Bitcoin’s recent sharp pullback looks more like a leverage reset than a structural bearish shift when viewed through aSOPR, Open Interest, and Funding Rates.

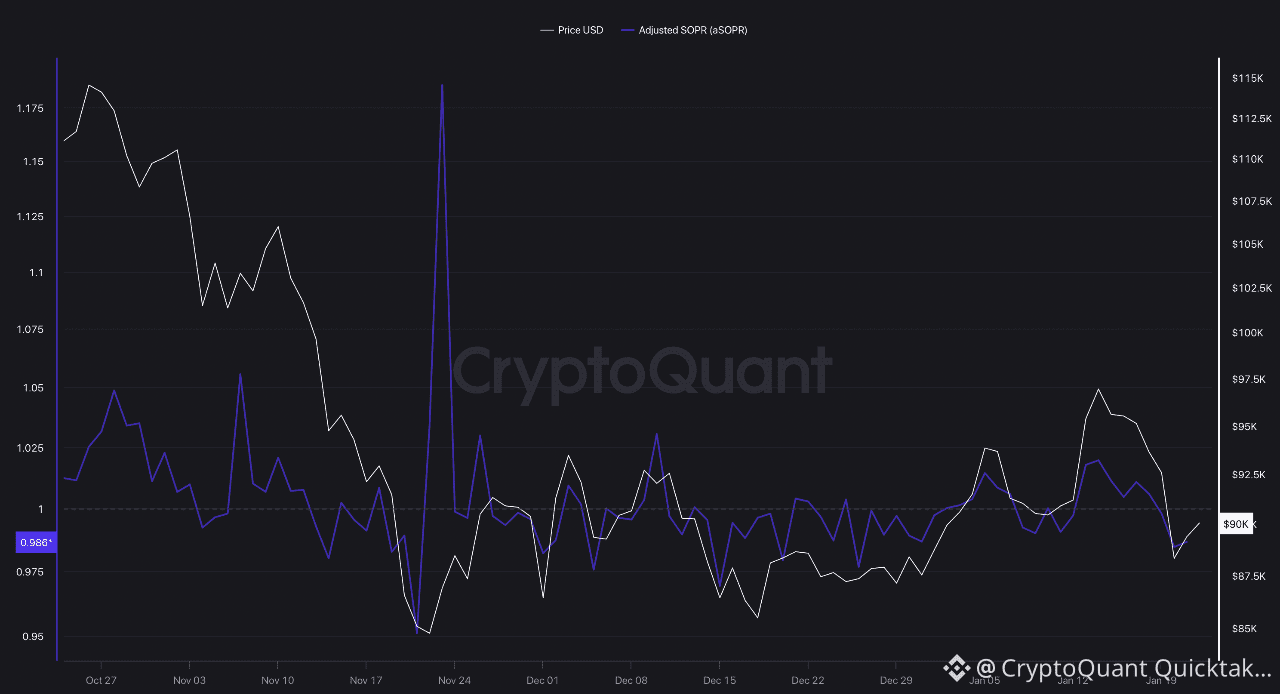

🔻 Adjusted SOPR (aSOPR) moved below 1, showing that many coins were sold at a loss. This typically reflects short-term panic selling, not long-term distribution. Importantly, aSOPR did not stay deeply below 1, suggesting selling pressure is fading.

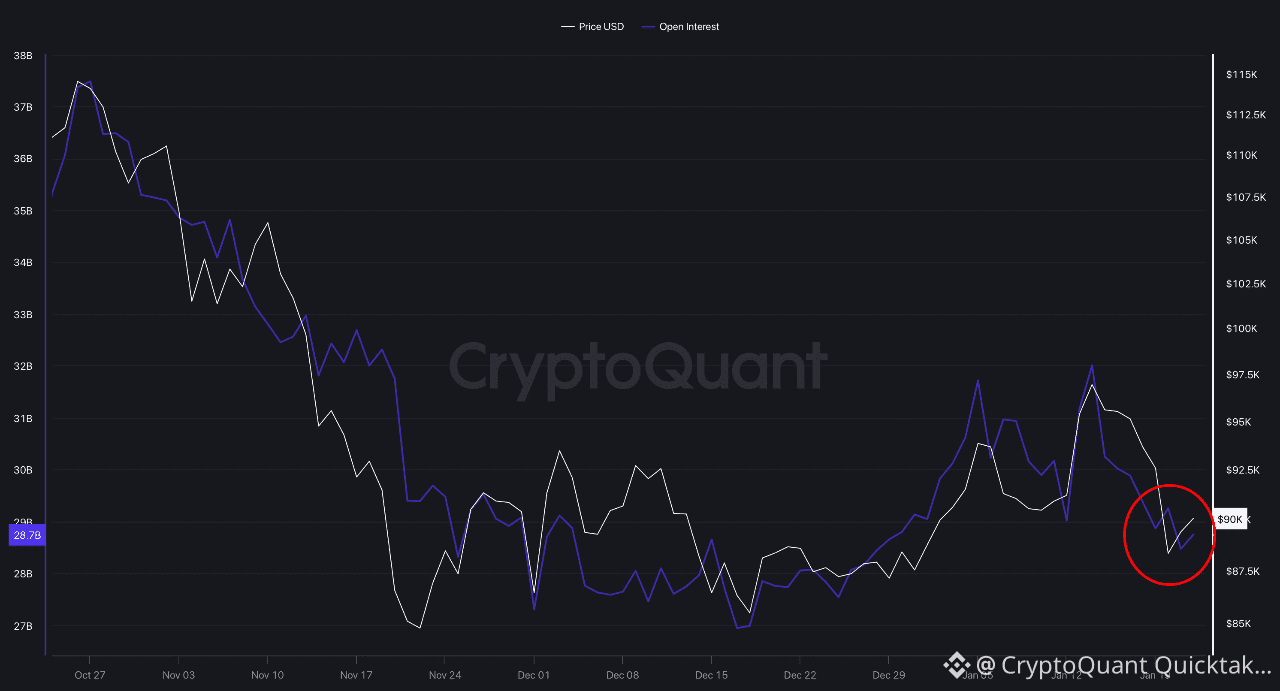

📉 Open Interest dropped alongside price, confirming a broad deleveraging event. This points to forced position closures and liquidations rather than aggressive new short positions.

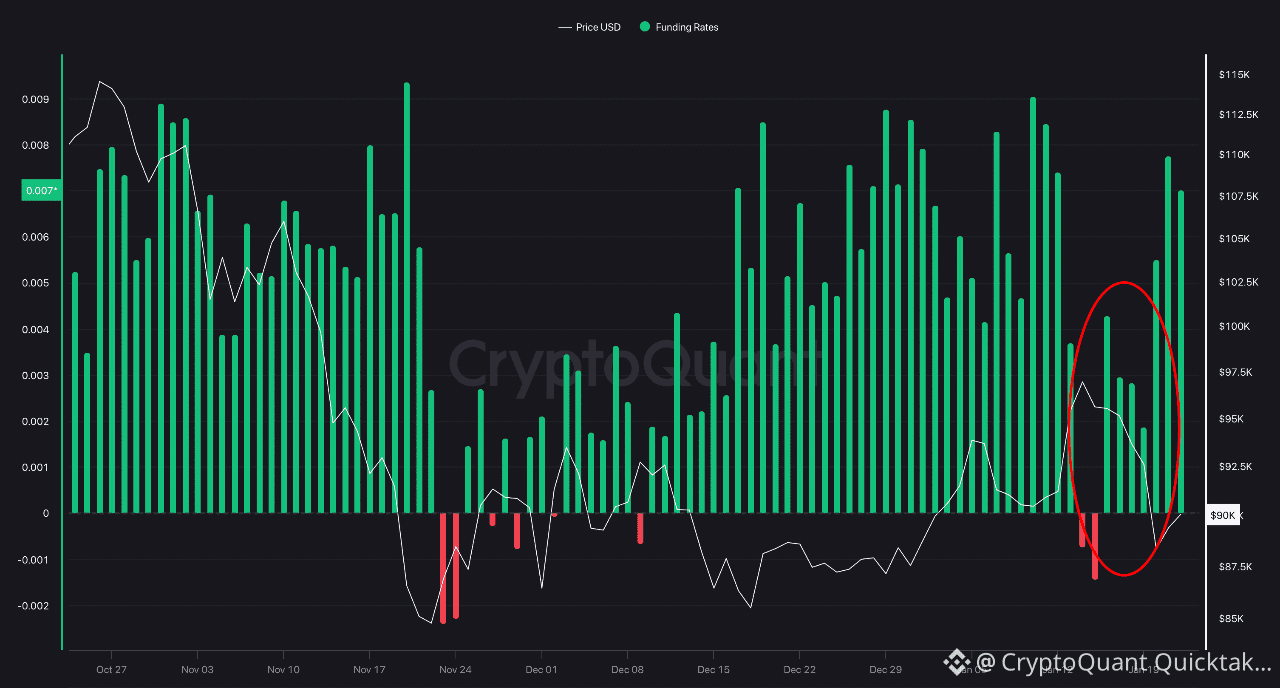

⚖️ Funding Rates compressed toward neutral and briefly turned negative. This indicates that overcrowded long positions were flushed, bringing derivatives positioning back to a healthier balance.

🔎 Combined Interpretation

aSOPR < 1 → Loss realization

Open Interest ↓ → Leverage cleared

Funding ↓ → Long excess removed

Together, these signals describe a cool-down phase driven by leverage cleanup, not a breakdown in market structure.

🧭 Conclusion

From an on-chain and derivatives perspective, Bitcoin appears to be resetting from overheated conditions. While volatility may continue, the data does not yet support aggressive downside continuation.

The market is stabilizing — not breaking.

Bias: Reset → Stabilization 🧊

Written by KriptoCenneti