Dusk Network starts from a simple but uncomfortable truth: finance does not like exposure, and blockchains do not like secrecy. I’m not talking about hiding things for fun. I’m talking about protecting balances, positions, relationships, and contract logic while still being able to say, yes, this transaction followed the rules. That tension is exactly where Dusk Network lives. And the real question it asks is this: can a public blockchain support serious finance without turning every action into public data?

In traditional systems, privacy comes from closed doors. Banks, clearing houses, and custodians sit in the middle and decide who can see what. That model works, but it is slow, costly, and full of trust assumptions. Public blockchains flipped that model by making everything visible. That helped verification, but it broke confidentiality. Dusk Network is trying to rebuild that balance using cryptography instead of middlemen. Proof instead of exposure. Isn’t that what financial infrastructure should aim for?

At the heart of Dusk Network is the idea of “prove without revealing”. The network does not need to see the sensitive details to know a rule was followed. It only needs mathematical proof that the rule was respected. This idea shapes how transactions work, how contracts run, and how assets are managed. Privacy is not an add on here. It is a design requirement.

Dusk Network supports different ways value can move. Some transactions are meant to be visible. Others should stay private. For that reason, the system does not force one single model on everything. The private side of this design is driven by a transaction model called Phoenix. Phoenix allows value to move while hiding amounts and links, but still prevents cheating. The network checks that funds exist, that nothing is double spent, and that everything balances out. The details stay protected. Why should outsiders see more than they need to?

This is where many people misunderstand “privacy”. They assume privacy means nothing can be verified. Dusk Network takes the opposite view. It is built around “selective disclosure”. You can keep most information private, but still reveal specific facts when required. If a rule needs proof, a proof can be shown. If oversight is required, the system can provide confirmation without exposing the full story. That approach feels far closer to how real financial systems already operate.

But finance is not only about transfers. Securities, funds, and regulated assets have structure. They have issuers. They have limits. They have actions over time. This is why Dusk Network introduces concepts like XSC and Zedger. XSC means Confidential Security Contract. The name matters. A security contract must follow legal and business rules, but it must also protect sensitive data. Investor positions, ownership size, and internal actions are not meant to be public broadcasts. Zedger builds on the Phoenix privacy foundation and adds the structure required for assets that behave like real financial instruments. Without this layer, privacy would be interesting, but incomplete.

I find this part important because many chains avoid talking about issuer control and asset lifecycle. It sounds less exciting than fast transfers, but it is critical for real adoption. In real markets, ownership is not always the same as key control. Mistakes happen. Access can be lost. Legal ownership still exists. A system that ignores this reality cannot host serious assets. Dusk Network does not ignore it. It designs around it.

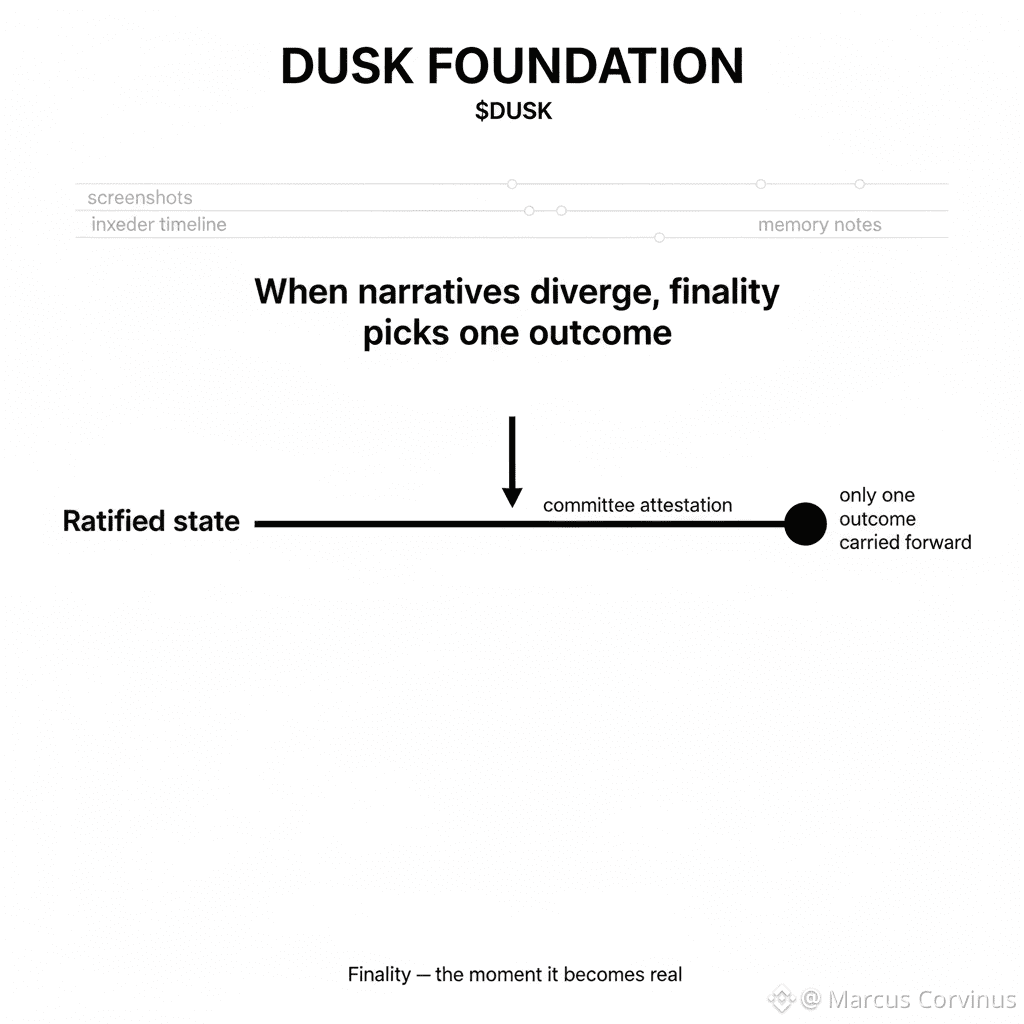

Another pillar of the system is “final settlement”. In finance, finality is everything. A transaction that might be reversed later is a risk. Dusk Network focuses on clear settlement so participants know when something is truly done. Once settled, it stays settled. That certainty reduces risk and makes complex markets possible. Without finality, how can institutions trust on chain systems?

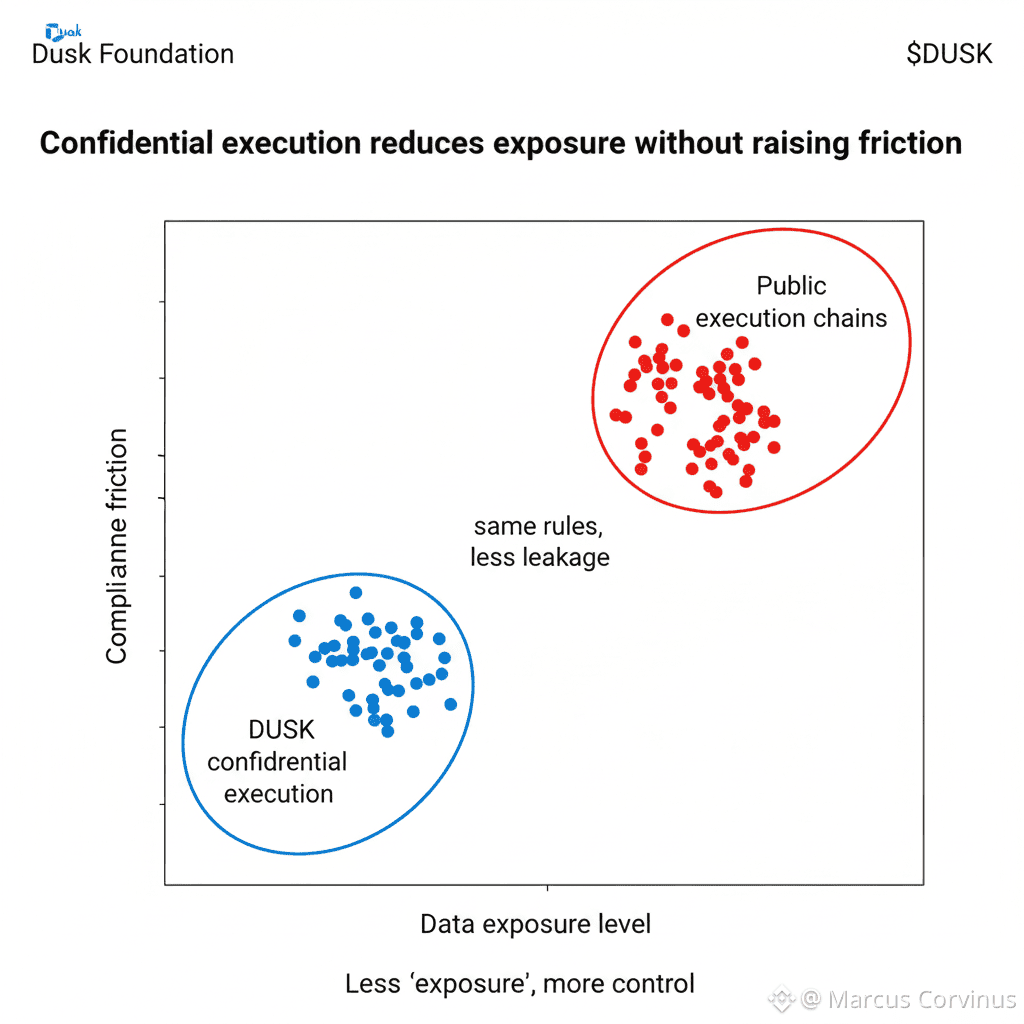

Smart contracts on Dusk Network also follow a different mindset. On many chains, everything a contract touches is public by default. On Dusk, builders must decide what stays public and what stays private. This forces developers to think carefully about data flow. If they design poorly, patterns can leak even if amounts are hidden. Privacy is not automatic. It is intentional. This makes Dusk Network not just a technical platform, but a design philosophy for financial applications.

Identity is another area where Dusk Network takes a careful approach. Finance often requires proof of eligibility, but not full exposure of identity. The system supports privacy preserving identity proofs, where someone can prove a fact without revealing unnecessary details. You can prove you qualify without sharing your entire profile. Isn’t that how digital identity should work?

When I step back and look at the full picture, I see a consistent theme. Dusk Network is not trying to replace laws or ignore regulation. It is trying to give markets better tools. Tools that protect “privacy”, enforce “rules”, and deliver “finality” at the same time. It offers private and transparent transaction options. It offers a privacy focused transaction model through Phoenix. It offers structured asset logic through Zedger. It offers a contract standard through XSC. Each part supports the same goal.

This approach is not easy. Privacy systems are complex. Combining them with smart contracts and regulated asset logic is even harder. But if the future of on chain finance includes real issuers, real assets, and real oversight, can it exist without this level of design?

That is the bet Dusk Network is making. Not that privacy alone wins. Not that compliance alone wins. But that “privacy with proof” is the only path that makes sense for serious finance.