If you have ever witnessed a trading venue collapse during a tumultuous session, you are aware that the uncertainty that follows the outage poses a greater danger than the outage itself. Has my order been delivered? Was it noticed by the opposing party? Has the record been updated? Confidence is a product in markets. Stretch that same sentiment throughout the crypto infrastructure, where "storage" is more than just a layer of convenience; it's where NFTs reside, where assets are stored in on-chain games, where DeFi protocols store metadata, and where tokenized real-world assets might potentially hold papers and proofs. Everything above that storage is susceptible to manipulation, selective withholding, or covert corruption.

Walrus is attempting to address the security issue of "will the data survive" as well as "will the data stay trustworthy even when some participants behave maliciously."

This danger concept is known as Byzantine faults in distributed systems. In the worst situation, nodes lie, band together, transmit inconsistent responses, or attempt to undermine recovery instead of just failing or disconnecting. Byzantine fault tolerance is not academic for traders and investors assessing infrastructure tokens such as WAL. It's the distinction between storage that acts like a fragile content server and storage that acts like a robust settlement layer.

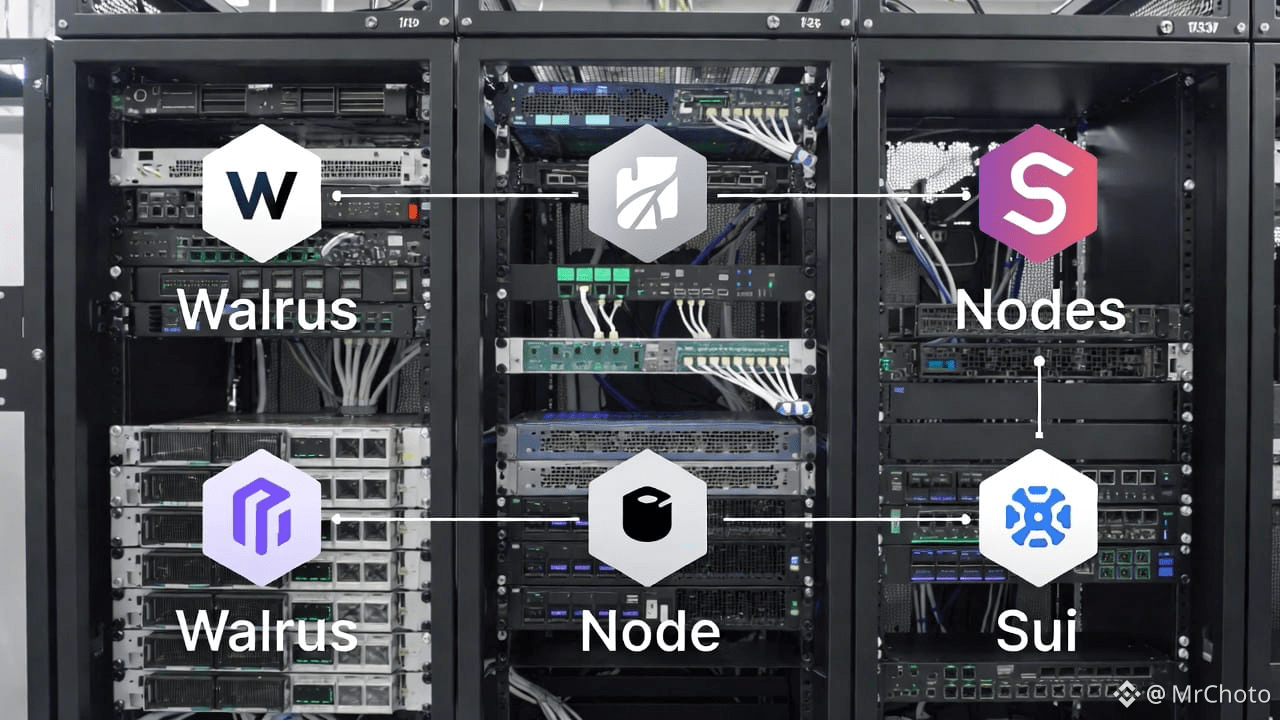

Using Sui as its control plane for coordination, programmability, and proof-driven integrity checks, Walrus is built as a decentralized blob storage network (big, unstructured data). The main technical idea is to employ erasure coding to recreate a file even if many sections are missing, rather than full replication, which is costly. In order to retain high resilience with comparatively low overhead (around a ~4.5–5x storage factor instead of storing full copies everywhere), Walrus' paper presents "Red Stuff," a two-dimensional erasure coding technique.

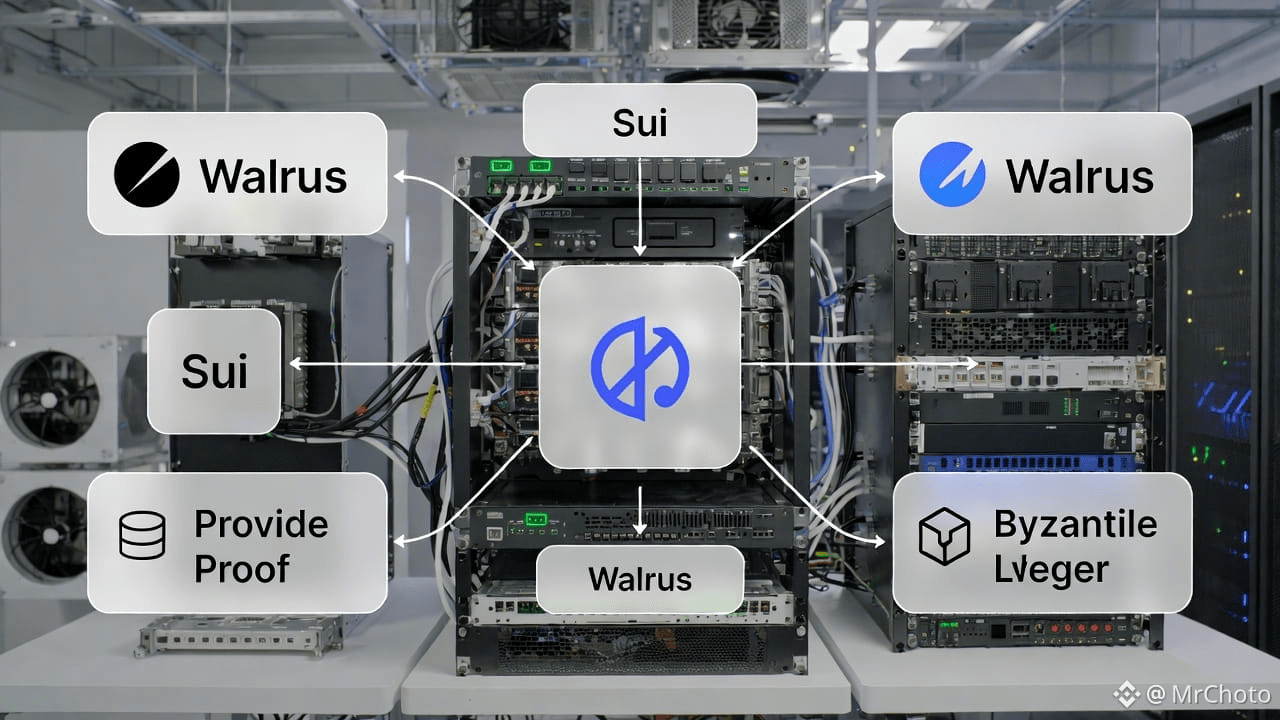

However, Byzantine behavior cannot be resolved by erasure coding alone. Garbage can be returned by a malicious node. It may assert that it has data that it does not. Different requesters may receive different fragments from it. By contaminating the process with the wrong parts, it may attempt to ruin reconstruction. Walrus uses blockchain-based accountability, cryptographic commitments, and coding to do this.

The useful intuition is that Walrus does not request that the network "trust nodes." Nodes are asked to provide proof. The system is designed so that a storage node's role is not just to store a fragment but also to consistently demonstrate that it is a trustworthy repository for that fragment over time. For this reason, Walrus places a strong emphasis on proof-of-availability techniques that can consistently confirm if storage nodes still have the data they agreed to hold.

It is comparable to margin in the parlance of traders. The market requires you to maintain collateral and maintain verifiable solvency at all times since it doesn't trust your assurances. #walrus treats storage with a similar level of discipline.

In this case, the control plane is important. In order to control node lifecycle, blob lifecycle, incentives, and certification procedures, Walrus interfaces with Sui. This ensures that storage is not merely "best effort," but rather required behavior inside an economic system. Because pure "goodwill decentralization" collapses under real money incentives, it is crucial in Byzantine settings to apply protocol restrictions linked to staking and rewards to penalize dishonest or underperforming nodes.

Churn—nodes departing, committees shifting, networks changing—is another significant Byzantine perspective. Because storage networks are unable to maintain a stable collection of members indefinitely, Walrus is designed with epochs and committee reconfiguration in mind. In any practical sense, a storage protocol that can withstand Byzantine faults for a week but falters during rotation events is not secure. Reconfiguration steps are part of Walrus' strategy, which aims to maintain availability even when the node set changes.

This is more important than it seems. The majority of long-term decentralized storage failures are gradual degradation events rather than spectacular attacks. Operators discreetly go. Incentives deteriorate. hardware modifications. Partitions of networks occur. If the security of the protocol is predicated on consistent participation, there won't be a single disastrous "exploit day." Reliability gradually collapses, and by the time consumers realize it, recovery is costly and unfeasible.

The retention issue is the portion that investors should be most concerned about at this point.

"Permanent storage" is a catchphrase in the cryptocurrency world. However, permanency is a long-term economic promise rather than a marketing slogan. Reasonable suppliers close their doors if storage rewards are less than operation expenses. Retention is affected if governance modifies emissions. The network gets narrower if demand collapses. Additionally, thinning networks are risky in a Byzantine situation because it makes cooperation simpler because there are less independent actors between users and coordinated manipulation when there are fewer nodes.

Because retention is the long game, Walrus's primary pillars are staking, governance, and rewards. Its architecture aims to maintain a sizable and financially motivated provider set in addition to dispersing coded fragments, preventing Byzantine actors from ever gaining the majority of influence. Because incentives attract honest capacity, which is what makes the math of Byzantine tolerance work in practice, WAL is functionally linked to the "security budget" of storage.

For a realistic analogy, consider exchange order books. One player cannot simply manipulate pricing in a liquid order book due to its inherent resilience. However, manipulation becomes inexpensive when there is a lack of liquidity. Storage networks exhibit comparable behavior. Liquidity is retention. Byzantine risk increases dramatically without it.

What should investors and traders do with this, then?

First, see storage tokens as infrastructure balance sheets rather than "narrative trades." How powerful incentives are in relation to costs, how well dishonest operators are punished, how the network manages churn, and how reliable proof procedures are over extended periods of time are the key questions. These concerns are highlighted in Walrus' published technical design, particularly in relation to erasure coding, proofs of availability, and control plane enforcement.

Second, keep a close eye on the retention story in addition to price activity if you're monitoring $WAL as an asset. Because security is compromised if the retention engine fails. Additionally, if security fails, demand breaks rather than gradually declining.

Web3 requires robust infrastructure that can withstand the worst-case threats, not just typical network disruptions, if it is to be more than just conjecture. Walrus is specifically built with that hostile environment in mind. The call to action for investors is straightforward: assess the protocol based on its failure modes rather than its best days, just like you would a market venue. @Walrus 🦭/acc