After researching for so long @Plasma , I realized that most investors, including many seasoned industry analysts, have fallen into a huge cognitive bias: we are used to focusing on K-line prices (Price Action) to observe rises and falls, but we ignore the deeper on-chain data (On-chain Data) surging beneath the surface.

What lies ahead is the most bizarre set of data comparisons in the crypto market at the beginning of 2026:

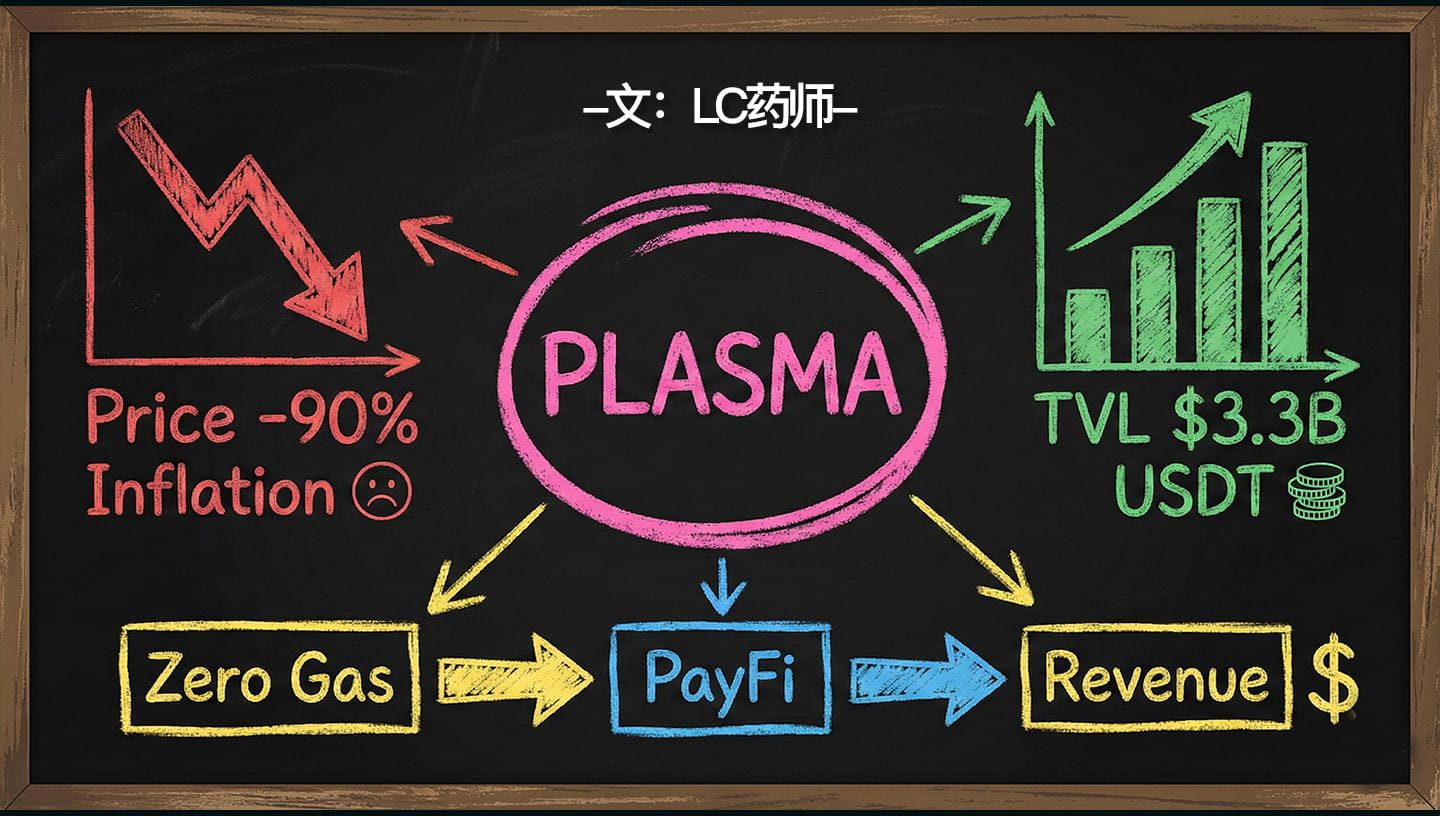

On one hand, the secondary market price of $XPL has become a ghost story - plummeting from a high of $1.68 to the current $0.13, a decline of over 90%, with the community in despair, referred to as a 'doomed project.'

On the other hand, Plasma's total locked value (TVL) on-chain is as high as 3.3 billion USD, with the amount of USDT locked on-chain second only to Ethereum's mainnet, even surpassing the recently popular Solana and Base.

This extreme divergence between 'coin price crash' and 'asset accumulation' is textbook-level 'value mismatch.' Is it a bubble of false prosperity about to burst, or is an 'invisible bank' that has been wrongly killed by market sentiment rising? Today, we set aside emotions and examine Plasma's ins and outs with the coldest logic.

One, Killer Weapons: 'Dimension Reduction Strike' against Traditional Public Chains.

Why is there still a willingness to deposit 3.3 billion USD here, despite the low coin prices? Because Plasma has done something extremely counterintuitive, even one could say it's 'revolutionizing public chains': thoroughly eliminating transfer wear (Zero Gas).

Let's review the current pain points of Web3 payments. On Ethereum, Solana, or even Layer 2, if you want to transfer USDT to partners across the ocean, even for a small payment of just 10 USD, you must ensure you have ETH, SOL, or other native tokens in your wallet as 'fuel fees.'

This is common knowledge for insiders, but for outside users (like cross-border traders, remittance users in Africa, or even the convenience store owner downstairs), it is an insurmountable barrier. They cannot understand why they need to 'buy another coin' before they can 'pay.'

Plasma's core weapon is the 'native stablecoin payment' technology based on underlying protocol optimization.

By introducing account abstraction and the paymaster mechanism, Plasma allows users to directly use USDT in their wallets to pay network fees, and even in many scenarios with official subsidies, transfers are completely free.

What does this mean? It means that when users use the Plasma wallet, their experience is no different from using PayPal or Alipay.

This is not a simple technical upgrade; it is a dimension reduction strike of the business model. It transforms the Web3 wallet from a complex 'geek tool' into a 'financial infrastructure' that everyone can use. For traditional payment institutions that are insensitive to price fluctuations but extremely sensitive to usability and certainty, this is an irresistible temptation. This is also why Tether firmly stands behind Plasma.

Two, The Achilles' Heel of Token Economics: Why good products didn't bring good coin prices?

Since the product experience is so good and the technology so advanced, why is the coin price dropping like a worthless token?

Here lies the biggest pain point of Plasma's current token economic model (Tokenomics), which is also the culprit behind this round of crash — 'the gap between utility and value capture.'

Success comes from 'zero Gas,' failure also comes from 'zero Gas.'

In the traditional public chain value capture logic (like ETH or SOL), the formula is very simple: the more congested the network = the more expensive the Gas fee = the more token burning/demand = the higher the coin price. This is a simple and crude supply-demand relationship.

But in Plasma's logic, in pursuit of an extreme user experience, the project team actively cut off this logic chain. Users can transfer without needing to buy XPL, but this directly leads to an extremely low burning demand for XPL as a fuel token. Even if there are millions of transactions on-chain every day, the consumption of the token is negligible.

This explains the bizarre '3.3 billion TVL'.

Currently, most of the 3.3 billion USD is not coming for real 'high-frequency payment liquidity,' but rather for the 'mercenary funds' that benefit from the high interest rates of lending protocols like Aave and Compound. Although this part of the funds inflates the appearance of TVL and makes the data look beautiful, they are in a 'lying flat' state on-chain and have not generated high-frequency trading wear and tear, unable to create deflationary pressure on the token, nor can they bear the selling pressure from the secondary market.

The conclusion is harsh: at this stage, Plasma is in an awkward phase of 'good reviews but poor attendance.' User experience is maximized, institutional funds are recognized, but token holders are paying the price for this 'free highway' through the decline in coin value.

Three, Future Reversal Point: Shifting from 'Public Chain Logic' to 'Banking Logic.'

So, in the face of such a dismal coin price, is there still hope for $XPL?

The answer is yes, but the premise is that we must change our valuation model. We can no longer assess Plasma using the logic of evaluating Ethereum (Gas burning) but should use the logic of evaluating Visa or PayPal (business flow and service fees) to view it.

This is the 'nuclear weapon' in the Plasma ecosystem that has not yet been fully priced by the market — Plasma One.

You can understand it as a Web3 version of Alipay, or a 'digital bank' native to the chain.

Plasma's ambition lies in the fact that when the early user accumulation (User Acquisition) is completed through the 'zero Gas' strategy, the real profit model is just beginning.

The future value capture of $XPL will come from the following three aspects, constituting a complete PayFi (payment finance) closed loop.

Merchant Fees: When millions of merchants worldwide start using Plasma to receive USDT payments, the system will charge a very low percentage (like 0.1%) as commercial service fees. This amount is far less than Visa's 3%, but it is huge revenue for the blockchain network.

Yield Spread: The huge stablecoin deposits made by users in Plasma One will be used for low-risk RWA (real-world asset) investments. The generated income is partially given to users and partially used to buy back and burn $XPL.

Fiat currency deposit and withdrawal channel fee: the 'toll fee' connecting the fiat world.

Only when TPS (transactions per second) transitions from the current 'DeFi idling' to real 'business flow' can $XPL make the thrilling leap from an 'inflationary mining coin' to a 'deflationary equity token.'

The current low coin price is essentially the market pricing the lag in this business closed loop.

Four, Risk Warning: The unlocking sword hanging over 2026 and institutional costs.

As a rational observer, before discussing the reversal, I must douse a bucket of cold water on all friends preparing to bottom-fish. We must confront another grey rhino in Tokenomics — the unlocking selling pressure.

Refer to Plasma's token release schedule (Vesting Schedule); 2026 will usher in a wave of critical institutional and team share unlocks.

Everyone should understand that early investors like Founders Fund and Bitfinex have extremely low chip costs (possibly even lower than the current $0.13).

This means that even though the current price has fallen by 90%, there are still dozens or even hundreds of times of paper returns for early institutions.

Therefore, any short-term rebounds lacking fundamental support are very likely to become good opportunities for institutions to offload their holdings.

Conclusion: In the face of significant unlocking pressure, one must not only have faith but also the wisdom to time the market.

Five, Ultimate Conclusion: Floor price or value trap?

Finally, back to the initial question: with a TVL of 3.3 billion, is Plasma now at the floor price, or is it a bottomless value trap?

It depends on what kind of future you believe in.

If you believe Web3 is merely a casino filled with Ponzi schemes and that stablecoin payments will never replace bank wire transfers, then Plasma is a complete value trap. Because without speculative enthusiasm, a zero Gas public chain is worthless.

However, if you believe Tether's monopoly position is unshakable and that a portion of future global trade settlements will migrate on-chain, then the current $XPL is the gold that has been wrongly killed among the ruins.

Plasma is walking a path that no one has walked before: first burning money to acquire users (zero Gas), then using the ecosystem to exchange for profits (PayFi).

This is akin to early Didi Chuxing or Meituan; before monopolizing the market, they were all loss-making.

For investors, this is a gamble on the 'payment track.'

What you are buying is not a coin, but a call option to the Web3 payment era.

In this gamble, what we need to do is not blindly go all in but to focus on the real business transaction volume on-chain, gradually building positions during panic, and then waiting for the critical point of 'payment explosion.'