Walrus, a decentralized storage protocol built on the Sui blockchain, enables efficient, high-availability storage for large binary data (known as blobs) through a sophisticated economic model. Due to its distributed architecture, storage capacity and write operations require competitive yet collaborative pricing. Storage nodes compete to provide ample capacity at attractive rates, while the system aggregates their contributions into a unified offering for users. This mechanism ensures economic efficiency, predictable costs, and strong incentives for reliable participation.

Storage Resources: The Foundation of Ownership and Trading

In Walrus, storage is traded as storage resources, tokenized reservations recorded on the Sui blockchain. Each resource specifies a starting epoch, an ending epoch (up to two years in the future), and a size in terms of encoded storage needed for blobs.

Users acquire these resources when ready to store data, then upload the blob and establish its Point of Availability (PoA) an on-chain certificate proving the data is durably stored and reconstructible. Once the PoA is published, Walrus (via its nodes) assumes responsibility for maintaining availability throughout the resource's duration.

Storage resources offer flexibility: they can be split (across time periods or spatial shards), traded on a secondary market, or reassociated from a deleted blob to a new one. This creates a liquid, secondary market that enhances overall economic efficiency by allowing resources to flow to where they are most needed.

Determining Storage Quantity

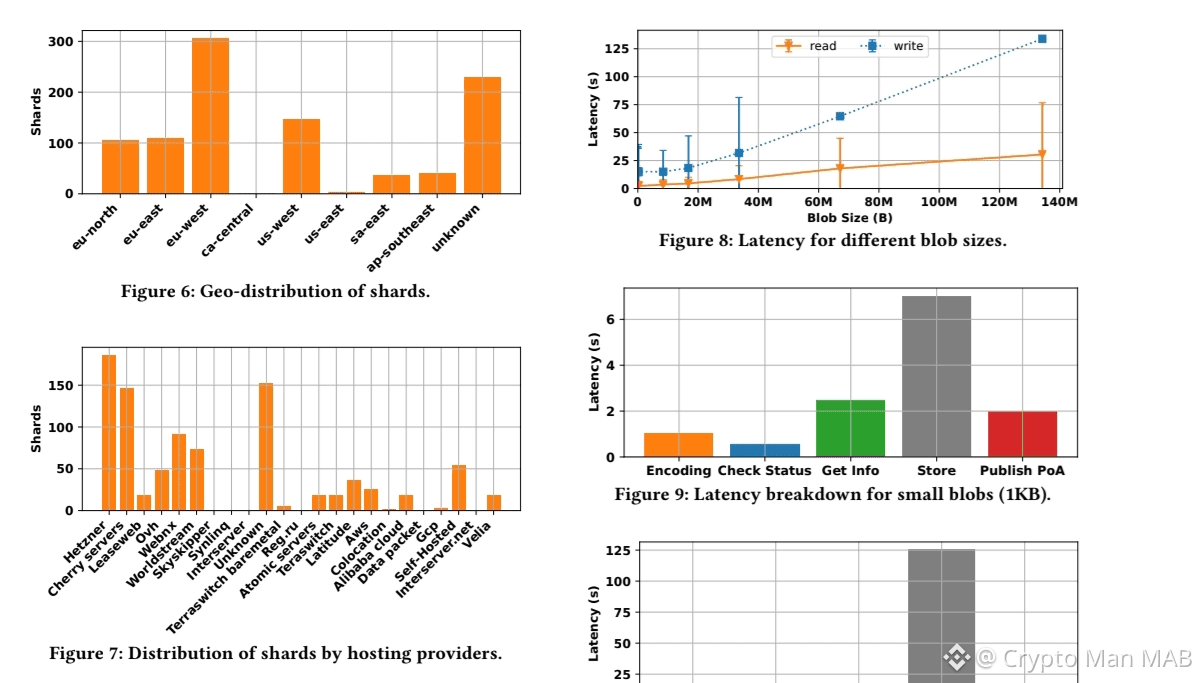

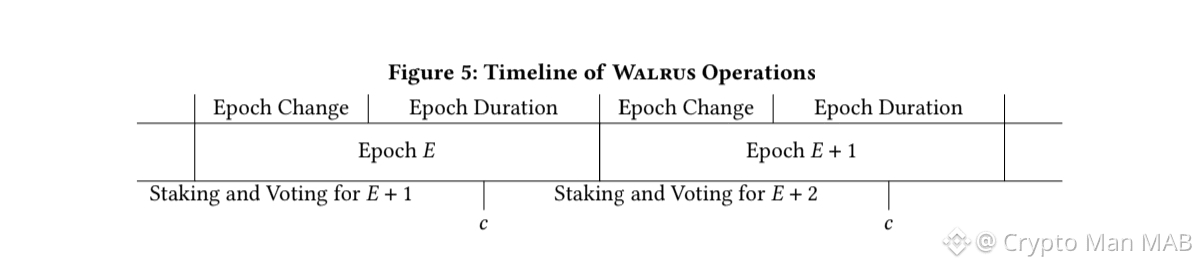

Storage nodes collectively decide the amount of storage available for sale each epoch. They vote on the system-wide shard size in advance of the epoch (before a fixed cutoff point). With a fixed number of shards and a replication factor (typically around 4-5x due to advanced erasure coding like RedStuff), this vote directly sets the total system capacity.

Voting mirrors staking mechanics: nodes submit proposals weighted by stake, and non-voters inherit their prior vote. Shard size proposals are sorted in decreasing order, and the 66.67th percentile (by stake weight) is selected--meaning two-thirds of stake-weighted proposals favor equal or larger sizes, while one-third favor smaller ones. This stake-weighted median approach resists manipulation and favors committed participants.

Unused storage (total capacity minus already committed amounts) becomes available for sale in the upcoming epoch. Users purchase resources by specifying size and an ending epoch, creating a fixed-term reservation.

To prevent long-term lock-in from early node decisions, ending epochs are capped at roughly two years ahead. If committed storage exceeds capacity, no new sales occur--but existing commitments remain enforceable, with nodes facing slashing for non-compliance (via availability challenges).

Walrus also supports efficient renewals: owners of existing blobs can extend coverage from the current ending epoch onward (again up to two years), paying the prevailing price. This provides a small renewal option benefit, as prices for the next epoch are typically known midway through the current one.

Pricing Storage and Writes

Nodes submit prices ahead of each epoch (before the same cutoff). They propose:

Storage price: per unit of storage per epoch.

Write price: per unit of encoded storage written.

Proposals are sorted independently in ascending order, and the 66.67th percentile (stake-weighted) is chosen ensuring two-thirds of stake favors equal or lower prices, promoting competitiveness while protecting against undercutting by low-stake actors.

The selected storage price applies directly. The write price receives a hardcoded multiplier (>1), creating a refundable deposit. This deposit incentivizes full distribution: Walrus assumes responsibility only after the PoA (requiring signatures from a threshold of nodes), but efficiency improves when users upload directly to all nodes rather than just the minimum (2f+1). The more signatures collected (reflected in the certificate), the larger the deposit refund--motivating broad uploads.

Payments to Storage Nodes

At launch, Walrus uses a straightforward payment flow:

Write payments: Users pay the current write price upon blob registration. These funds are distributed to nodes at epoch end.

Storage payments: Users prepay the full storage resource cost at purchase (regardless of when the blob is registered). Smart contracts allocate tokens to shard-level buckets, distributing them proportionally to assigned nodes at epoch end.

This prepaid, fixed-price model delivers two major advantages:

Price stability for users Costs are locked in upfront in WAL tokens. Users avoid exposure to WAL price volatility or mid-contract price hikes, while nodes cannot engage in predatory repricing.

Commitment enforcement Users cannot exit early without forfeiting payments, giving nodes confidence to lower future prices without risking mass cancellations of existing contracts.

Overall, Walrus's pricing and payment system balances competition among nodes with system-wide coordination, delivering predictable costs, strong availability guarantees, and incentives aligned toward long-term reliability in a decentralized storage ecosystem.