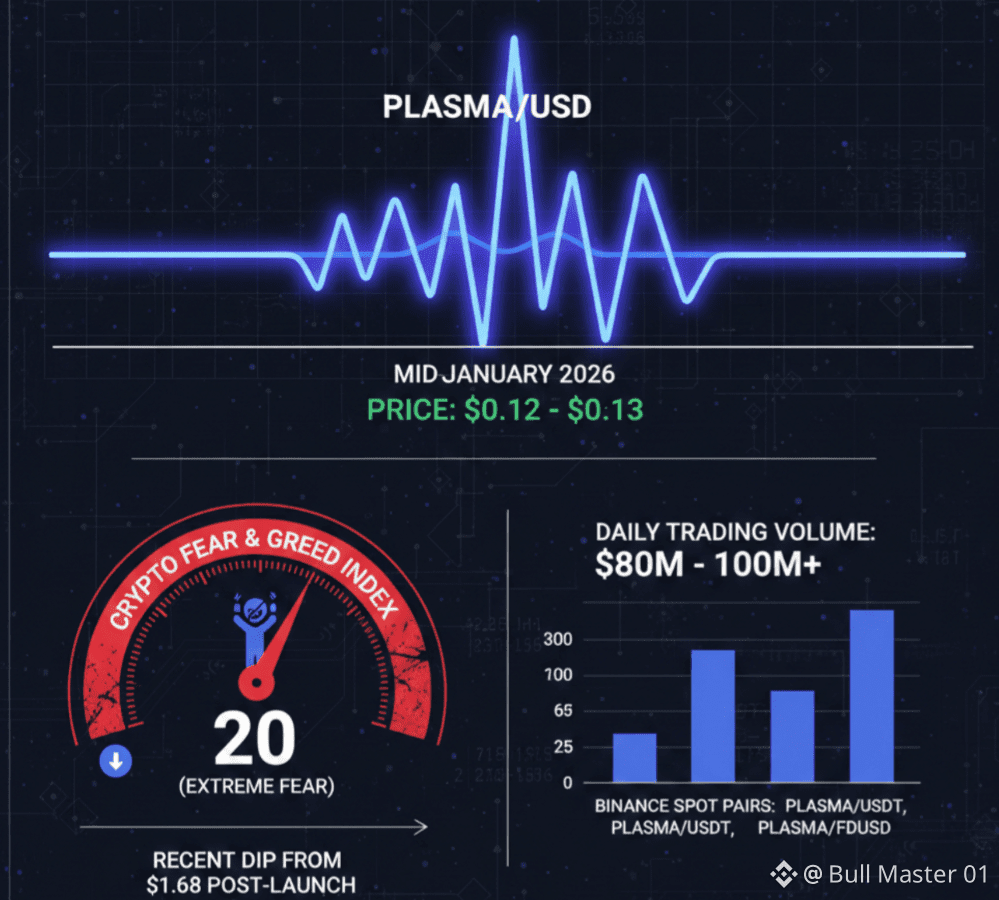

@Plasma enters mid-January 2026 navigating a volatile market phase, with its price stabilizing around $0.12–$0.13 amid broader crypto sentiment influenced by extreme fear levels (Fear & Greed Index at 20). Despite recent dips—down from highs near $1.68 post-launch—the token maintains robust daily trading volume exceeding $80–$100 million across major venues, including Binance where it ranks prominently in spot activity against USDT, BNB, and FDUSD pairs.

The project's strength lies in its unwavering commitment to stablecoin dominance. As a Layer 1 optimized solely for digital dollar flows, Plasma has scaled stablecoin TVL to approximately $4–$4.5 billion, securing second place globally in this metric. Utilization remains exceptionally high: lending pools operate at ~92% capacity with nearly 98% of borrowed assets in active use, reflecting genuine demand for efficient settlement rather than speculative parking. This positions Plasma ahead of many generalist chains in real economic activity, particularly for remittances, merchant processing, and cross-border payouts.

Key drivers include the protocol-level paymaster enabling truly gasless USDT transfers—users send funds without ever touching XPL or incurring costs, sponsored by foundation mechanisms. Custom gas payments in whitelisted assets (like stablecoins or BTC) further enhance accessibility. PlasmaBFT consensus delivers consistent sub-second finality and 1,000+ TPS, making it suitable for high-frequency, real-time scenarios where delays erode value.

Ecosystem momentum builds steadily. Over 30 exchanges now support USDT on Plasma, with recent additions boosting liquidity. Integrations with payment rails like Rain, MassPay, Tangem Wallet, and LocalPayAsia expand offline and regional use cases, aligning with global trends toward stablecoins as practical funding tools. The internal beta of Plasma One—a self-custodial stablecoin neobank—reports strong early metrics: dozens of users across multiple countries, hundreds of daily transactions, and thousands in spend volume, hinting at upcoming private beta rollout in Q1.

Token utility advances with staking and delegation activation targeted for Q1/Q2 2026, allowing holders to secure the network, earn rewards from tapering inflation (starting ~5%), and participate in governance. An EIP-1559 burn on base fees adds long-term deflationary dynamics. Upcoming canonical pBTC bridge will introduce Bitcoin collateral without custodians, while support for additional stablecoins diversifies issuer risk.

Binance remains a focal point for visibility. The ongoing CreatorPad campaign (January 16–February 12) distributes 3.5 million XPL vouchers to verified creators completing quality-focused tasks—posting original content, trading minimum volumes, and engaging authentically—via an updated leaderboard emphasizing substance over spam. This initiative, paired with features like Simple Earn, Margin, Futures, and Convert, fosters deeper community involvement and liquidity.

Challenges persist: an imminent January 25 unlock (~88.9 million XPL for ecosystem/growth, valued ~$11–$12 million) introduces supply pressure, potentially contributing to short-term volatility alongside broader altcoin liquidity concerns from late-2025 events. Centralization risks in early validators (notably Bitfinex ties) warrant monitoring as decentralization progresses per roadmap.

Yet Plasma's trajectory emphasizes substance—gradual feature rollouts, core upgrades to production, and distribution expansion to make stablecoins "held, moved, and spent everywhere." In 2026's evolving landscape, where Hong Kong prepares stablecoin licenses and enterprises adopt them for treasury optimization, specialized rails like Plasma stand to capture outsized share in the shift toward instant, low-friction global money.

For observers eyeing infrastructure plays over meme-driven narratives, $XPL offers exposure to a chain proving utility at scale. As adoption compounds through DeFi depth, payment partnerships, and neobanking experiments, Plasma could solidify as the neutral, open backbone for digital dollars in everyday life. The question isn't hype—it's whether focused execution wins against fragmented competition.