Zedger and Dusk Network represent a tightly integrated technological foundation designed to enable privacy-preserving, regulatory-compliant tokenization and management of real-world assets (RWAs) and securities on a public Layer 1 blockchain. While Dusk Network serves as the overarching privacy-first protocol built for institutional finance, Zedger functions as a specialized asset protocol and hybrid transaction model that powers its flagship use case: Confidential Security Contracts (XSC).

Dusk Network: The Privacy-First Layer 1 for Regulated Finance

Dusk Network is a permissionless Layer 1 blockchain launched with mainnet in early 2025, engineered specifically for the convergence of traditional finance (TradFi) and decentralized finance (DeFi). Its core mission is to unlock economic inclusion by bringing institution-grade assets such as stocks, bonds, funds, private equity, and other RWAs into self-custodial wallets while maintaining strict confidentiality and compliance.

Key distinguishing features of Dusk include:

Native zero-knowledge proofs (ZKPs) for confidential transactions and smart contracts.

Built-in compliance primitives (e.g., KYC/AML enforcement, transfer restrictions, selective disclosure).

Instant finality via its consensus mechanism (Segregated Byzantine Agreement with Proof-of-Blind Bid).

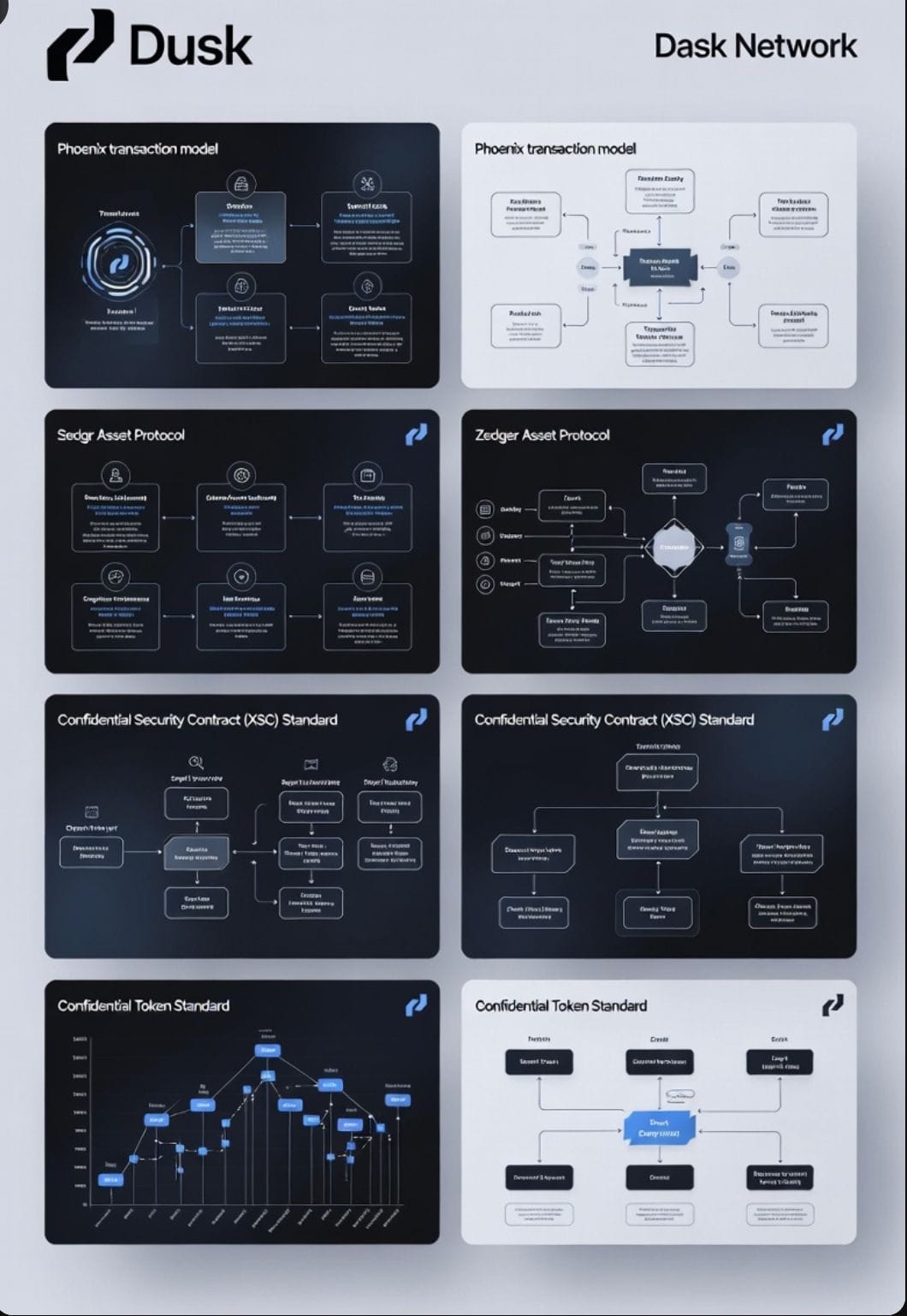

Dual transaction models: Phoenix for general confidential transfers (UTXO-based with provable sender revelation) and specialized models for regulated assets.

Support for frameworks like MiCA (EU crypto regulation), MiFID II, and DLT Pilot Regime.

Dusk positions itself not as a general-purpose chain but as infrastructure tailored for regulated markets, where privacy protects sensitive financial data while regulators and counterparties can verify necessary details.

What is Zedger?

Zedger is Dusk Network's proprietary asset protocol and hybrid transaction model, designed explicitly for the full lifecycle management of tokenized securities and compliant assets. It combines the strengths of UTXO (Unspent Transaction Output) models like strong privacy and double-spend prevention with account-based capabilities, such as persistent balances, programmable logic for compliance rules, and features essential for securities (e.g., capped transfers, redemption, dividend distribution, proxy voting).

Introduced as a cornerstone technology alongside Phoenix in late 2019 conceptual papers, Zedger has evolved into a production-ready component post-mainnet. It operates directly on Dusk's Rusk VM (a WebAssembly-based, ZK-friendly execution environment) and serves as the default transaction model for XSC-based assets.

Core technical attributes of Zedger:

Hybrid design Merges UTXO privacy (commitments, nullifiers, ZK proofs) with account-model usability (e.g., tracking ownership over time, enforcing issuer-defined rules).

Confidential lifecycle management Enables private issuance, transfers, redemptions, dividends, and voting without exposing balances or transaction details publicly.

Built-in compliance Supports regulatory requirements like preventing multiple accounts per user, transfer restrictions (e.g., lock-ups, accredited investor checks), and auditable yet private reporting.

Segregated privacy Allows issuers and holders to maintain confidentiality while enabling selective transparency (e.g., to regulators or counterparties via ZK proofs).

Zedger complements Phoenix: Phoenix handles general confidential payments and smart contract interactions (including spending from public outputs), while Zedger focuses on asset-specific functionality required for securities.

How Zedger Powers Dusk's Flagship Use Cases

Zedger is central to Dusk's Confidential Security Contract (XSC) standard the protocol's purpose-built framework for tokenized securities. XSC contracts, running on Zedger, embed compliance logic directly into the asset:

Issuance and fractionalization Companies or funds tokenize assets privately, enabling fractional ownership and broader access.

Compliant trading and settlement Transfers respect rules (e.g., no sales to unapproved parties), with atomic, instant finality.

Corporate actions Private dividend payouts, voting, redemptions--all without leaking sensitive data.

Hybrid regulated/non-regulated flows Via the Confidential Token Standard, Zedger assets interact seamlessly with non-regulated tokens.

Recent roadmap items (post-2025 mainnet) include Zedger beta launches for privacy-preserving asset tokenization, integrations with DuskEVM (for easier developer onboarding), and pilots with partners like NPEX (a regulated Dutch MTF) to bring European securities on-chain.

Zedger also underpins advanced features like Hedger (an EVM-compatible evolution running on Dusk's execution layer for broader asset management) and supports Dusk's push into MiCA-compliant payments and programmable staking.

Why Zedger + Dusk Matters in 2026

In an era of surging RWA interest--where institutions demand privacy, compliance, and on-chain efficiency Zedger addresses a critical gap. Most blockchains force trade-offs: full transparency (Ethereum), full anonymity (Monero), or bolted-on privacy. Dusk + Zedger delivers selective, programmable privacy natively, with formal security properties and regulatory alignment.

This makes Dusk suitable for high-stakes applications: tokenized corporate bonds, private funds, carbon credits, or even electronic money circuits. As adoption grows (via partnerships, Lightspeed L2 for scalability, and real tokenized issuances), Zedger stands as the engine turning regulatory hurdles into programmable, confidential advantages.

In summary, Dusk Network provides the secure, private blockchain foundation, while Zedger delivers the specialized transaction and asset logic needed to make compliant security tokenization a reality on-chain bridging TradFi rigor with blockchain's efficiency and inclusion potential.