This thing started back in 2018, and honestly, it's been grinding quietly ever since. Most blockchains go crazy for memes or DeFi hype, but Dusk? It's laser-focused on big finance stuff—banks, regulators, institutions that actually need to follow rules. The whole point is solving that annoying clash: you want privacy so nobody sees your trades or balances, but regulators gotta be able to check things when they need to. Normal public chains show everything to everyone, permissioned ones feel too centralized. Dusk tries to thread the needle with privacy built right in, but still auditable if authorized.

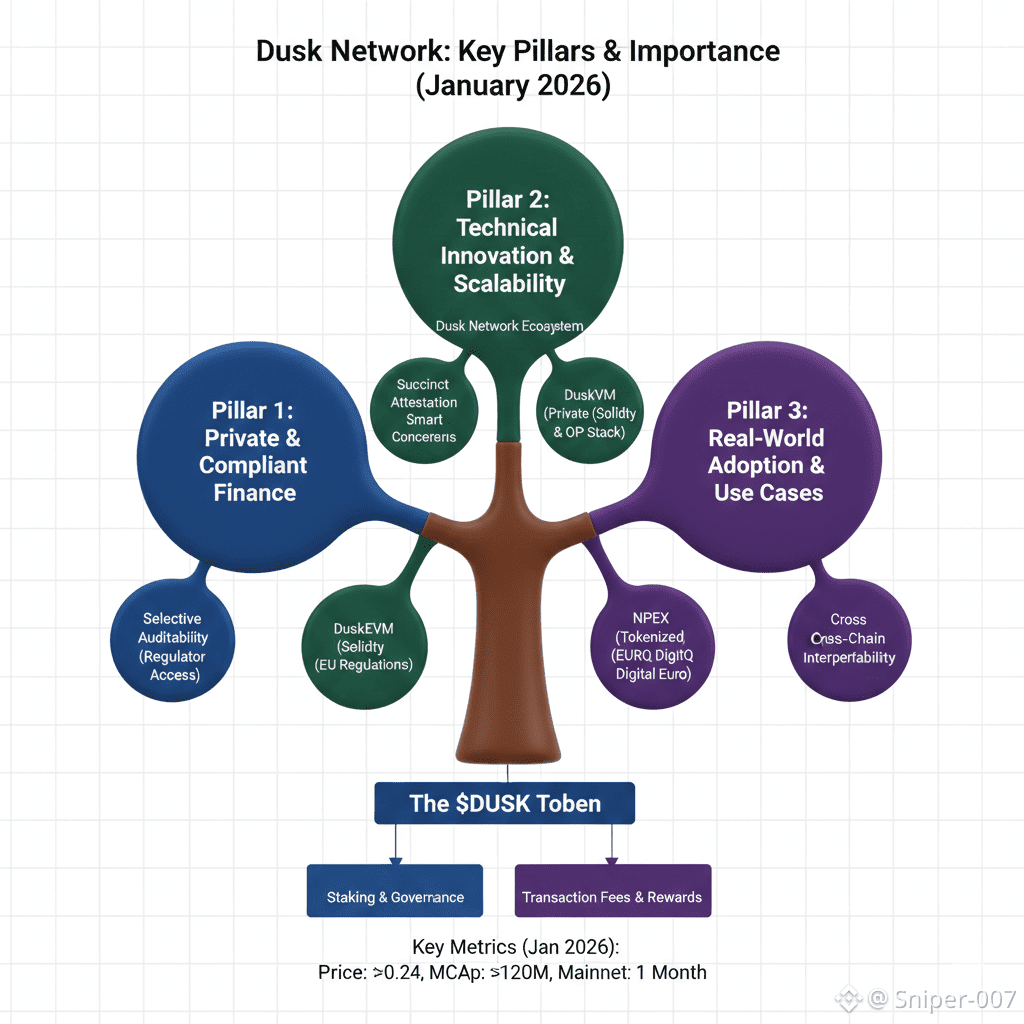

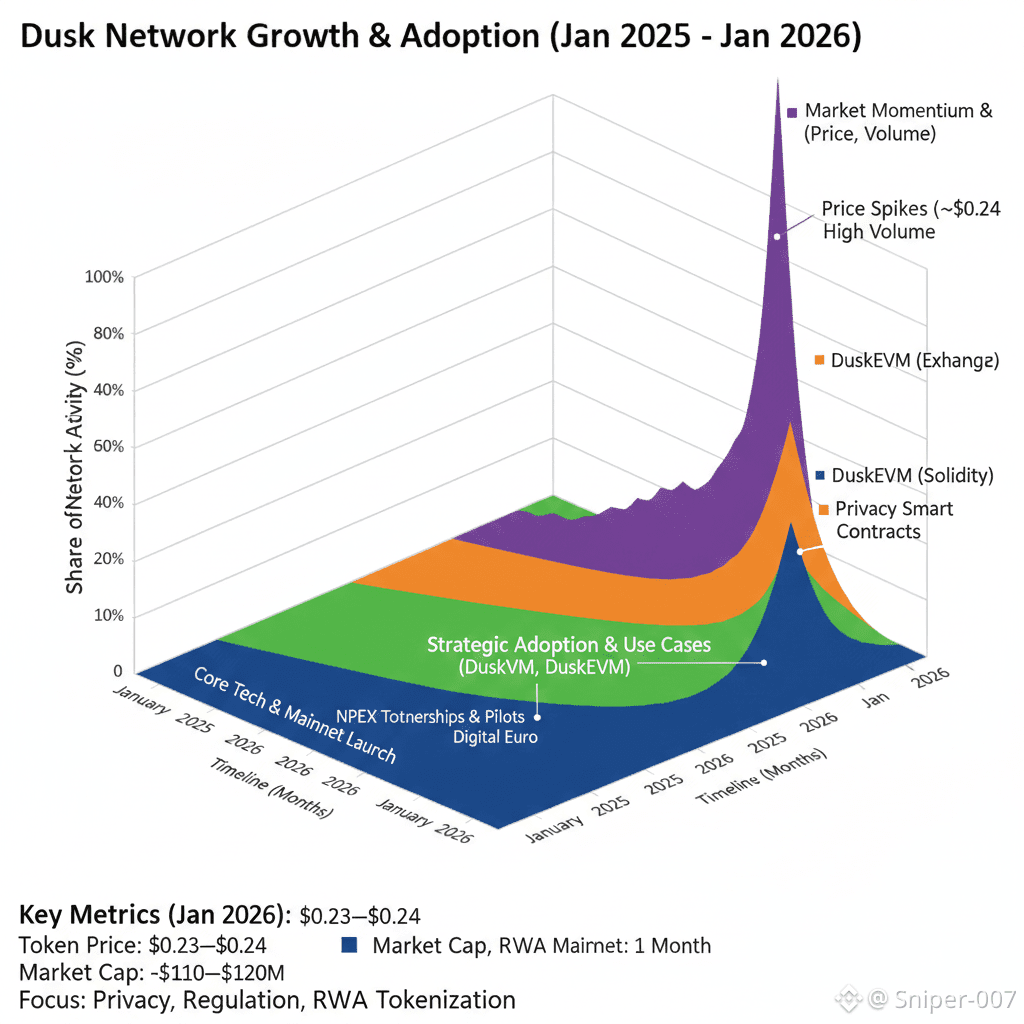

Tech-wise, it's kinda unique. They got this DuskDS layer for settlement and consensus—uses something called Succinct Attestation. Instead of huge validator groups or slow PoW, they pick small random committees for each block: one proposes, another validates, then a final one seals it. Keeps things fast and final, which matters a ton when you're dealing with real money that can't wait hours.

Then on top, they've got options for devs. DuskVM runs on WebAssembly with zero-knowledge proofs for super private smart contracts. And DuskEVM is Ethereum-compatible (OP Stack based), so you can drop Solidity code there with almost no changes and still get the privacy perks. Bridges let assets hop between them easy. Pretty flexible without breaking security.

The transaction thing is cool too—they do public ones like regular chains, but shielded ones hide details using zk proofs. And here's the smart part: selective auditability. Regulators or whoever's allowed can peek at specific txs without unlocking the whole network. That's huge for compliance without killing privacy.

$DUSK token keeps it all running. Pay fees with it, stake to secure the network (validators get rewards from fees and new tokens), governance votes on upgrades. They soft-slash bad actors—nothing too harsh, just temporary stake locks. Started with 500 million supply, another 500 million emits slowly over years to avoid crazy inflation. Liquid staking and stuff through contracts too, so holders aren't locked forever.

It's its own layer-1, but plays nice with others—EVM compat means easy ports from Ethereum, cross-chain bridges for assets. They're big on EU regs like MiCA, which helps institutions feel safe. Partnerships are real: Cordial Systems for custody/wallets, but the standout is with NPEX (that Dutch licensed exchange)—they built a platform for issuing and trading tokenized equities, bonds, funds, all compliant. And Quantoz brought in EURQ, their MiCA-compliant digital euro stablecoin, so regulated on-chain euros and settlements are happening.

Mainnet's live now—went active early January 2026 after years of building. Price has been wild lately, sitting around $0.23–$0.24 with big pumps (up like 250%+ in a week sometimes from privacy coin rotation and news). Market cap's in the $110–120M range, volume spiking hard. Not tiny, not massive, but moving.

Challenges? Yeah, privacy tech at scale is tricky—bugs or slowdowns could hurt. Institutions move slow, need proof it works forever before jumping in. Competition from other privacy or RWA chains exists, and token swings are token swings.

But looking forward, with MiCA rolling out and tokenized assets getting serious, Dusk feels positioned nice. It's not flashy, no endless shilling—just steady building for a world where finance on-chain actually follows laws, keeps secrets when it should, and settles fast. If more exchanges and fintechs plug in, this could be quiet infrastructure for real regulated markets.

Kinda refreshing in crypto. Not chasing pumps, just trying to make tokenized finance work properly.

What you think—seen anything like this in the space, or is Dusk new to you? $DUSK sitting strong right now. 🕵️♂️