$DUSK isn’t just another privacy coin trying to compete for retail attention. Its real ambition is bridging traditional finance with blockchain, and that’s where Real‑World Assets (RWAs) come into the picture. In most blockchains, tokenized assets exist in a vacuum — you can swap or stake them, but they’re mostly digital abstractions. @Dusk flips that model: it’s designed to handle real, regulated assets on-chain while keeping the transactions private, compliant, and auditable.

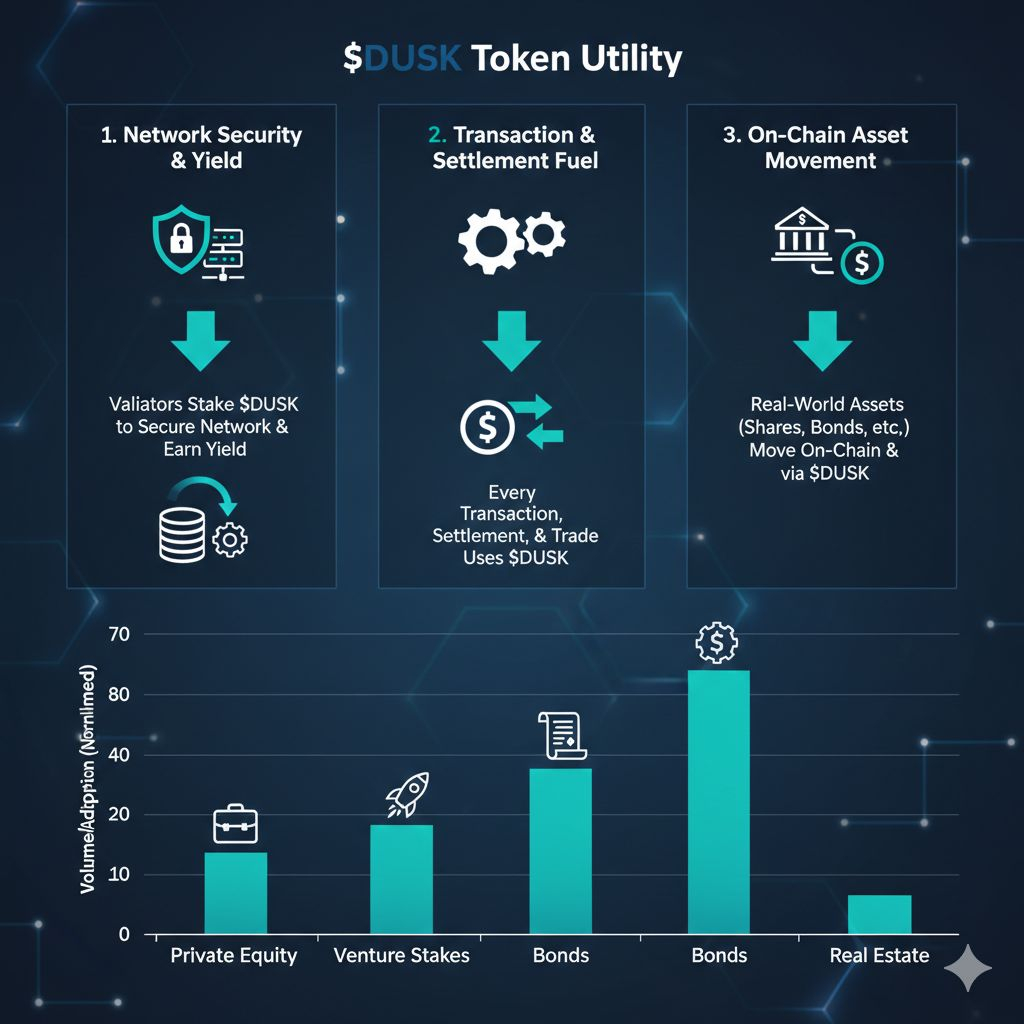

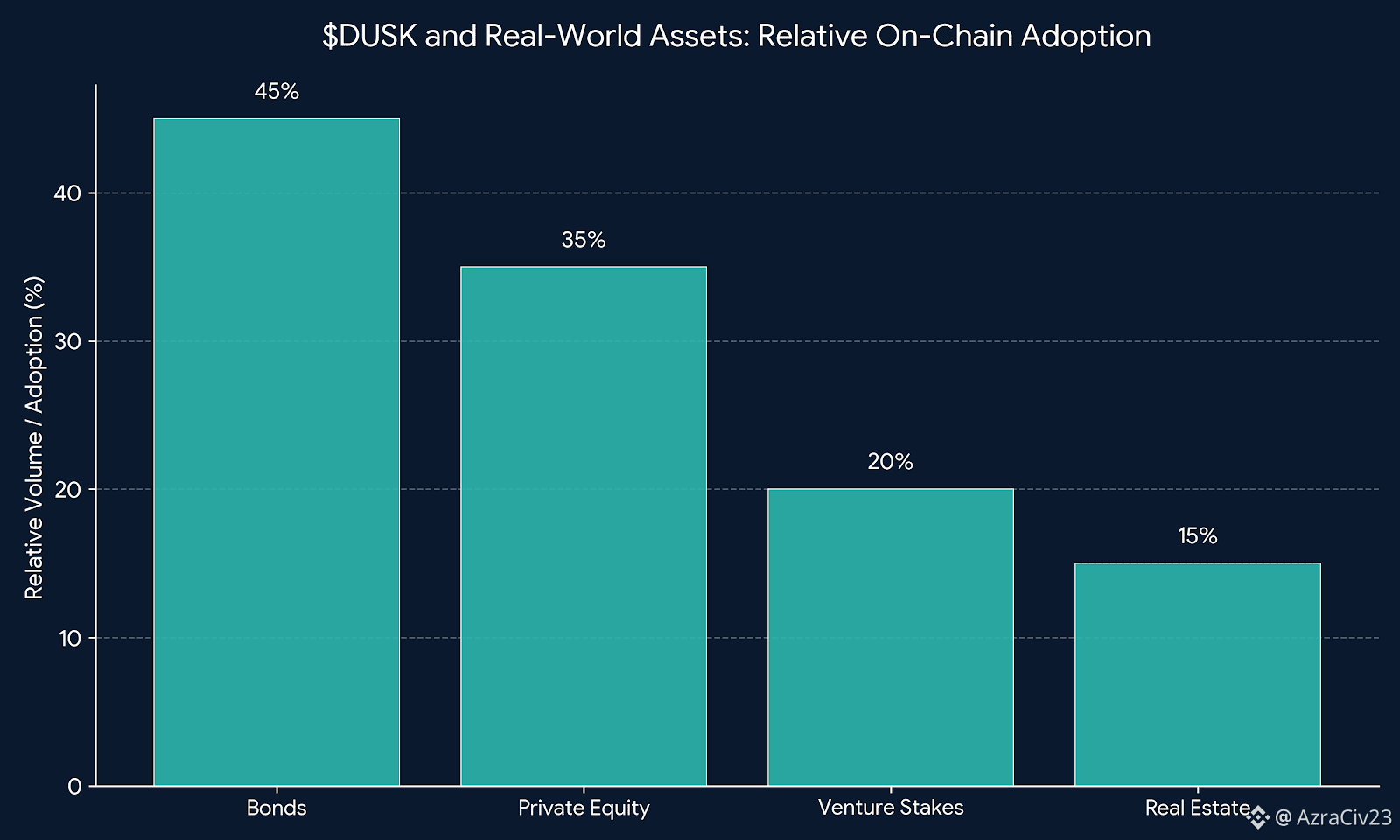

Think of it this way: banks, exchanges, and institutional investors want the efficiency and programmability of blockchain, but they can’t afford to put every trade on a public ledger where competitors and regulators can see the full details. DUSK solves that by combining zero-knowledge proofs with selective disclosure. A bond, a stock token, or even a private loan can move across the chain, settle instantly, and remain confidential, yet still meet regulatory requirements. That’s why DUSK talks about RWA — it’s not hypothetical, it’s the core use case that defines the network’s value.

Technically, this is ambitious. The network uses Succinct Attestation PoS for consensus, layered with a modular architecture that separates confidential execution, EVM-compatible contracts, and data settlement. On top of that, DUSK integrates identity verification tools, letting regulated actors confirm KYC/AML requirements without exposing sensitive data. This is what enables RWAs to exist safely on-chain — something almost no other L1 is doing with privacy and compliance baked in.

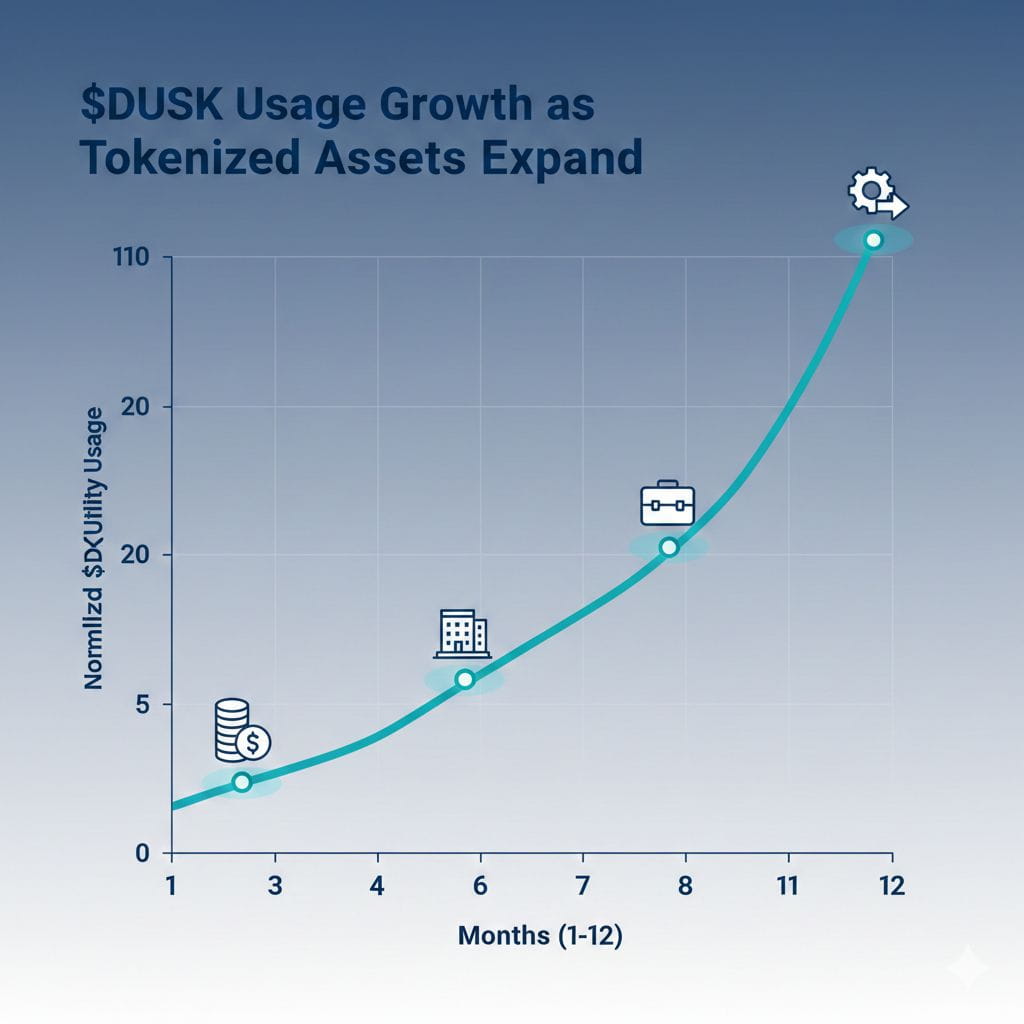

From a token perspective, DUSK plays a central role here. Every transaction of an RWA, every confidential smart contract execution, and every validator securing the network uses the token. Its long-term emission schedule aligns incentives for participants to support infrastructure rather than chase short-term speculative gains, which mirrors the slow-moving, high-stakes nature of real-world finance.

And yet, the market often interprets DUSK differently. Exchange inflows, platform concentration, and daily trading volumes sometimes dominate the price, making technical charts look jittery even though the fundamental adoption story — RWA tokenization, institutional pilots, and privacy-first compliance — keeps advancing steadily in the background. In other words, DUSK’s chart might spike or pull back, but under the hood, real financial infrastructure is being built that could sustain the network for years.

The takeaway is clear: DUSK isn’t aiming for hype-driven speculation. Its narrative lives in real-world financial integration, regulated asset settlement, and privacy-preserving blockchain architecture. RWAs aren’t just a feature; they are the raison d’être of the network, and understanding that is key to seeing why the token, despite short-term market swings, could grow in relevance as traditional finance slowly migrates on-chain.