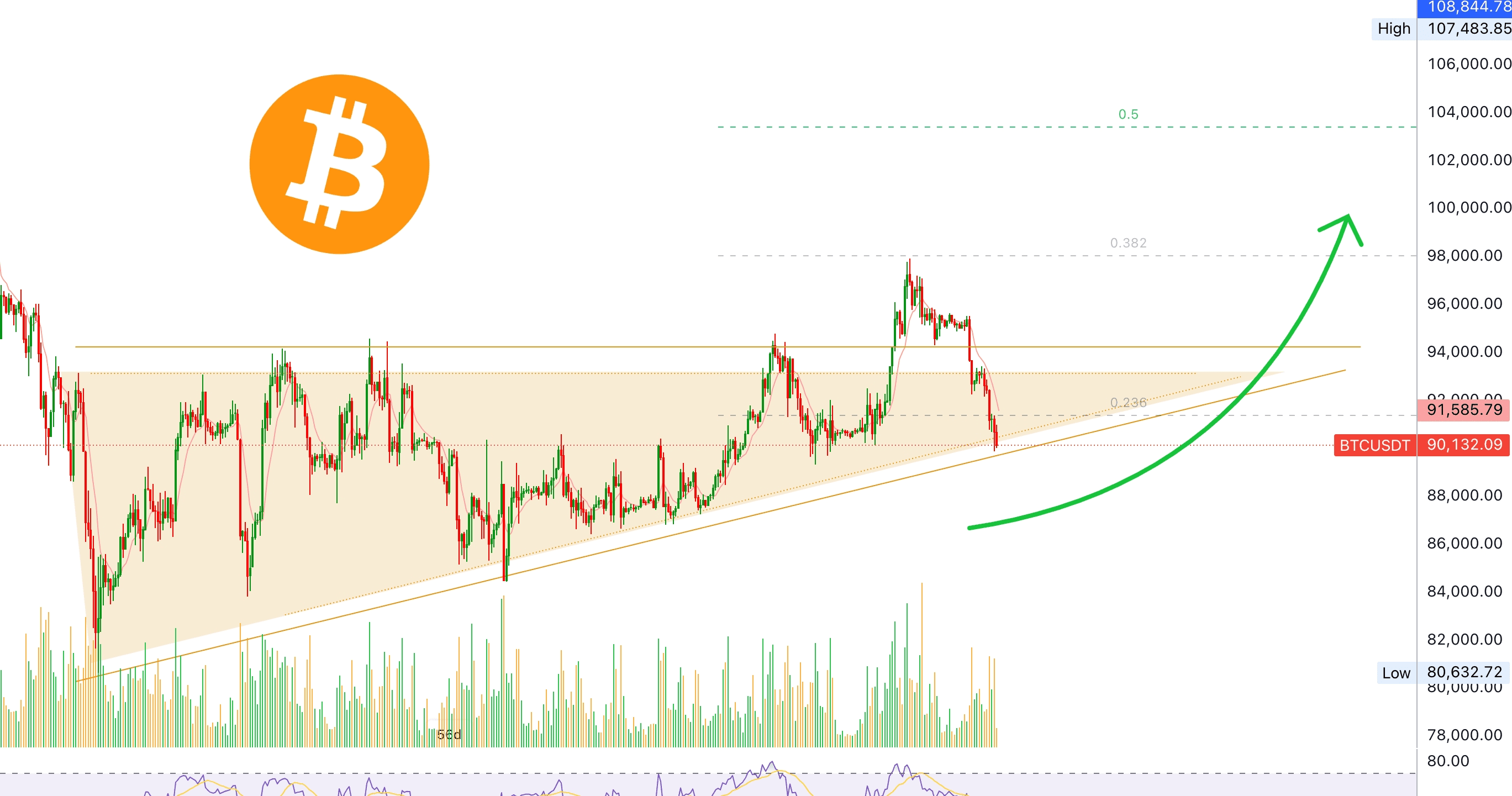

Bitcoin has now entered a significant turning zone. Many traders have become fearful after observing recent price action, but the technical signals tell a different story.

📉 RSI Oversold: Prothom Strong Signal

Bitcoin's 4H timeframe RSI has now entered the oversold zone, which is a very rare event. This kind of RSI level has only been seen a few times in the last few months, and each time it has been followed by a bullish bounce.

When RSI becomes oversold like this, it indicates that the sell pressure is gradually weakening.

🔻 Bearish momentum is decreasing

On January 15, the highest sell volume was seen in Bitcoin. However, recently, even though the price has made a new low, the volume is not as strong as before.

What does it mean?

👉 Sellers are exhausted

👉 Downtrend weak

This divergence usually signals a trend reversal.

🟥 6 Days of Consecutive Red Candle – History Repeat?

Bitcoin has seen very few instances of 5 or more consecutive red candles in its history.

Last time when there were 6 consecutive reds, the market rebounded strongly the next day.

Now the same pattern is forming again.

💰 Opportunity to buy below $90,000?

Bitcoin is still holding a strong higher-low structure.

In this context, if the price goes below $90K, it's not panic — rather an opportunity.

Smart money usually accumulates here.

📌 Big Picture

This dip is not the final story. It could be a relief rally or a pause before a new bullish leg.

For those who can manage risks with patience, this zone could be a game-changing entry.

🔚 Bottom Line

The market is scaring, but the data says otherwise.

RSI, volume, and historical patterns — all together, Bitcoin is standing in a bullish reversal zone.

Stay patient. Follow the strategy. Don't trade with emotion.