The Confidence of Short-Term Capital

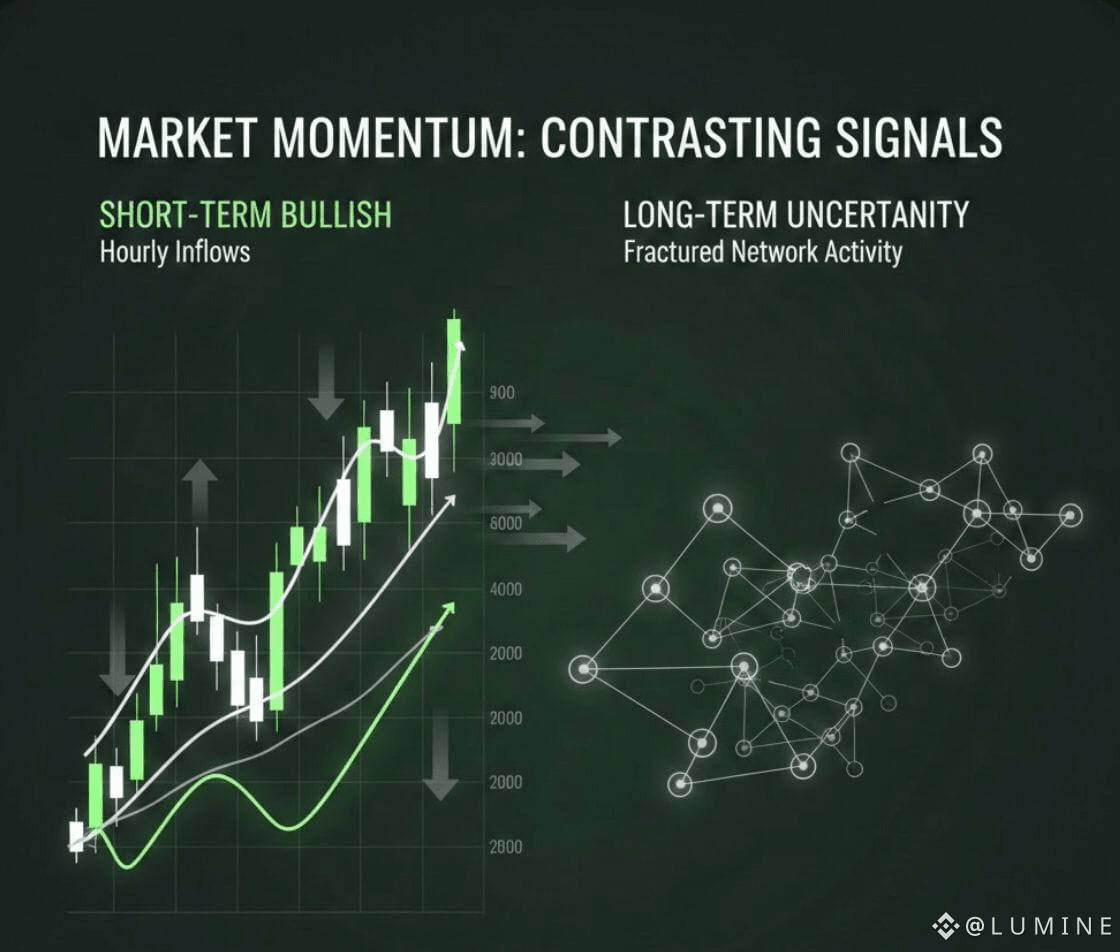

The left side of the visual is pure momentum theater. It speaks the language of traders, algorithms, and fast-moving capital. Hourly inflows are pushing price higher, and the structure is familiar to anyone who has watched a market heat up in real time. Higher highs form with increasing confidence. Pullbacks are shallow, quickly absorbed, and followed by renewed expansion. The moving averages curve upward like a narrative that feels almost inevitable.

This is short term bullishness at its most seductive. It thrives on liquidity, speed, and shared belief. Capital flows in because price is rising, and price rises because capital flows in. It is reflexive, self-reinforcing, and powerful. In this phase, the market rewards decisiveness. Hesitation feels expensive. Waiting feels like missing out.

What makes this momentum especially compelling is its cleanliness. The arrows pointing upward, the consistent candle bodies, the smooth oscillations beneath the price all suggest control. Volatility exists, but it is constructive rather than chaotic. This is the kind of environment where trends feel trustworthy and narratives feel aligned.

Yet this confidence, however convincing, is also fragile by nature.

The Illusion of Stability in Rising Markets

Short-term bullish structures often create the illusion that risk has diminished. When price moves smoothly, participants subconsciously assume that the system supporting it is equally healthy. But markets rarely reward assumptions for long. The image subtly challenges this comfort by placing the bullish price action beside something far less orderly.

The candles climb, but they do not explain why. They show what capital is doing now, not what the network beneath it is becoming. This is where many participants stop looking, satisfied with confirmation instead of curiosity. The image does not let us do that.

Beneath the Surface: A Fractured Network

On the right side, the tone shifts dramatically. Gone are the clean lines and directional certainty. In their place is a tangled network of nodes and connections, some strong, some weak, many irregular. This represents long-term network activity, the underlying structure that supports value, adoption, and sustainability. And here, the story is far less settled.

This network does not collapse, but it does not unify either. Connections are scattered, uneven, and complex. Growth exists, but it is not synchronized. Some nodes cluster tightly, others drift outward, loosely connected, uncertain of their role. This is not a picture of failure. It is a picture of transition.

Long term uncertainty is rarely dramatic. It doesn’t announce itself with crashes or headlines. It shows up as fragmentation, as misalignment between parts of the system that once moved together. It suggests that while capital is enthusiastic in the short term, conviction is still being negotiated at a deeper level.

When Momentum and Fundamentals Diverge

Short-term momentum and long-term structure are speaking different languages. One is decisive and directional. The other is exploratory and unresolved. This divergence is not unusual, but it is profoundly important.

Markets can rally aggressively even when their foundational networks are still evolving. In fact, they often do. Price is a vote, not a verdict. It reflects current sentiment, positioning, and opportunity, not final outcomes. The fractured network reminds us that adoption, utility, and systemic cohesion move on a slower clock.

This is where sophisticated market participants separate themselves from reactive ones. They understand that bullish price action is information, not instruction. They read momentum, but they also read context.

The Psychology of Participation

Emotionally, this environment is complex. Short-term bullishness creates excitement, confidence, and sometimes overcommitment. Long-term uncertainty creates hesitation, analysis paralysis, and selective conviction. Participants are forced to operate on multiple time horizons at once, often without realizing it.

Traders thrive in the left side of the image. Builders, investors, and strategists are more focused on the right. The tension between these perspectives creates volatility not just in price, but in narrative. One group says the trend is obvious. The other says the story is unfinished. Both are correct, and both are incomplete on their own.

Strategic Clarity in a Contradictory Market

The most impressive professionals are not those who choose one side of this image. They are the ones who can hold both truths simultaneously. They respect short-term momentum without worshiping it. They acknowledge long-term uncertainty without fearing it.

This kind of clarity allows for flexible strategy. It allows participation without blindness, optimism without denial. It encourages scaling rather than chasing, observation rather than assumption. The image, at its core, is a lesson in balance.

The Market as a Living System

What this visual ultimately communicates is that markets are living systems, not linear machines. They pulse, fragment, reconnect, and evolve. Clean charts can coexist with messy foundations. Strong inflows can occur alongside unresolved structural questions.

This is not a warning sign. It is a reality check.

Those who succeed long term are not the loudest bulls or the most cynical skeptics. They are the observers who understand where momentum is coming from, what it depends on, and how quickly it can change when the network beneath it reorganizes.

A Final Perspective

In this space, professionalism is not about certainty. It is about awareness. It is about reading what is visible while respecting what is still forming. And above all, it is about understanding that the strongest trends are not those that move the fastest, but those that survive the complexity beneath them.