The year 2026 is starting under conditions just as uncertain as those observed in 2025. Investors remain cautious, limiting risk appetite and making Bitcoin, as well as the broader crypto market, less attractive.

The crypto market continues to face a clear lack of liquidity. It is moving through a corrective consolidation phase, characterized by low volumes and a clear wait for catalysts, while other markets, such as precious metals or equities, continue to attract capital and perform well.

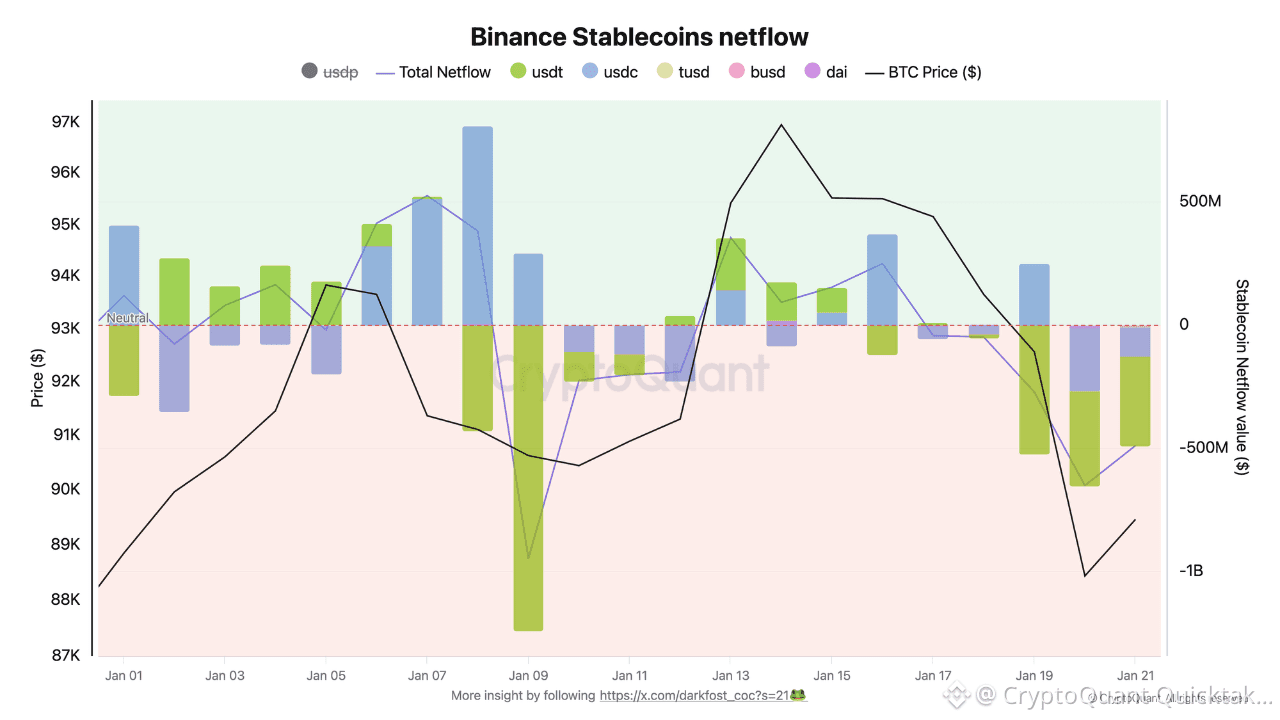

To better understand liquidity flows within the crypto ecosystem, analyzing stablecoin flows is particularly relevant. Observing movements on Binance, the platform with the largest trading volumes, provides valuable insights into investor behavior.

This chart, showing stablecoin flows on Binance, tells us a lot about the current situation. Since the beginning of the year, the number of days with positive netflows is roughly equal to the number of days with negative netflows, reflecting the market’s current indecision.

However, in terms of amounts, outflows dominate. On January 9, the netflow reached –$950M, compared to a maximum positive inflow of $380M. Over the past three days, more than $1.4B in stablecoins, mainly USDT, have left Binance.

When stablecoins leave a platform like Binance, which offers numerous trading pairs and yield opportunities, it indicates a gradual disengagement from some investors. For now, this movement remains contained, but it will need to be monitored closely to ensure it does not become a dominant trend.

Written by Darkfost