Over the years the blockchain infrastructure has been constructed based on a simplifying premise: that transparency is always good and regulation can be managed elsewhere. This is a sufficient assumption in early experimentation, open networks and speculative markets. It did not work for finance. Blockchains were never rejected by institutions, issuers, and regulated participants because they were not innovative.

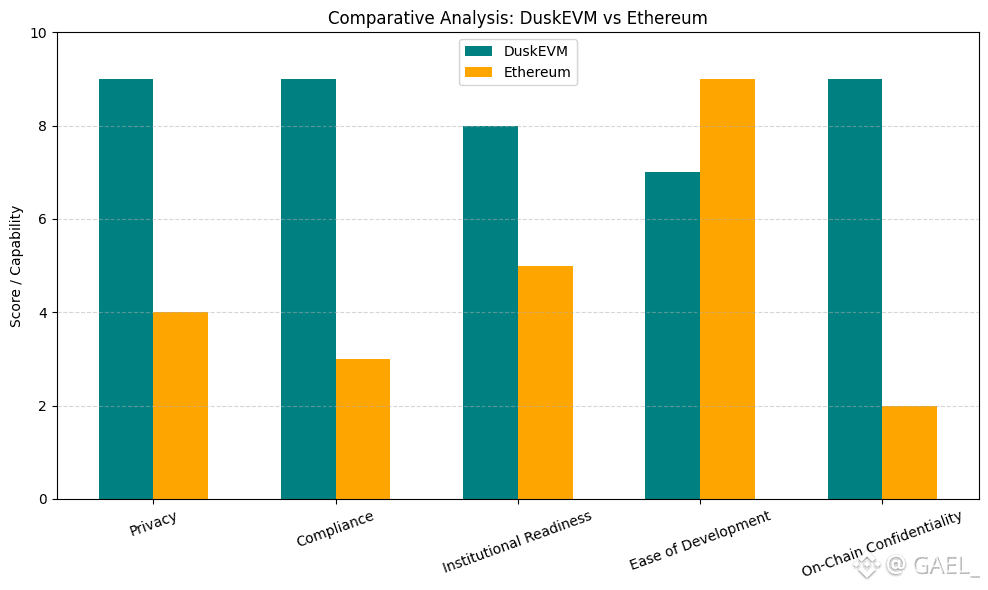

They have dismissed them stating that the underlying architecture did not pay much attention to the way in which the financial systems actually work. Finance cannot afford privacy as an option, and compliance cannot be an addition. It is based on this fact that the @Dusk Foundation begins not as a limitation but rather as a design principle.

The beauty of the architecture of @Dusk is not an individual component, but how several issues are solved on the protocol level instead of being pushed to applications or off-chain processes. Conventional blockchains put implementation on the default and encourage developers to design around that implementation.

Compliance occurs in layers by use of custodians, reporting or trusted intermediaries. The outcome of this is fragmentation: privacy location, regulatory location, and settlement location are all in different places. This division is denied in @Dusk . Its architecture considers confidentiality, verifiability and regulatory accountability as complementary needs, which should be implemented in the same execution environment.

The design of @Dusk is centered on secret execution which can be proved. Transactions, smart logic and changes of assets can be kept secret and yet generate cryptographic evidence that rules have been adhered to. It is important as regulators do not need permanent public access to all of the actions, but rather, they need the possibility to check the legitimacy given specific conditions. It is possible thanks to the architecture of zero-knowledge that Dusk uses. Sensitive data is never exposed, but this system is auditable when it is necessary. It is nothing to do with covering up action. It is concerning imposing a financial rationale without making it public.

The implications of this architectural decision lie very profoundly in the way regulated finance can be on-chain. Issuers of assets no longer have to decide which of the two is complied with and which is confidential. Settlement does not require counterparties, strategies, and positions to be leaked out to the whole network. Audits are not necessitated to build up fragmented information across dissimilar systems. All this occurs in an integrated protocol space in which privacy and accountability are innate; not tradeoffs. This consistency is more important to institutions that consider risk than performance standards or experimentation capabilities.

The other aspect of the architecture of the @Dusk Foundation that is usually not given due attention is the way it influences the conduct of the developer. Defensive design is necessary in building regulated financial applications on most chains. Developers are taking more time to combat exposure than financial intent. Logic becomes rigid. The data models turn into unnatural. In Dusk, the responsibility falls on cryptography. Developers are free to define rules, conditions and flows as they know that execution of it remains a secret by design. The change makes this less complex and less cognitively expensive to develop compliant financial infrastructure.

What comes out of it is not a platform that pursues stories, but infrastructure that goes hand in hand with reality. Dusk is not trying to overthrow regulation and recreate legacy systems. It believes in their limitations and develops a decentralized structure that can work within their limitations. That humility is deliberate. Financial systems do not change fast and infrastructure that fails to recognize this is likely to be experimental. The architecture of @Dusk makes it different, a layer of the base, which can accommodate serious financial business without compromising decentralization.

The success of on-chain finance will not be marked in the long run by the extent to which protocols purport transparency or speed. It will be stipulated by their ability to accommodate reality financial behavior without discontinuing it. The @Dusk Foundation is placing a structural bet by attempting to integrate privacy and regulatory logic into its architecture: it believes that the future of blockchain finance will be systems whose first approach to finance, and second approach to decentralization. There is no training of that bet, though. And architecture is what lives with time.