The position of $BTC in relation to gold continues to deteriorate, challenging the long-held narrative of Bitcoin as digital gold.

As gold approaches new all-time highs just below $4,900 per ounce and has risen approximately 12% so far this year, bitcoin barely shows a slight increase this year and remains below $89,000.

This divergence is also evident in longer time frames. Both in one-year and five-year views, gold has provided better returns. Over five years, bitcoin has risen approximately 150%, while gold has increased around 160%.

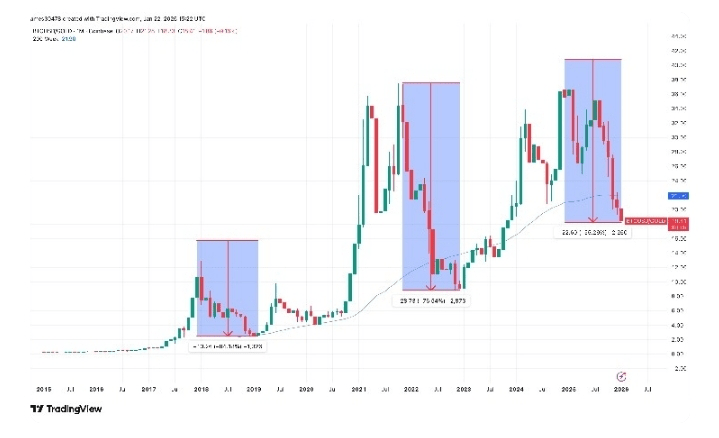

The BTC to gold ratio currently stands at around 18.46, firmly below its 200-week moving average (WMA), which reflects the long-term trend based on nearly four years of price data. The 200-week WMA is around 21.90, placing the ratio approximately 17% below the 200-week WMA.

During the last major bear market in 2022, the ratio fell to over 30% below the 200WMA and remained below it for more than a year. The current decline began in November, suggesting that if history repeats itself, it could stay well below the 200WMA until late 2026.

The ratio peaked at nearly 40.9 in December 2024, while since then bitcoin has fallen approximately 55% against gold. In previous cycles, even deeper declines were observed, with a drop of 77% during the bear market of 2022 and an 84% drop in the 2017 to 2018 cycle.

-Dan Pentagram