Market size: Market cap & Price

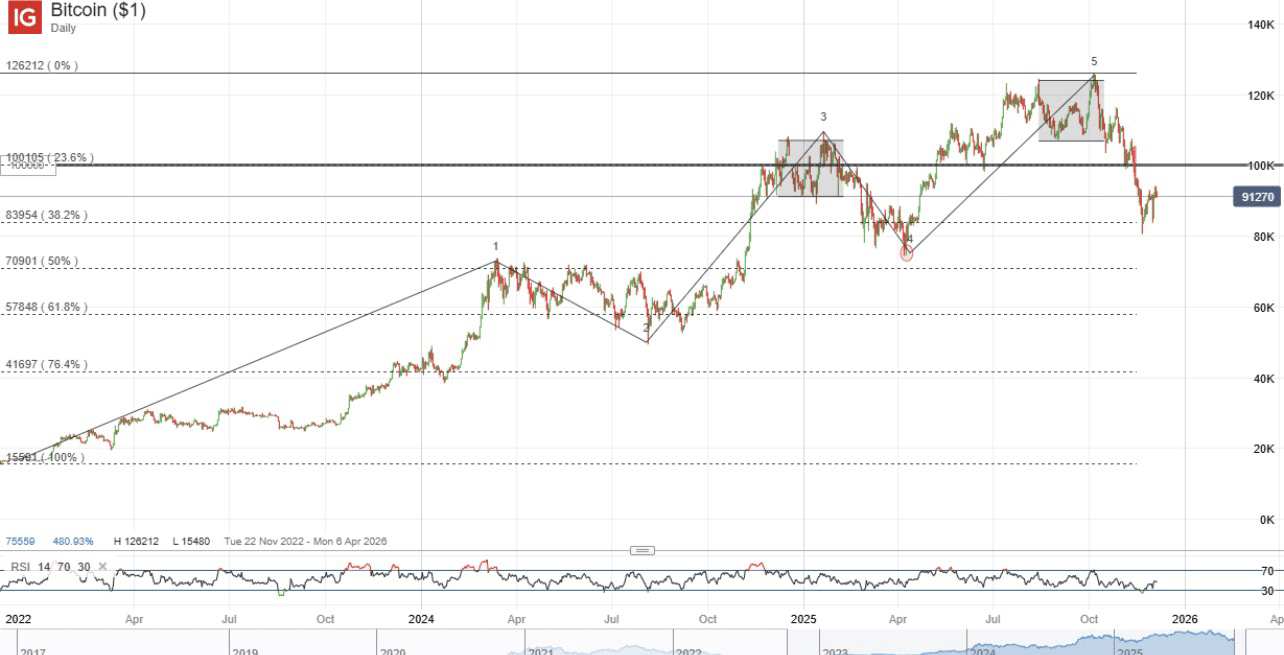

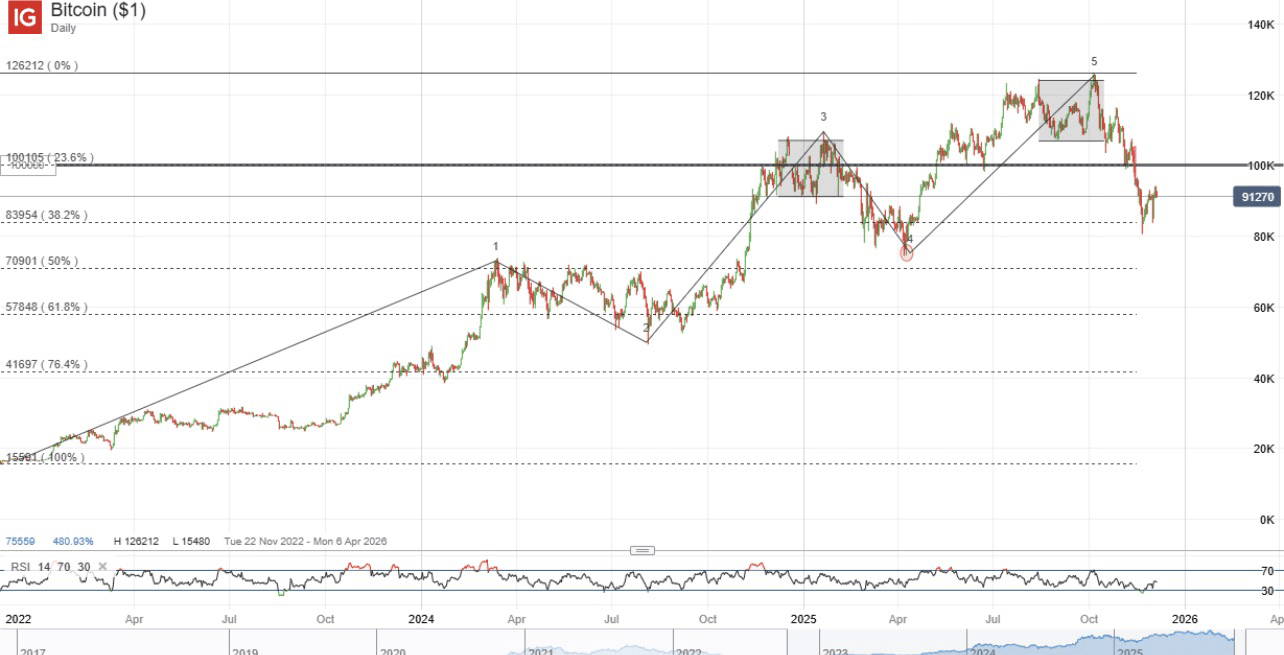

Bitcoin ( $BTC ) :

• Market cap: ~$1.7–1.8 TRILLION

• Price at the beginning of 2026: ~$87k–$90k

• Liquidity: tens of billions USD/day

• ETF spot: real institutional money flow, continuous

• Position: base asset of crypto

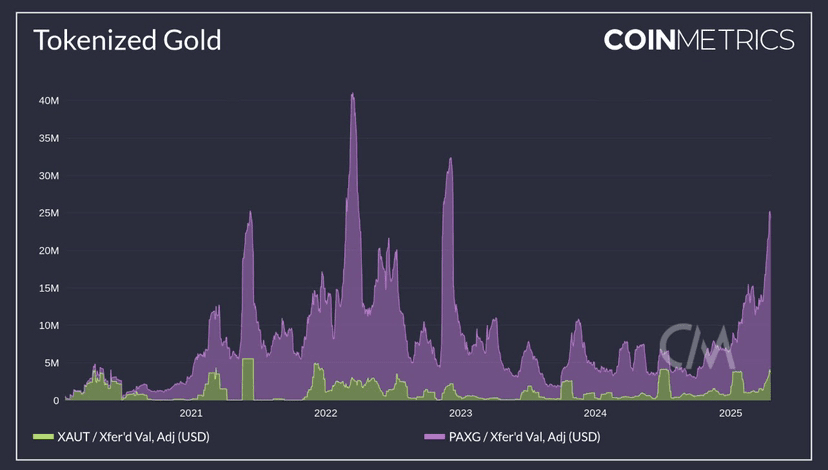

Tokenized gold ( $XAU $PAXG ) :

• Total market cap: ~$4.4B

• Growth in 2025: +177% (strong, but from a low base)

• Nature: token representing physical gold

• Dependent: issuer, audit, legal, storage

The data is only a part to affirm the position, Bitcoin in 2026 is still assessed as the number 1 blue chip in the digital asset era due to its distinct scarcity as well as institutional attractiveness and ETF investment funds despite its high risk.

However, tokenized gold is also considered a blue chip even though its market capitalization and effect are only a fraction of Bitcoin, but it will be a blue chip in a small niche of the digital asset world. It is regarded as an on-chain asset where safety will be an on-chain insurance for risk-averse investors.

In summary, there is no 'absolute blue-chip' for all investment goals as it will depend on the risk appetite of the investors. Bitcoin stands out in the role of storing digital value while tokenized gold represents the role of a safe on-chain asset.

According to your personal risk appetite - Will you choose Bitcoin or tokenized gold?