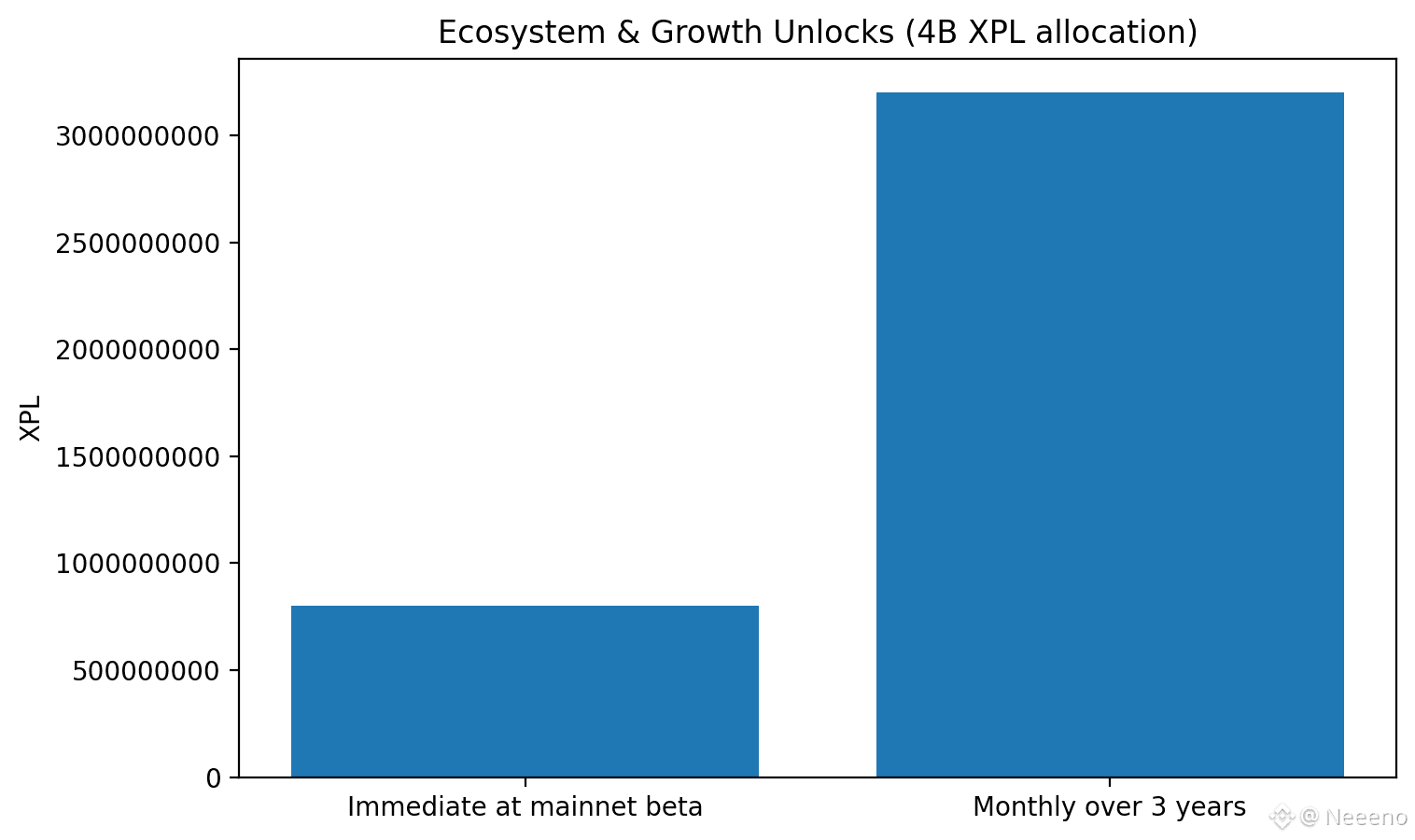

The distribution details matter because they shape how fear behaves in the market. Plasma documents 40% allocated to “Ecosystem and Growth,” with 8% unlocked immediately at mainnet beta launch and the remaining portion unlocking monthly over three years. It also assigns 25% each to team and investors on multi-year schedules, and 10% to a public sale with different unlock treatment depending on jurisdiction. The result is not just a chart of percentages; it’s a map of when supply pressure can realistically arrive, when builders might feel supported, and when early participants might feel betrayed or protected by the rules that were written before the token had a price.

The U.S. lockup clause is a small detail that becomes huge the first time markets panic. Plasma’s docs state that public-sale XPL purchased by U.S. purchasers is subject to a 12-month lockup and becomes fully unlocked on July 28, 2026. That single date matters because it’s the kind of thing traders, builders, and treasury teams will whisper about during volatility: not as gossip, but as a concrete moment when circulating supply dynamics can change, narratives can flip, and people can start projecting motives onto normal vesting mechanics. A payment chain can’t afford ambiguity here, because ambiguity turns into accusations, and accusations turn into fragility.

Plasma’s mainnet beta announcement also frames XPL ownership as part of a social contract: 10% sold to community members in the public sale, plus an additional 25 million XPL distributed to recognize smaller depositors who completed verification and participated. You can read that as marketing, but it’s also an operational bet: in systems meant to be used by normal people, concentrated ownership is not only a governance risk, it’s a perception risk. Perception becomes reality the first time fee policies change or a major integration gets preferential treatment. Spreading ownership early is one way to reduce the odds that users interpret every decision as extraction.

The other side of honest economics is admitting that incentives can be gamed. Payment chains attract adversaries who don’t care about ideology; they care about edge cases. The “simple” act of moving stablecoins at scale invites spam, denial-of-service attempts, routing tricks, and failure amplification through wallets and exchanges. Plasma’s public materials repeatedly emphasize operational safety—launching beta first, limiting certain subsidized behaviors during rollout, extending broader access over time—because the most expensive failures are the ones that teach users the system can’t protect them when it’s crowded.

Even when the chain is fine, the user’s experience depends on middlemen—wallets, exchanges, and apps—not the chain itself. Under pressure, those layers disagree. The chain has to be designed so disagreement resolves quickly and predictably, or else “payment-speed” turns into “payment anxiety.”

Since launch, the market has also been doing what markets do: turning infrastructure into a daily scoreboard. CoinMarketCap currently lists XPL with a circulating supply of 1,800,000,000 and shows price and volume moving sharply, including an all-time high in late September 2025 and an all-time low in December 2025. Those swings aren’t just trader trivia. They affect whether validators and service providers feel economically secure, whether ecosystem incentives feel “enough,” and whether users start to confuse token volatility with payment reliability. The chain has to survive that confusion, because the end user paying with stablecoins doesn’t want to inherit the emotional weather of the native asset.

When you step back, Plasma’s recent updates read like an attempt to force a very particular kind of maturity into the room. A fixed mainnet beta date, a stated day-one stablecoin figure, a public accounting of how participation was gathered, an explicit 10B genesis supply framing paired with ongoing validator economics, and concrete unlock mechanics including a U.S. date stamp. These aren’t the details that get applause in a hype cycle. They’re the details that keep a payment system from becoming a rumor factory when something goes wrong. And in payments, something always goes wrong—an integration breaks, a wallet mislabels a status, an exchange delays withdrawals, a region experiences sudden demand. The only question is whether the infrastructure stays calm enough that humans stay calm too.

Plasma’s promise, if you take it seriously, is not that it will be loved.

Plasma’s goal isn’t attention. It’s trust. And trust in payments comes from one thing: being there when it matters. That kind of reliability is invisible when it’s working, and brutal when it’s missing. Plasma’s recent record is mostly dates and numbers, not poetry: mainnet beta aimed for September 25, 2025; the project talked about roughly $2B in stablecoins active from day one and wide partner reach; XPL launched with a 10 billion genesis plan and a clear split of who gets what; 800 million XPL was unlocked right away for ecosystem use; U.S. public-sale XPL was set to unlock fully on July 28, 2026; and circulating supply around launch was commonly listed near 1.8B. These facts don’t promise a perfect future, but they do show a responsible mindset: state the terms clearly and build for continuity, not applause.