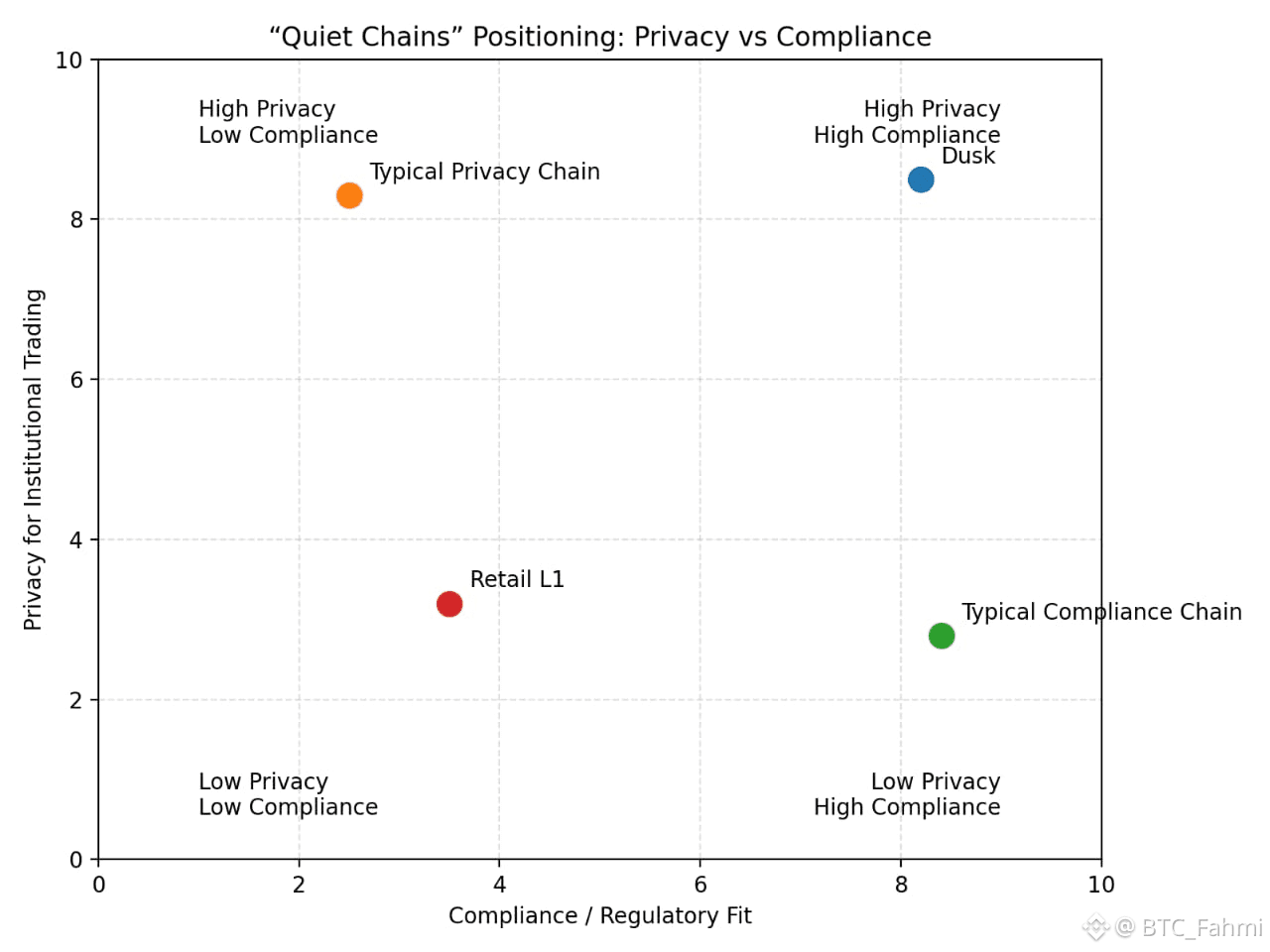

The first wave of crypto tried to replace banks. The next wave is trying to work with them without losing the benefits that made crypto worth caring about in the first place. That’s where “quiet chains” come in: networks built less for memes and more for regulated markets, real settlement, and institutional grade privacy.

Dusk Network is one of the clearest examples of that idea. It doesn’t market itself as a general-purpose chain for everything under the sun. Its identity is narrower, and that’s exactly why serious investors are watching it: Dusk is positioning itself as a blockchain designed for regulated finance where privacy is not a luxury, but a requirement.

To understand why this matters, you have to look at what regulated finance actually needs. Institutions can’t run capital markets on a chain that broadcasts every position, trade size, counterparty interaction, or investor behavior to the entire internet. Even when wallet identities are hidden, the metadata isn’t. Patterns reveal strategies. Flows reveal intent. And in real markets, intent is money.

At the same time, regulators are not interested in shadow markets. They want auditable systems, clear accountability, and compliance frameworks that match laws like MiFID II, MiCA, and frameworks such as the EU DLT Pilot Regime. Dusk is built to live inside that reality: not a fantasy world where regulation is ignored, but a world where compliance and privacy are engineered into the protocol. This is why Dusk describes itself as a regulated and decentralized network built for institutions, users, and businesses.

That combination privacy plus compliance is hard. Many projects claim both, but most end up choosing one. Privacy chains often become “too private” for regulated adoption, while compliant networks become too transparent for real trading behavior. Dusk’s core thesis is that regulated finance doesn’t require public exposure it requires selective disclosure. In other words: transactions can be private by default, but provably compliant when needed.

This is where its technology starts to matter. Dusk’s design is tied to privacy-preserving cryptography (including zero-knowledge approaches) and a Proof-of-Stake consensus approach aimed at enabling participation without leaking sensitive validator identity metadata. The project’s documentation and research materials describe a PoS-based consensus and architecture designed around privacy and programmability.

But here’s the key point for traders and investors: technology only matters if it gets adopted. The real question isn’t “Is Dusk technically impressive?” The question is “Does it fit the direction regulated markets are moving?”

Right now, the trend line is clear. Tokenized real-world assets (RWAs), regulated on-chain trading venues, and compliant settlement rails are moving from conference-stage talk to actual integration. Dusk has been leaning into that direction publicly through partnerships and collaborations aimed at regulated market infrastructure. For example, Dusk announced a strategic collaboration with 21X, including Dusk being onboarded as a trade participant and plans for deeper integration (including 21X integrating DuskEVM). The project has also been linked to efforts around regulated securities exchange infrastructure in Europe, including partnership coverage involving NPEX in the Netherlands.

This is where the “quiet chain” framing becomes powerful. Dusk isn’t trying to dominate retail narratives every cycle. It’s trying to become a piece of financial plumbing — the kind nobody talks about, but everybody depends on.

Now let’s talk market reality, because investors always do. As of January 23, 2026, DUSK is trading around $0.16, with a market cap in the ~$79M range and significant daily volume. That price action should not be treated as a verdict on the project’s future; it’s more of a reminder that infrastructure narratives take time to monetize. Many traders want instant feedback loops, but regulated adoption moves slowly, through pilots, approvals, and procurement cycles.

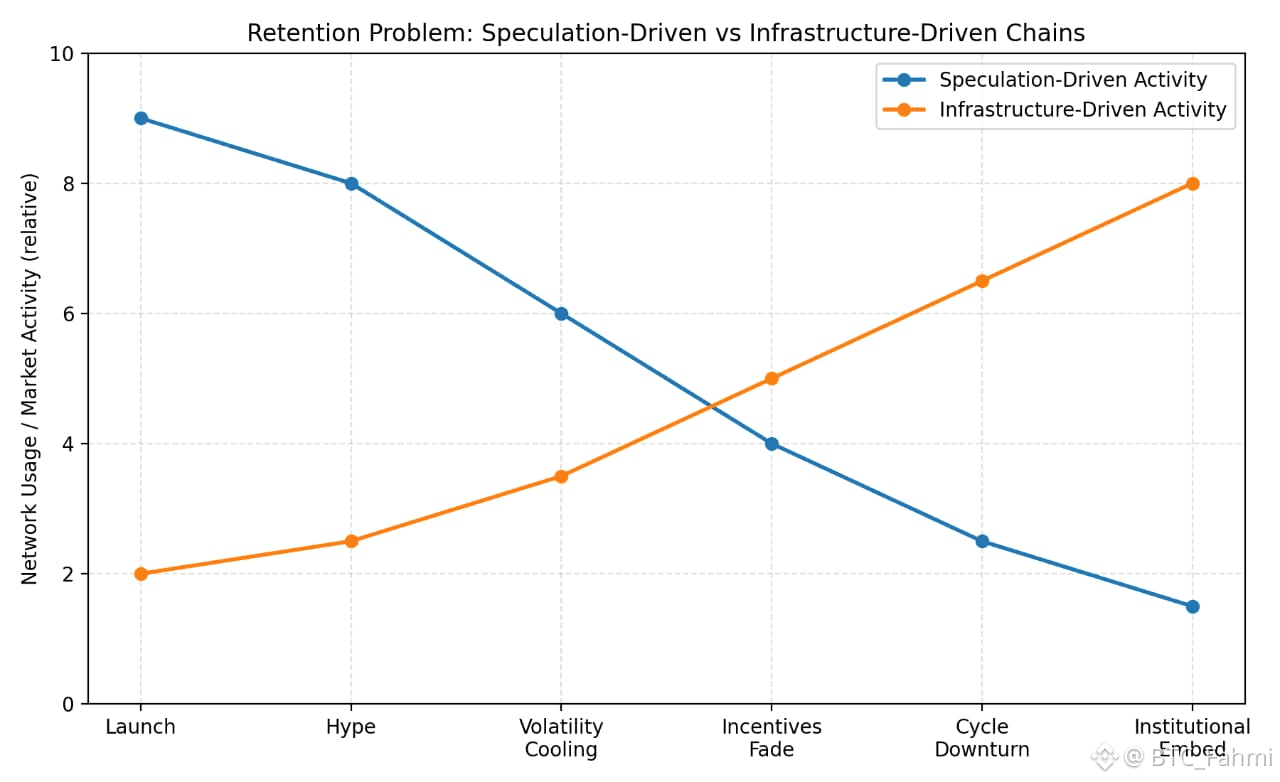

And that leads directly into what I call the retention problem the silent killer of most “serious” crypto projects.

In regulated finance, “retention” isn’t about having a community that posts daily. Retention means: will institutions keep using the rails once the novelty fades? Will liquidity stay after incentives drop? Will issuers continue issuing, and traders continue trading, when markets get boring?

Most crypto networks lose retention because their product-market fit depends on speculation. Once volatility cools, activity drops, validators leave, liquidity thins, and the chain feels like an abandoned mall.

Dusk’s bet is different: if you can build rails that regulated markets actually need, retention becomes structural. A regulated venue doesn’t “move on” because another trend appears not if the venue is compliant, liquid, and integrated. If Dusk becomes embedded in issuance and settlement flows, usage can persist across cycles in a way meme-driven chains usually can’t.

A simple real-world comparison: think about trading infrastructure like FIX protocol, SWIFT messaging, or clearing systems. Nobody gets excited about them, but that’s the point they’re stable because finance depends on them. Quiet doesn’t mean weak. Quiet can mean sticky.

Of course, the risks are real. The biggest isn’t technical it’s execution. Regulated infrastructure takes longer, costs more, and depends on relationships that retail driven projects don’t need. If partnerships don’t mature into live volume, or if regulation evolves in unexpected ways, the growth curve can remain slow.

But the unique angle here is this: most blockchains are racing to be louder. Dusk is racing to be more acceptable — to regulators, institutions, and market operators who can’t afford chaos.

If you’re a trader, the lesson is to stop looking at these assets like a weekly narrative coin and start evaluating them like infrastructure options. Infrastructure doesn’t pump every day. But when it wins, it can become foundational.

Don’t just track DUSK’s price track whether Dusk continues adding regulated participants, integrations, and real issuance activity. Follow the proof of adoption, not the noise. Because the future of regulated finance will not be led by the loudest chain.

It will be led by the quiet ones that survive.