Blockchain is full of promises—speed, yield, decentralization, but few projects focus on the things that really matter for real-world finance: compliance, privacy, and trust. Dusk has taken a different path. From its founding in 2018, the team asked a simple but fundamental question: how do you build a blockchain that works for regulated markets while still enabling innovation? Every product, every partnership, and every design decision reflects that vision.

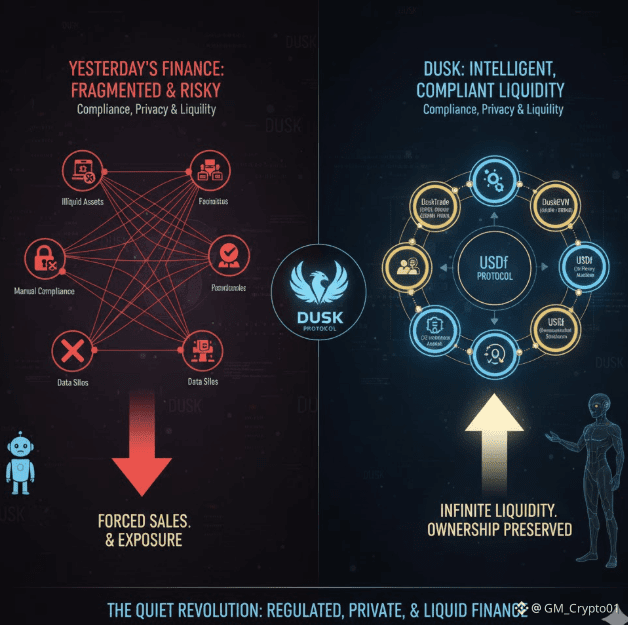

Traditional finance is often slow and rigid. Liquidity is episodic. To free capital, investors have to sell assets, give up exposure, and navigate layers of regulation and reporting. Crypto promised freedom, but for institutions, certainty, transparency, and compliance are essential. Dusk builds a platform that meets these requirements. Its Layer 1 blockchain is designed for real economic activity, not speculation. It is modular, private, and built to scale.

In 2026, Dusk is launching DuskTrade, its first platform for real-world assets, in partnership with NPEX, a regulated Dutch exchange. This is more than a product launch. DuskTrade will bring over €300 million of tokenized securities on-chain, creating a fully compliant, auditable marketplace. Investors can deploy capital without selling their assets, and ownership remains intact. The waitlist opening in January gives early participants the chance to engage with a platform that combines innovation with regulation.

DuskEVM, launching in the second week of January, expands the ecosystem. This EVM-compatible layer allows developers and institutions to deploy Solidity smart contracts directly on Dusk while maintaining privacy and regulatory safeguards. It bridges the gap between Ethereum developer tools and the compliance requirements of real finance, making it possible to build decentralized applications for tokenized assets, DeFi, and other regulated markets without compromise.

Privacy is built into Dusk’s DNA. Hedger allows private, auditable transactions on EVM using zero-knowledge proofs and homomorphic encryption. Hedger Alpha is already live, giving developers the ability to experiment with transactions that are confidential yet verifiable. Privacy and compliance are not in opposition. They work together to create trust and adoption in regulated finance.

Dusk also reimagines liquidity. USDf, an overcollateralized synthetic dollar, allows users to unlock value from digital tokens or tokenized real-world assets without selling them. Liquidity becomes continuous, programmable, and non-disruptive. Investors retain exposure while capital becomes usable, allowing markets and applications to function more efficiently.

The potential is enormous. A pension fund could deploy capital into tokenized bonds or DeFi strategies while remaining fully compliant and privacy-conscious. An institution could use a portfolio of tokenized securities as collateral and access liquidity on demand without moving the underlying assets. These scenarios are possible because Dusk builds for the realities of finance, not speculation.

Modularity is another strength. By separating settlement, smart contract compatibility, and privacy, Dusk allows each component to evolve independently without compromising security. New applications or regulatory updates can be added without disrupting the network. It is the plumbing of traditional finance reimagined for a decentralized world.

Dusk shows a key lesson for the future. Infrastructure comes first. Many projects focus on hype or yield, but Dusk focuses on the foundation that allows those things to exist sustainably. Real-world assets, privacy, compliance, and liquidity coexist because they are engineered into the system from day one.

As 2026 unfolds, Dusk is proving that regulated finance and decentralized innovation can coexist. DuskTrade, DuskEVM, and Hedger form an ecosystem where auditability, privacy, and usability are built in. USDf introduces liquidity without forcing asset liquidation. This is infrastructure that developers, investors, and institutions can rely on.

Dusk is not just building products. It is building the foundation of modern finance, where tokenized assets, privacy, and liquidity coexist naturally. In a space dominated by hype and fleeting trends, Dusk emphasizes durability, compliance, and economic realism. It is quietly laying the groundwork for a new era of finance that is regulated, private, and liquid by design.