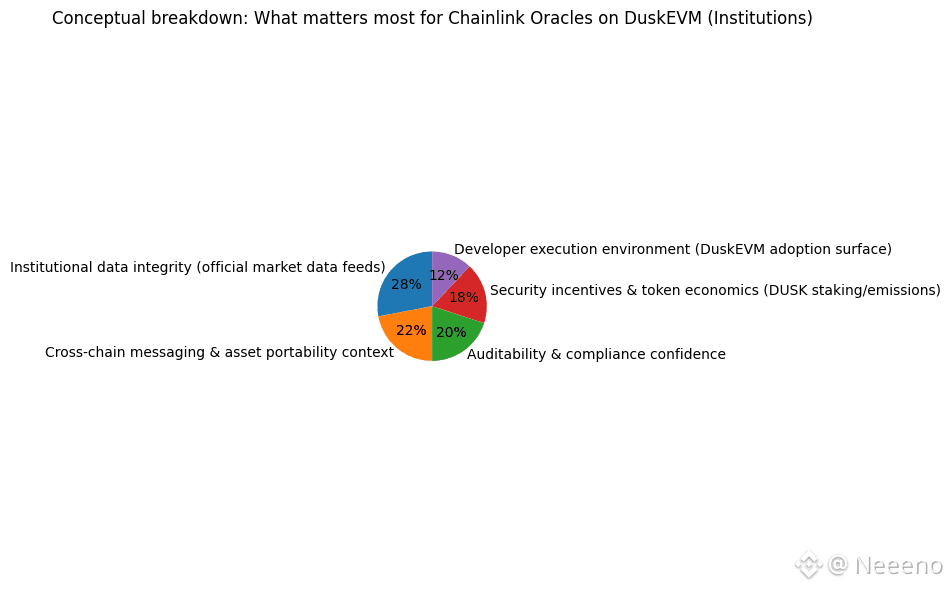

$DUSK The first thing you learn, living close to DuskEVM, is that “data” is never just data. In a regulated market, a number on-chain is an obligation. It is a promise that someone can defend in front of an auditor, and a promise that someone else can safely build on without quietly inheriting legal risk. That’s why the conversation around Chainlink oracles on DuskEVM isn’t really about plugging the outside world into smart contracts. It’s about deciding which parts of reality are allowed to cross the threshold—and under what conditions—when the people using the system are not hobbyists, but institutions that have to survive scrutiny.

Dusk has been explicit for years that its destination is regulated finance, not a vibes-based version of it. And when you choose that destination, you also choose a different kind of failure.

In open markets, failure is usually obvious—things go down, positions get wiped, and users get mad. In regulated markets, failure can be quieter but worse: records don’t add up, prices are disputed, information is inconsistent, and the system feels unreliable when it matters most.. That fear is quiet, but it changes how institutions move. They slow down. They add intermediaries. They keep things off-chain. So the real question becomes: can you build an on-chain environment where the “outside world” can be represented with enough integrity that a compliance team doesn’t flinch?

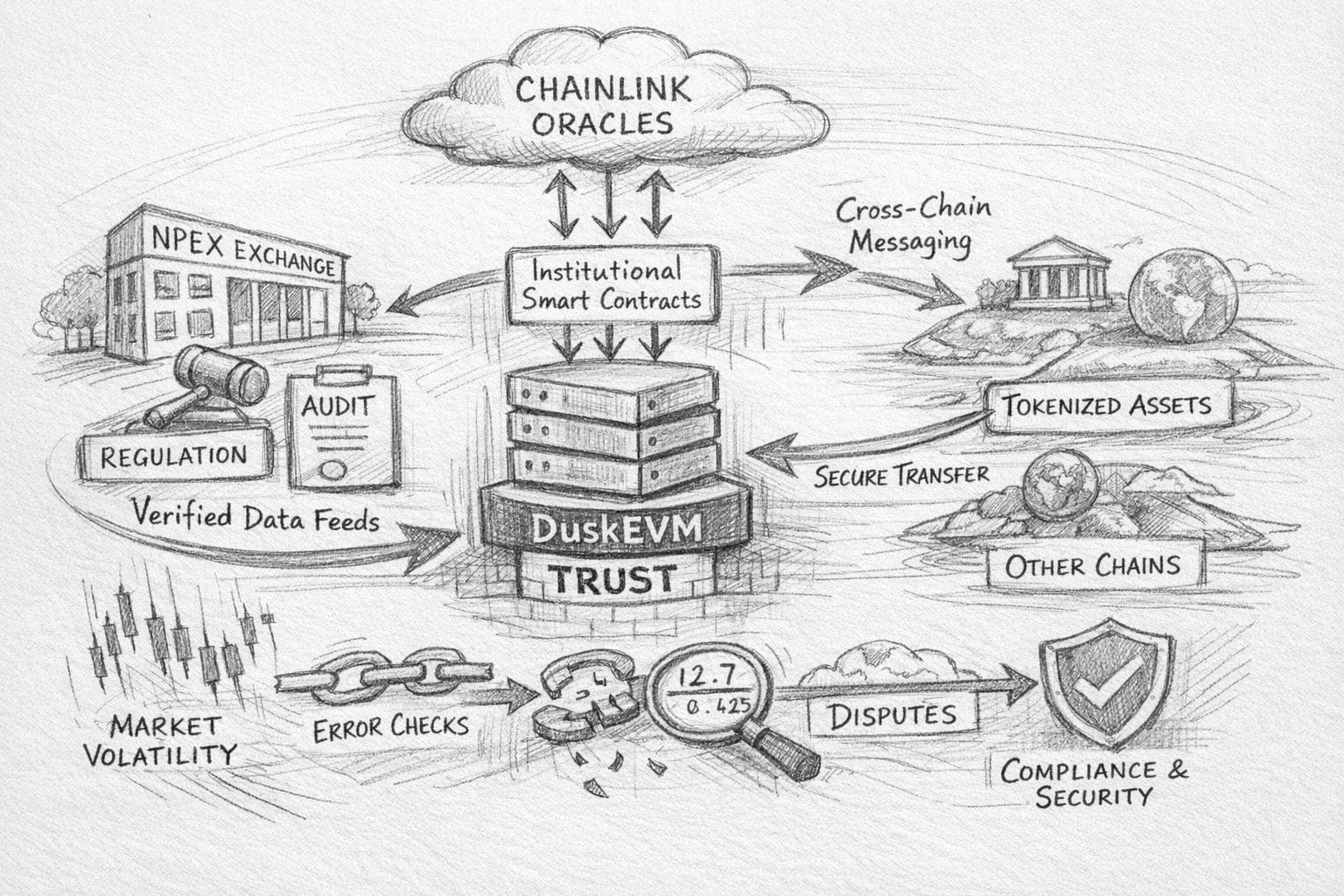

That’s where the Dusk–Chainlink relationship stops being an ecosystem headline and starts reading like a structural decision. In November 2025, Dusk announced that it would adopt Chainlink’s interoperability and data standards alongside NPEX, positioning official exchange data to flow on-chain and framing Chainlink as the cross-chain messaging rail for assets issued in that environment. The detail that matters isn’t the brand name. It’s the intent to make regulated exchange data an “official” on-chain input, rather than leaving it to whoever shouts the loudest or scrapes the fastest. Dusk described a setup where NPEX exchange data is delivered on-chain as an exclusive oracle source for that venue, with additional low-latency price updates for trading-grade applications.

If you’ve never worked around real markets, it’s easy to assume price is just a number you can fetch. But in institutional settings, price is a dispute waiting to happen. Two counterparties can “agree” on a trade while still disagreeing on the reference data that justified it. And when that dispute escalates, the system is judged not by how it behaves in normal conditions, but by whether it can reconstruct what happened, why it happened, and who was responsible for each link in the chain. That’s why Dusk leaning into a standard oracle layer matters: it’s a way of saying, “We know where the number came from, and we can explain it later.”

Even more subtle is what cross-chain messaging means in this context. In retail DeFi, cross-chain is usually framed as convenience—move liquidity, chase yield, connect apps. For institutions, cross-chain is more like jurisdictional reality. Assets do not live in a single place. Capital doesn’t either. If a tokenized instrument is issued under one set of rules and later interacts with another environment, the compliance posture can’t evaporate mid-transfer. Dusk’s partnership language is deliberately oriented around preserving the context that institutions need when assets travel, rather than treating transfers as pure motion without memory.

This is also why DuskEVM is such an interesting surface area for the oracle problem. The Dusk documentation describes DuskEVM as an environment where developers can deploy contracts using familiar EVM tooling while benefiting from Dusk’s architecture and regulatory framing.That familiarity is a double-edged gift. It lowers friction, yes, but it also imports expectations. Developers bring patterns from other chains where data is often treated casually—an API call wrapped in a contract-shaped box. DuskEVM, if it’s going to serve institutions, can’t afford that looseness. It has to make it emotionally easy for a cautious builder to trust what they’re reading, and emotionally hard to ship something that’s “good enough” until it breaks in public.

So you start noticing the real work happens in the seams. How does off-chain information become something the chain can carry without becoming a liability? How do you prevent the most common human mistake—assuming the last value you saw is still true—when markets can move faster than anyone’s comfort? How do you design incentives so that the people delivering data are paid for being boring, not rewarded for being dramatic? There’s a reason institutions love infrastructure that disappears. It’s not that they don’t appreciate innovation. It’s that innovation is expensive to explain after the fact.

Chainlink’s own institutional material leans heavily on the idea that cross-chain and off-chain connections should be verifiable, not merely available. One widely circulated Chainlink report published in December 2025 states that the network has delivered more than 18 billion verified on-chain messages across 70+ blockchains. Even if you treat that number as marketing-adjacent, the underlying point aligns with what Dusk is trying to do: the job is not to be clever, it’s to be consistent. Institutions don’t adopt a system because it can do one impressive thing. They adopt it when the system has a long, uneventful history of being right

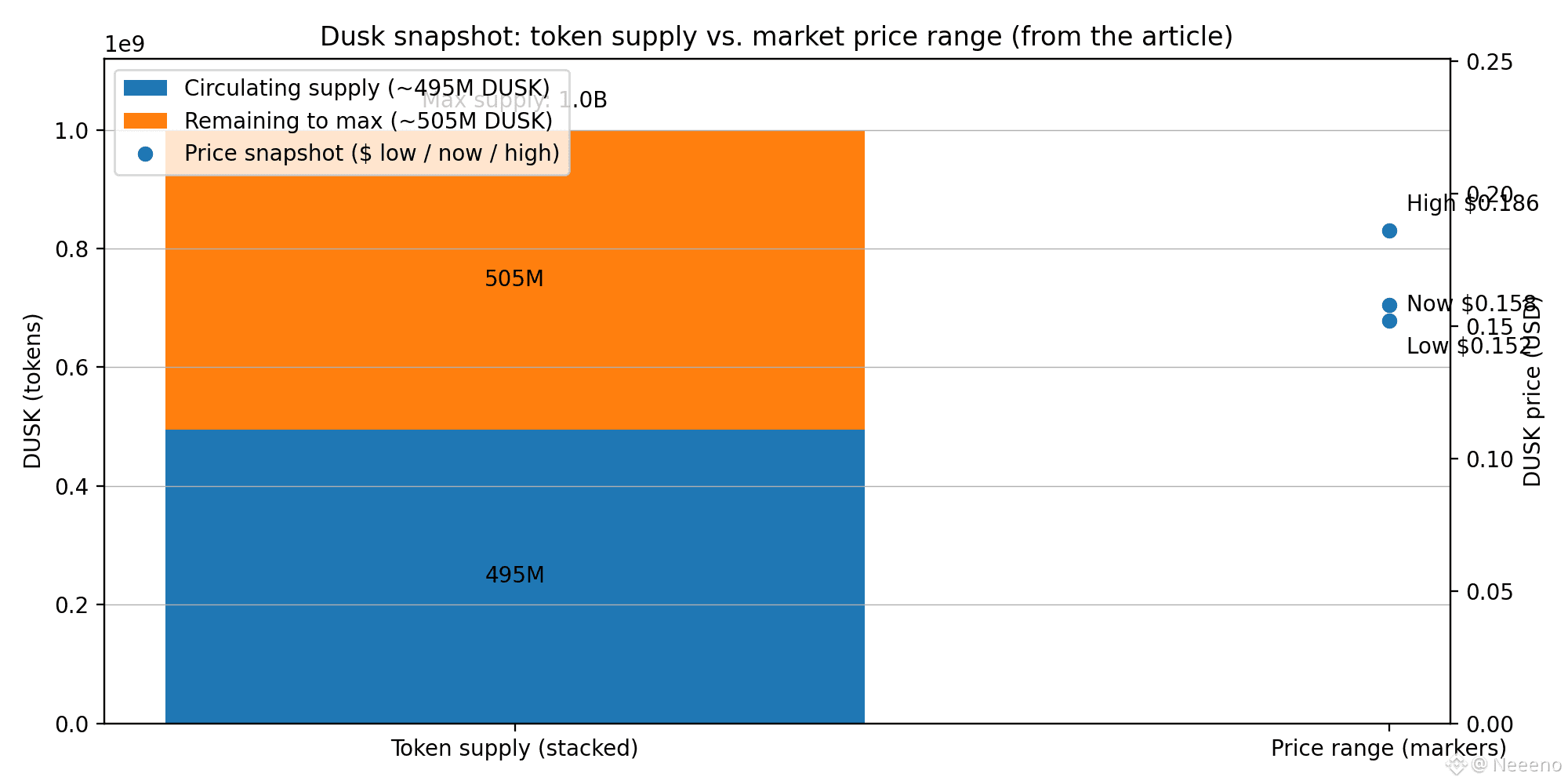

But none of this exists in a vacuum, because the token is part of the story whether we like it or not. DUSK is not just a unit of account—it’s the mechanism through which the network pays for security, participation, and continuity. Dusk’s own tokenomics documentation describes a maximum supply of 1,000,000,000 DUSK, with 500,000,000 initial supply and another 500,000,000 emitted over time (described as 36 years) to reward stakers.That schedule matters when you’re building institutional infrastructure because long-term reliability requires long-term incentives. Short-term token economics create short-term behavior. And short-term behavior is exactly what regulated markets are trained to distrust.

Right now, the market data around DUSK tells a story of a token that has become very liquid again—whether for the “right” reasons or not. As of today (January 24, 2026), DUSK is trading around $0.158 with an intraday range roughly between $0.152 and $0.186. Public trackers list circulating supply around ~495 million DUSK out of a 1 billion max supply, with a market cap in the neighborhood of ~$79M and 24-hour volume that has recently printed in the tens of millions of dollars.That liquidity is a kind of stress test of its own. When volume spikes, systems don’t just get used more—they get used more carelessly. That is when oracle assumptions get punished.

And the institutional angle shows up again when you look at what Dusk has been building toward in parallel. The same November 2025 announcement frames the integration around NPEX and the idea of regulated assets arriving on-chain with official market data.If you’ve ever watched an institution evaluate new infrastructure, you know the emotional order of operations: first, “Can this break us?” then, “Can we explain this?” and only later, “Can we grow with it?” Getting exchange-grade data and cross-chain messaging into the same narrative as regulated issuance is an attempt to answer those first two questions before anyone asks for growth.

There’s also a quieter architectural point here. Dusk has talked about evolving its architecture over time into a modular, layered approach, which is what you do when you realize that regulated finance is not one problem, but many problems that shouldn’t all share the same failure modes.Oracles fit naturally into that worldview because they are, by definition, boundaries. They are where assumptions enter. They are where disputes begin. Treating the boundary as first-class infrastructure—rather than a developer convenience—changes how the entire system feels to build on. You stop thinking in terms of “getting data.” You start thinking in terms of “taking responsibility for an input.”

In practice, this is what I think DuskEVM plus Chainlink is really aiming for: reducing the number of moments where a human has to take a leap of faith. Under pressure, people don’t rise to their ideals; they fall to their defaults. Developers default to whatever is simplest. Traders default to whatever is fastest. Risk teams default to whatever keeps them out of trouble. A well-chosen oracle layer doesn’t remove human nature, but it can make the safe path the easiest path, and make the dangerous shortcuts more obvious.

And when things go wrong—because they always do—the value becomes painfully clear. If a market moves violently, you need to know whether the on-chain system ingested stale information or whether the outside world itself was chaotic.

When sources conflict, use a neutral rulebook. And when a cross-chain event is questioned, tell the story using verifiable records—not hype, status, or crowd noise. That’s the difference between infrastructure that merely functions and infrastructure that can be defended.

If you zoom out one last time, the most telling thing is how little any of this is trying to be glamorous. The Dusk–Chainlink update in November 2025 reads like a commitment to being accountable about inputs and portability of assets, not a celebration of novelty.The tokenomics read like a long, slow plan for keeping participants paid to keep showing up. And the market data—price around $0.16, circulating supply around 495 million, liquidity surging and fading as attention shifts—reminds you that public markets are emotionally volatile even when the infrastructure underneath is trying to be steady.

That’s the core tension of building institutional rails in public: you’re trying to create something calm inside an environment that rewards drama. Oracles and cross-chain messaging are not exciting when they work, and that’s the point. Quiet responsibility looks like refusing to treat reality as a toy. Invisible infrastructure looks like data arriving the same way every time, even when markets are panicking.

Reliability isn’t a performance—it’s steady work. It matters more than most people notice, and it works best when it isn’t being praised.