$XPL It didn't stand out to me because of marketing. It stood out because of the structure.

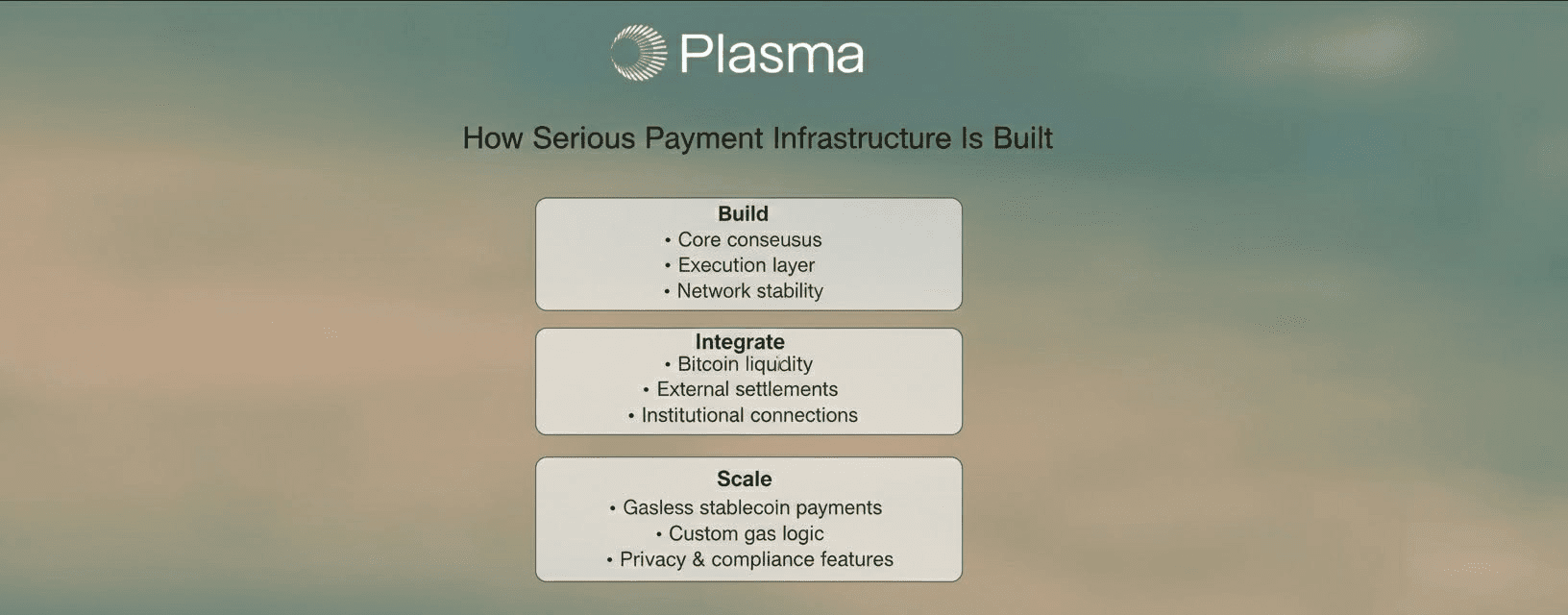

When I looked at Plasma's roadmap, what I saw wasn't a list of buzzwords. I saw a system built in layers—the way real financial infrastructure should be built.

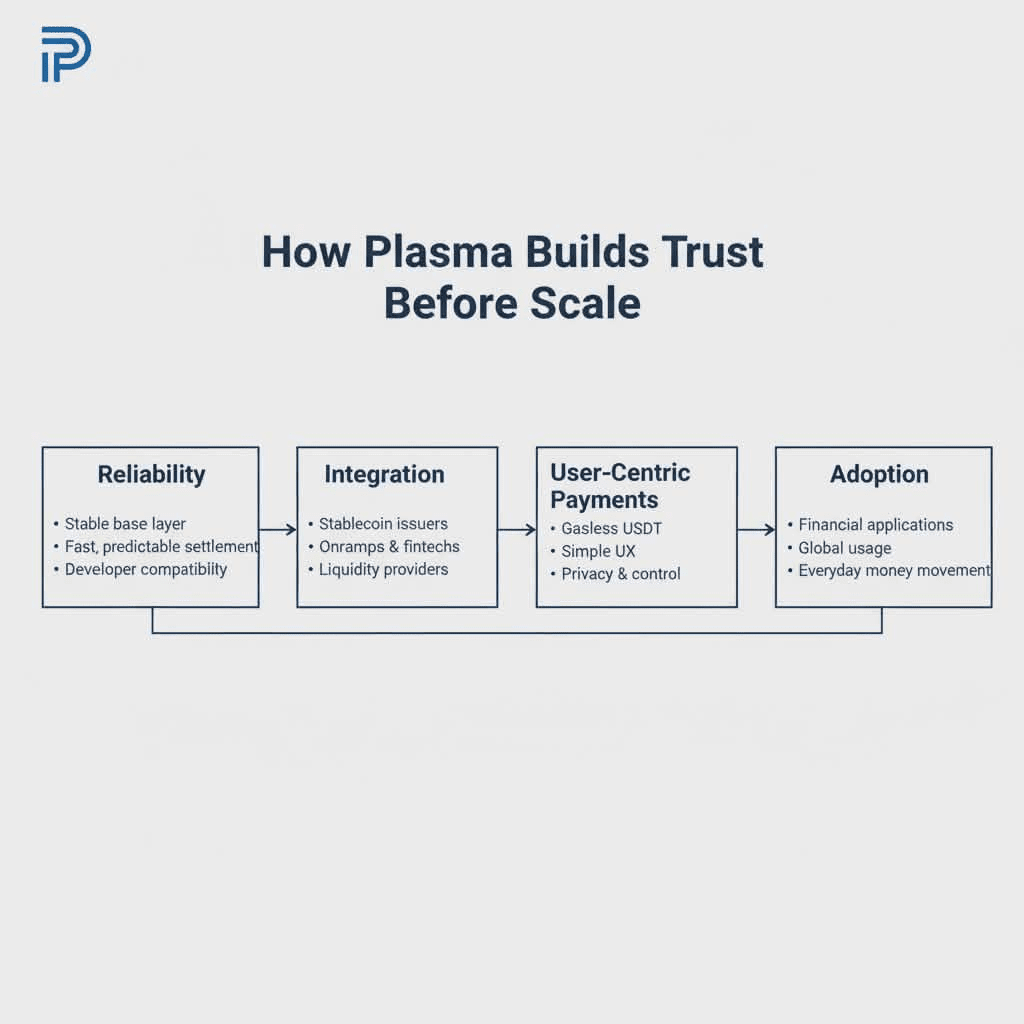

Plasma doesn't try to be everything on day one. It tries to be reliable first.

Phase 1: Main Network Beta - Foundation Layout

Plasma starts with its core: Plasma BFT compatibility and a fully EVM-compatible implementation layer. For me, this is the most important stage because nothing else matters if the foundation isn't stable.

Fast finalization, low latency, predictable productivity - these aren't just "good things to have" for payroll. They're mandatory.

By supporting existing smart contracts from day one, Plasma eliminates friction for developers. No new languages. No new mental models. Just build.

This is where integrations begin: stablecoin issuers, gateways, liquidity providers, financial companies, and banking-as-a-service platforms.

In my opinion, this is Plasma saying: "Let's connect first to the real economy."

Phase 2: Bitcoin Bridge and Settlement

Then comes Bitcoin.

Plasma's trust-reducing Bitcoin bridge isn't about speculation—it's about settlement. Linking Plasma's status to Bitcoin brings credibility, neutrality, and access to the deepest liquidity in the cryptocurrency world.

This is important for the movement of global money.

If stablecoins are to be used globally, they need bridges to our most secure underlying layer. Plasma understands this.

Phase 3: Key Features of Stablecoins

This is where plasma becomes truly different.

USDT transfers without gas.

Custom gas symbols.

Confidential transactions.

These aren't cosmetic upgrades. These are features designed to reflect how people actually use money.

In my experience, most users don't care about blockchain technology. They care about sending money easily, privately, and without surprises. Plasma is designed directly for this behavior. #Plasma

Phase 4: Local Tools and Infrastructure

Finally, Plasma focuses on tools - APIs, SDKs, wallet integrations, entry gateways, compliance tools.

This is where ecosystems grow.

Developers don't build on ideas. They build on tools.

By charging a local infrastructure dedicated to stablecoins, Plasma is positioning itself not just as a network - but as a platform for financial applications.

Why does this map look different to me?

What I personally like about this approach is that it doesn't pretend that everything has already been resolved.

Instead of hiding behind "we're built to last," Plasma says:

We will launch, integrate, learn, and then improve.

This is how real systems develop.

From what I've seen in Web3, the projects that last are those that treat infrastructure as a process, not as a product.

Plasma looks like one of those projects.

He is not trying to attract attention.

She is trying to gain trust.

In payments, trust matters more than hype.

That's why I'm watching this roadmap closely - not primarily as a trader, but as someone interested in how to make digital money usable on a global scale.

If Plasma executes this phased vision well, people won't talk about it much.

They will only use it.

That's when you know it's worked.