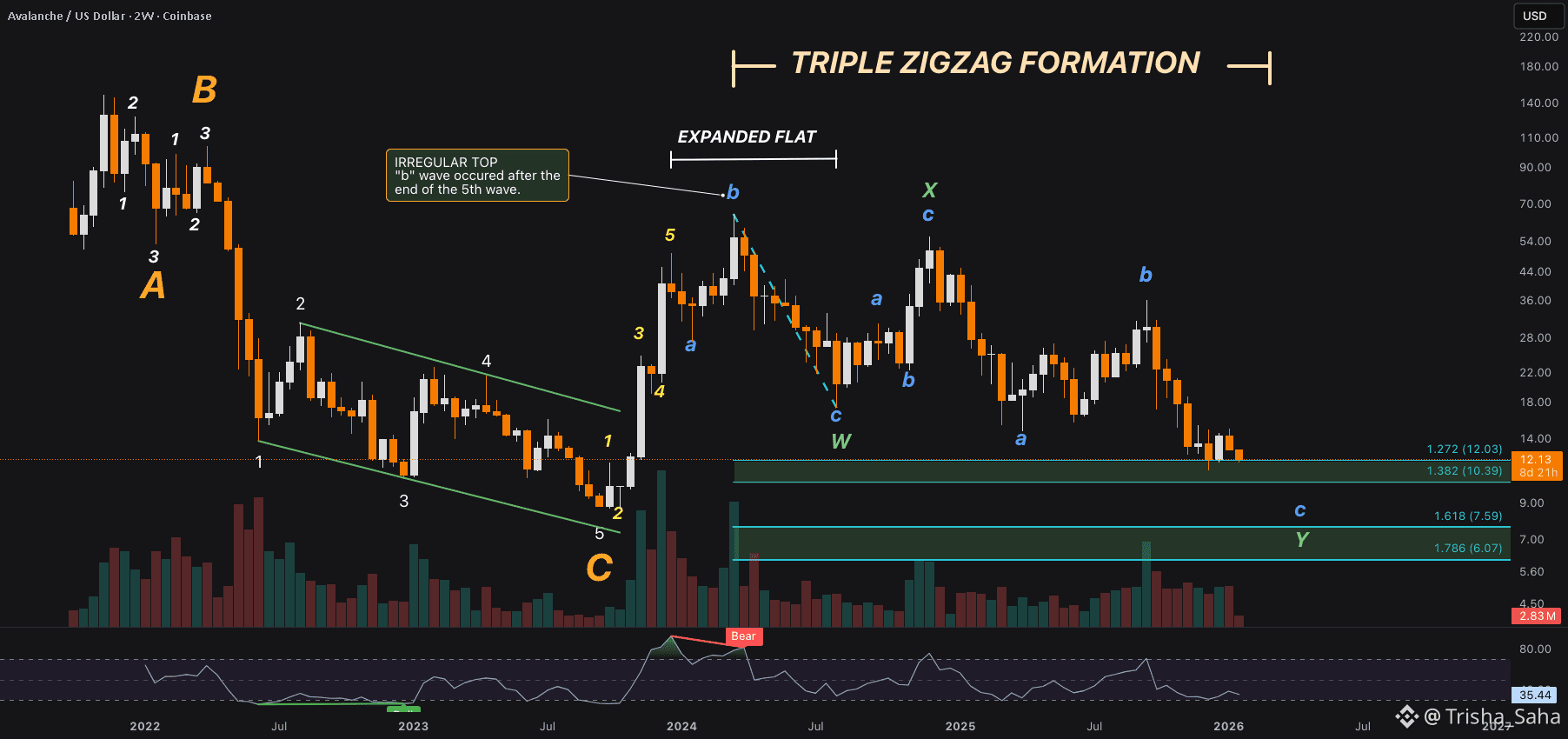

Triple Zig-Zag

It appears that AVAX has been forming a triple zig-zag correction on a high time frame. After further study of lower time frames, I have discovered smaller fractals of this correction of lower degrees. Price action is currently supported by the 1.272 pocket, which COULD lead to a reversal, but the1.618 (Wave "W" × 0.618) is a favored ratio above the 1.272 . However, there are crumbs on a lower time frame that suggest we may be experiencing another fractal of this structure.

On The 8-Hour Chart

An ABC correction has complete, and has price has become impulsive to the down side; the dominant trend has resumed. Price is currently in the Golden Window (0.618-0.786) retracement of wave B and in an area of high liquidity. Could this be a shakeout reversal pattern or continuation pattern? 👇👇👇

On the 1-Hour Chart

An exotic expanded running flat was printed that potentially marked wave 2 or B of a higher degree. Afterward came a 5 wave impulse down with a truncated 5th followed by an ABC to the upside. It's possible that we are in the middle of a zig zag correction and are waiting for confirmation of wave 2 of the potential 5 wave impulse down. An invalidation level would be @ $12.49 and would suggest that the high time frame triple zig zag may be complete at the 1.272 of wave "W". 👇👇👇

...if price action continues to the down side the 1.618 of wave A is a common area of retracement. The 1.272 ratio on the 1-Hour chart is also a potential retracement level, but less common than the 1.618.

This Publish Is Intended For Educational Purposes Only