There are two kinds of blockchain projects in this industry.

There are two kinds of blockchain projects in this industry.

The first group spends its time trying to outrun regulation hoping that by the time rules show up, their product will be too big to ignore.

The second group much smaller and far less noisy tries to build as if regulation already exists.

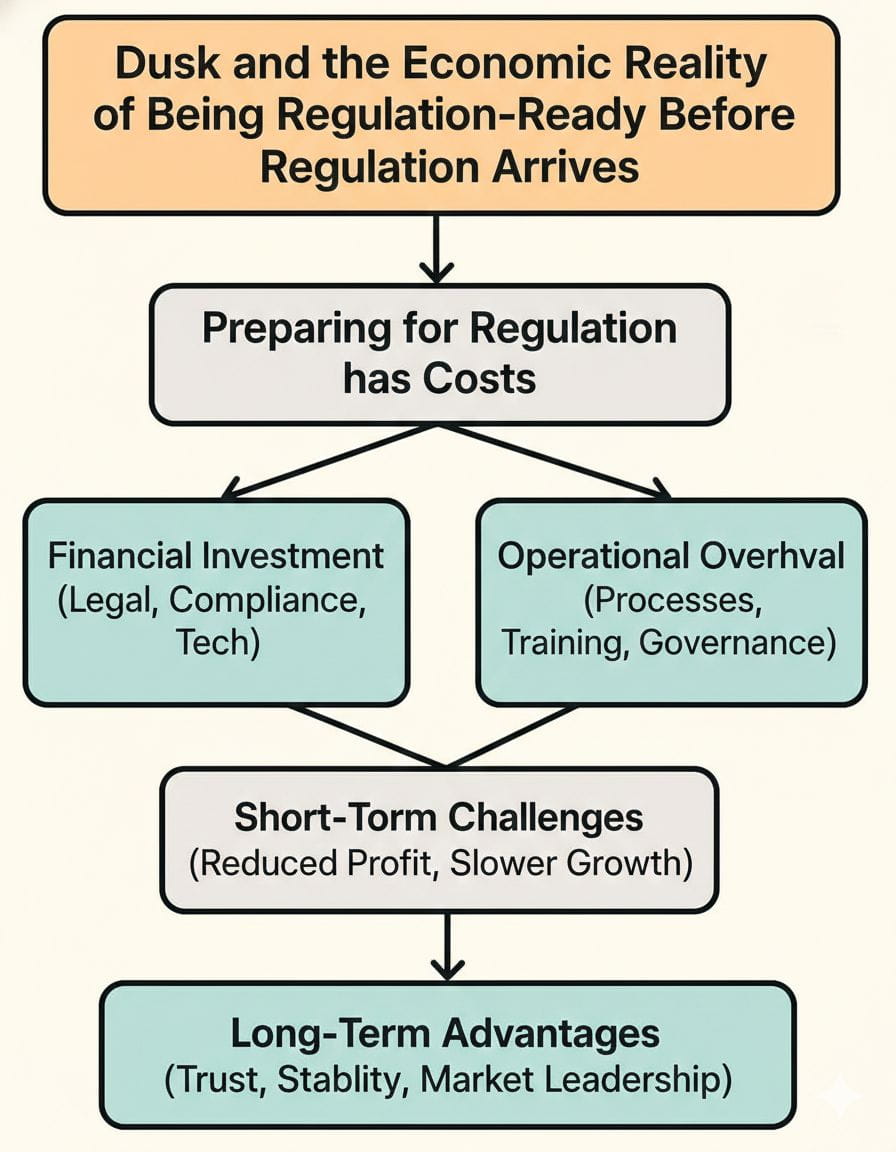

Dusk belongs firmly in the second camp, and that choice comes with a real cost.

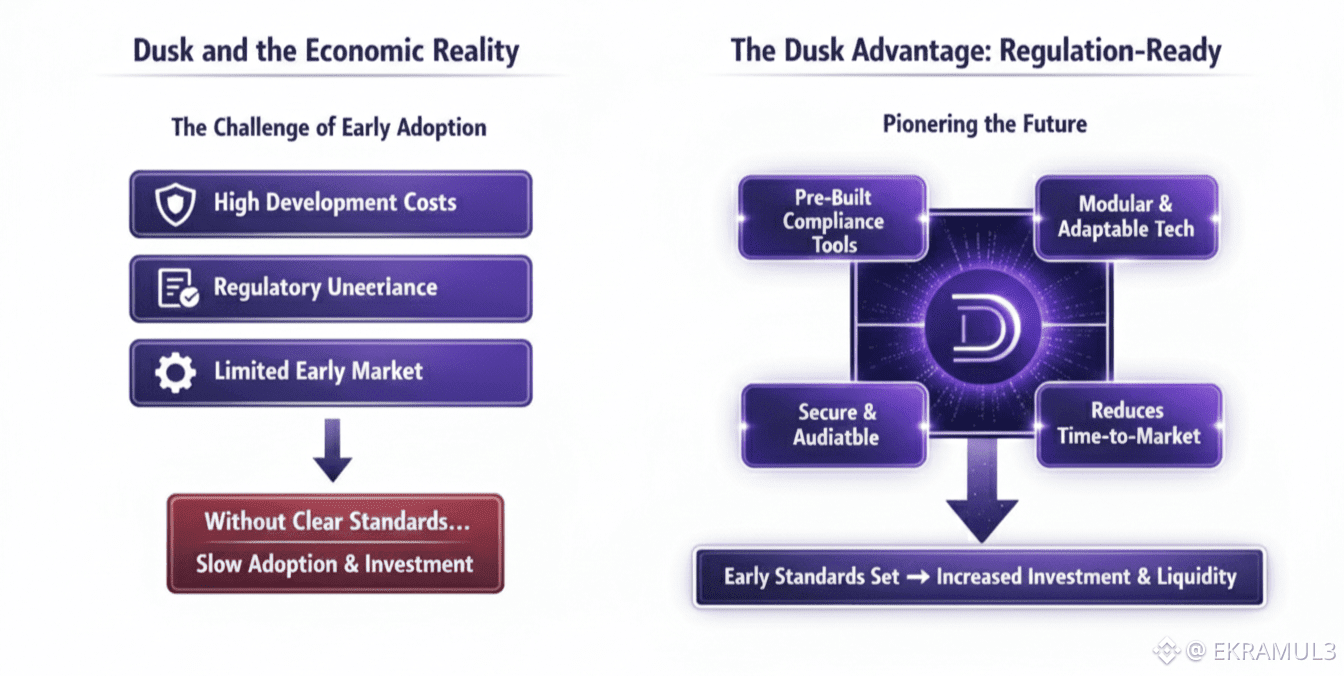

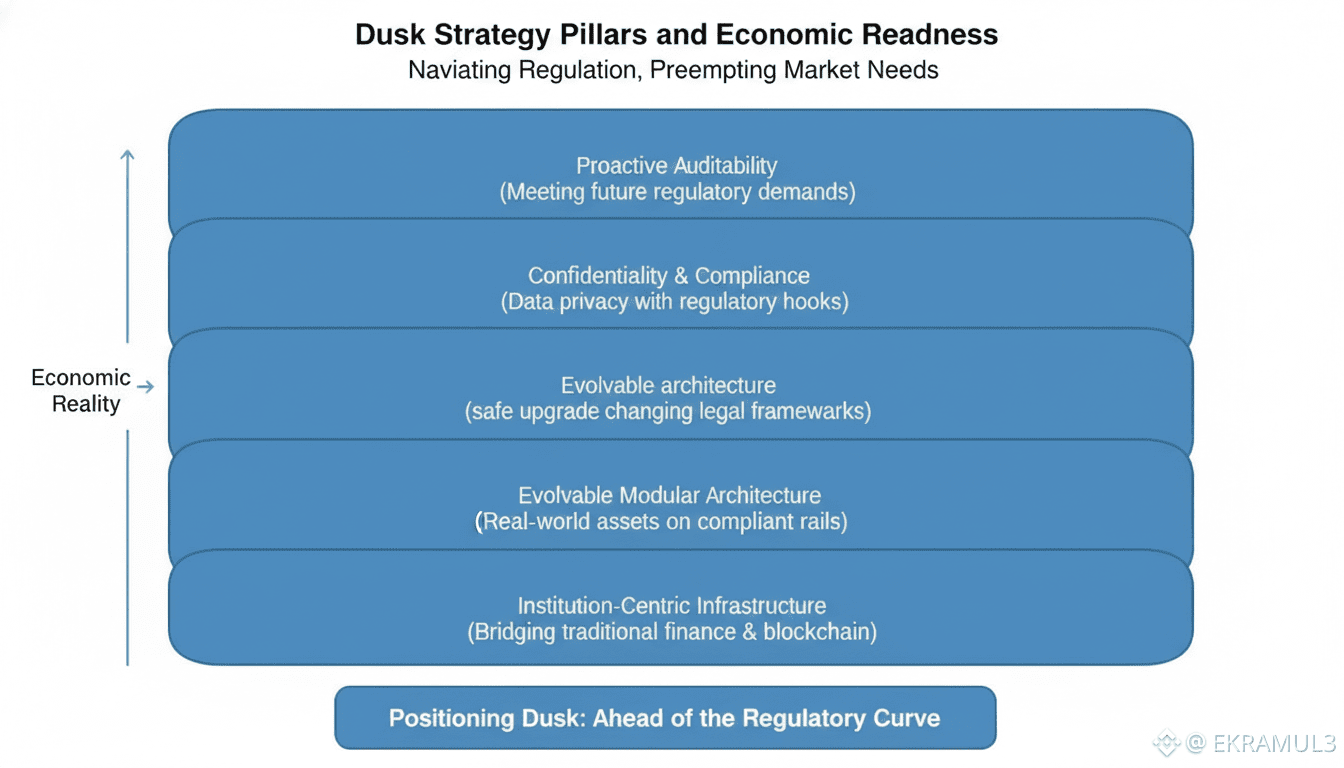

Most chains treat compliance as an add-on or a negotiation layer. Tools, dashboards, wrappers, blacklists, allowlists everything is built after the chain is live, and usually off-chain. Dusk takes the opposite approach: it assumes that the base layer itself will be inspected, audited, questioned, and expected to behave like financial infrastructure. It’s not romantic, it’s not hype-fuel, and it’s not built for the crypto marketing cycle. It’s built for regulators, auditors, and institutions who don’t care about memes and TPS, but care deeply about finality, disclosure, observability, and legal clarity.

Where Dusk breaks from the rest of the market is in how it treats privacy. Not as a cloak, not as a default ideology, and not as an anonymity lens. Instead, Dusk treats privacy as a configurable attribute of financial systems something you dial up or down depending on the counterparty and the obligation. In traditional markets, this style of “selective visibility” isn’t innovation it’s how the world already works. Issuers, counterparties, clearing houses, custodians, regulators all see different slices of the same transaction. No one gets the entire picture unless they’re legally entitled to it. Dusk is the first L1 that tries to replicate that structure natively.

The network’s bifurcated execution model allowing transparent and confidential transfers to coexist looks boring if you view it through a retail lens. But if you think like a custody desk or a broker-dealer, it’s exactly the abstraction you need to avoid data leakage. It means internal treasury operations don’t bleed signal into the public market. It means corporate payments don’t become competitive intelligence. It means securities can settle without exposing investors and allocations to third parties. In short: privacy stops being about hiding; it becomes about functioning.

The network’s bifurcated execution model allowing transparent and confidential transfers to coexist looks boring if you view it through a retail lens. But if you think like a custody desk or a broker-dealer, it’s exactly the abstraction you need to avoid data leakage. It means internal treasury operations don’t bleed signal into the public market. It means corporate payments don’t become competitive intelligence. It means securities can settle without exposing investors and allocations to third parties. In short: privacy stops being about hiding; it becomes about functioning.

And while the privacy story gets most of the attention, Dusk’s base-layer discipline is arguably more radical. DuskDS exists to do one thing well: establish deterministic truth. It doesn’t attempt to overload settlement with arbitrary logic, exotic execution layers, or state bloat. Dusk treats settlement like banks and exchanges treat settlement sacred, final, and legally consequential. That mindset is extremely rare in crypto, where “settlement” often means “no reorg for a few minutes probably.”

The move toward a modular stack with an EVM-compatible execution environment is another example of Dusk optimizing for real adoption rather than doctrinal purity. Developers don’t want to learn new languages. Auditors don’t want bespoke tooling. Institutions don’t want vendor lock-in. Dusk’s pragmatism isn’t ideological; it’s an admission that familiarity reduces friction more than elegance does.

Where things get more revealing is in the operational details. Dusk doesn’t pretend bridging is magic, or that asset migration is flawless, or that custodial boundaries disappear because the word “trustless” was written in the documentation. The system admits where trust exists, where finality is conditional, where rollup constraints introduce latency, and where off-chain processes still live. That level of candor is unusual in crypto but totally normal in regulated environments, where hidden assumptions can blow up entire institutions.

Even staking behaves like infrastructure rather than theater. No punitive lock traps. No gimmicky penalties. No “supply sink” mechanics designed to inflate price optics. The staking system optimizes for operational flexibility something institutions actually need. Liquidity that can exit cleanly is not a risk; it’s a requirement of professional capital.

If you zoom out, the most interesting part of Dusk isn’t what it adds. It’s what it refuses to ignore. It assumes that regulators will ask questions. It assumes that auditors will need histories. It assumes that compliance teams will demand proofs. It assumes that disclosures must be selective, not universal. And most importantly, it assumes financial infrastructure cannot rely on social consensus to resolve disputes.

If you zoom out, the most interesting part of Dusk isn’t what it adds. It’s what it refuses to ignore. It assumes that regulators will ask questions. It assumes that auditors will need histories. It assumes that compliance teams will demand proofs. It assumes that disclosures must be selective, not universal. And most importantly, it assumes financial infrastructure cannot rely on social consensus to resolve disputes.

The broader crypto industry still treats regulation as a future event something that might happen, later, after growth. Dusk treats regulation as an environment something that already exists, and that must be priced into the architecture from day one. That choice slows hype but accelerates credibility. It’s also expensive. It forces the chain to behave like financial infrastructure before any financial institution actually uses it. But when adoption eventually arrives, the cost of readiness becomes the competitive moat.

If Dusk wins, it won’t be because it outran regulation.

It will be because it met regulation halfway while everyone else pretended the bill would never arrive.

And in institutional finance, paying that bill early is usually the cheapest way to do it.