Cutting through the noise to look at what Plasma is actually delivering versus what's just roadmap talk.

First, the foundation that's already live. PlasmaBFT consensus delivers sub-second block finality – not theoretical, actually happening on mainnet. The EVM execution layer running on Reth (Rust-based Ethereum client) means any Ethereum smart contract deploys without modification. Hardhat, Foundry, MetaMask – all your existing tools work natively.

The gasless USDT transfer system works exactly as advertised. Protocol-managed paymaster covers the gas for simple stablecoin sends. This isn't some testnet demo – it's processing real transactions on mainnet with actual users.

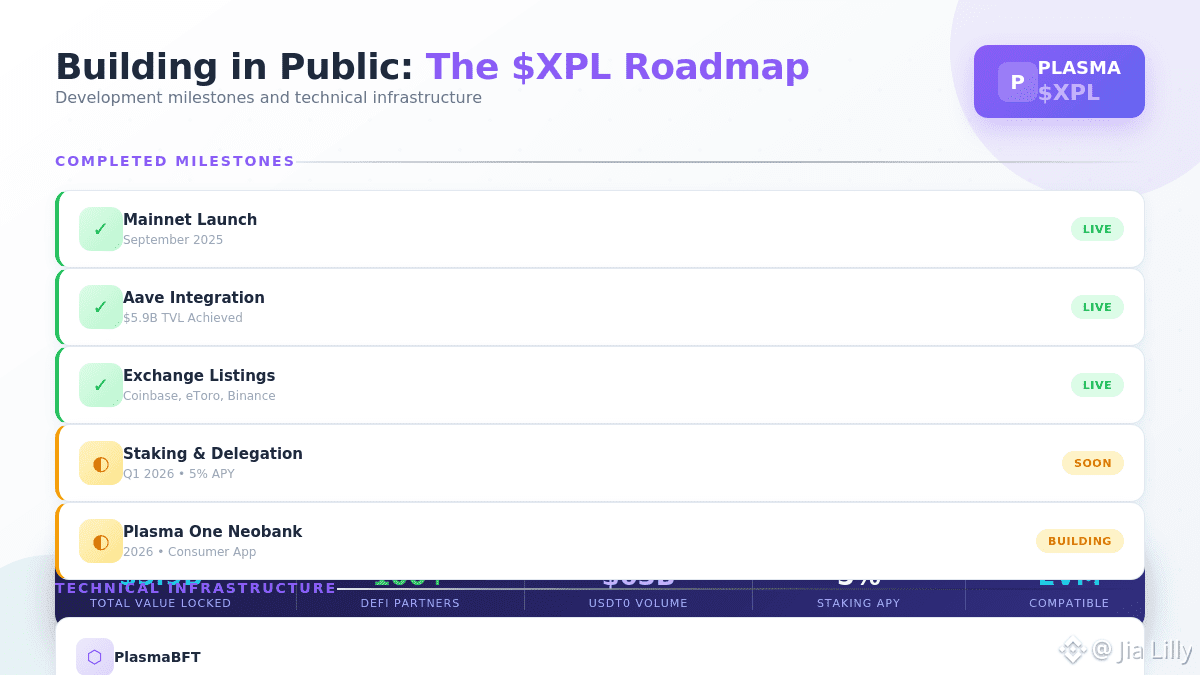

Now for what's coming. The staking and delegation system launches Q1 2026. Validators stake $XPL to secure the network and earn 5% annual rewards initially, decreasing by 0.5% yearly until hitting 3% baseline. Here's a smart design choice: misbehaving validators lose rewards, not their staked capital. This reduces catastrophic risk while still maintaining accountability.

Delegation means you don't need to run infrastructure to participate. Stake your $XPL with validators you trust and earn passive yield. This opens network participation to regular holders.

The Reactive integration went live in November 2025, transforming Plasma from simple settlement into an environment for automated cross-chain workflows. Treasury rebalancing, conditional settlements, compliance triggers – institutions can now build sophisticated stablecoin operations that respond automatically to on-chain events.

Plasma One development continues as the team's consumer-facing play. This stablecoin neobank targets saving, spending, and sending digital dollars without traditional banking infrastructure. The focus on unbanked populations and cross-border payments addresses real friction in the global financial system.

The January 2026 Binance creator campaign dropped 3.5 million $XPL in rewards for content creators on Binance Square. Community building through incentivized participation rather than just throwing money at influencers.

Token economics update: 40% of supply goes to ecosystem growth, with 8% unlocked at mainnet and the rest vesting monthly over three years. Team and investor tokens (25% each) follow a three-year unlock schedule with one-year cliff. US public sale participants face a 12-month lockup ending July 28, 2026.

The USDT0 integration deserves emphasis. Tether's cross-chain network connecting Plasma to 17 other chains processed $63 billion in volume over 12 months. This isn't isolated infrastructure – it's connected infrastructure that routes global stablecoin liquidity.

Developer tooling remains fully Ethereum-compatible. Same opcodes, same precompiles, same execution behavior. The team focused on not reinventing wheels that already work.

Looking at what's shipping versus what's promised: mainnet is live, DeFi integrations are active, exchange listings happened, staking is imminent. The execution tempo suggests this team actually builds rather than just announces.

Whether price follows remains to be seen. But the infrastructure development? That's verifiable on-chain.