Hey fam, let’s have a real‑talk moment about a project that has been stirring the pot quietly but meaningfully in the crypto world, Plasma and its native token XPL. I know some of us have been watching this space and wondering what’s real, what’s hype, and where things are headed next, so I want to break down what’s happened, what’s happening, and why I think this narrative deserves way more attention than it’s getting.

From its eye‑catching launch to the ups and downs of market reactions, plus all the ecosystem moves happening behind the scenes, there’s a lot more depth here than meets the eye. Let’s dive in.

The Launch That Turned Heads

When Plasma launched its mainnet beta on September 25, 2025, it was one of the most talked about debuts of the year. The concept was bold: build a blockchain specifically optimized for stablecoins with zero fees on transfers and massive liquidity right from day one. That was something the community hadn’t really seen before a chain built around the actual use of stablecoins rather than speculative assets.

From day one, more than $2 billion in stablecoin liquidity was active on the network, spread across integrations with well‑known DeFi protocols like Aave, Ethena, Fluid, and Euler. That wasn’t just a tech demo, that was real capital being moved and used on chain the day Plasma went live.

The idea was clear: make the blockchain not just a playground for apps but a real engine for money movement that could rival legacy financial rails in terms of cost, speed, and accessibility. And this was backed by some of the biggest names in the space from the start.

Massive Early Liquidity and DeFi Integration

Here’s something that still impresses me when I bring it up in chats with friends. In the first week after launch, over $7 billion in stablecoins were deposited into Plasma, and the total value locked in the DeFi ecosystem exceeded $5 billion. That instantly vaulted Plasma into one of the top chains by stablecoin liquidity.

What this means in plain terms is that a ton of dollars digital dollars were already being used on this network almost immediately. That kind of liquidity is not easy to muster unless there’s real excitement from traders, integrators, and liquidity providers. And that initial enthusiasm wasn’t just hype stablecoins like USDT already had use cases that traders and users were trying to apply directly on the chain.

The growth in daily active users also reflected this. Tens of thousands of people began interacting with the network daily, well beyond what most new chains see during launch phases.

A Token With a Story

The XPL token itself has been one of the most visible parts of this whole narrative. When it launched, it was distributed widely through various mechanisms like public sales, ecosystem incentives, and even airdrops for early participants, including efforts to make ownership broad rather than concentrated.

And the price action? Well, it was wild. XPL quickly spiked in its first few days of trading, briefly hitting highs that drew a lot of eyeballs. The rally wasn’t just because of speculation; it was tied to the frenzy around its mainnet debut, liquidity influx, and exchange listings.

But make no mistake: price alone doesn’t tell the whole story here. What we saw after that initial peak was a normal market correction mixed with narrative shifts. Within a month or two, the token experienced significant downward pressure and dropped a large percentage from its early highs. That prompted a lot of public discussion around liquidity, market makers, and token distribution.

The founder and team weighed in publicly to deny insider selling, and they clarified vesting and lockup structures. That became a flashpoint in community chats, and it reminded everyone just how emotional markets can be when expectations and reality collide.

But here’s the important thing: beyond the price swings, the narrative of what Plasma is building has not changed. The team remains focused on utility, infrastructure, and growth beyond speculation.

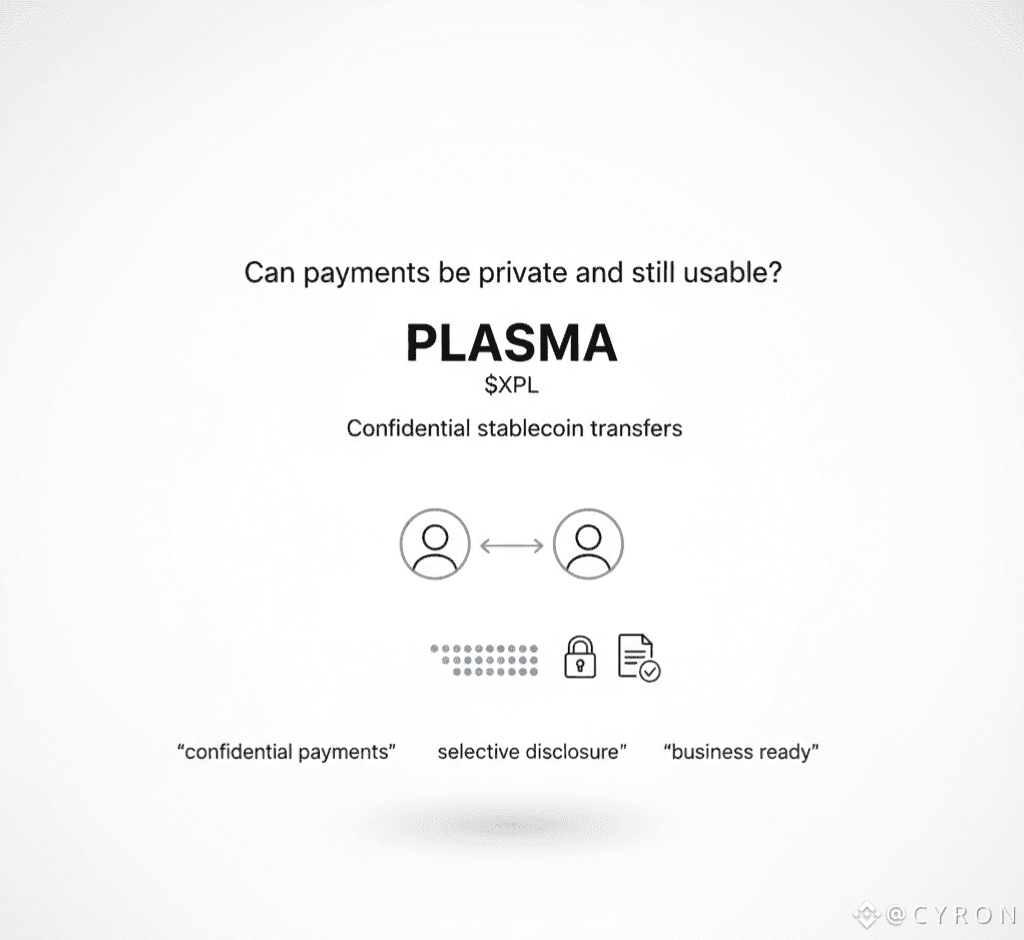

What Makes Plasma Different

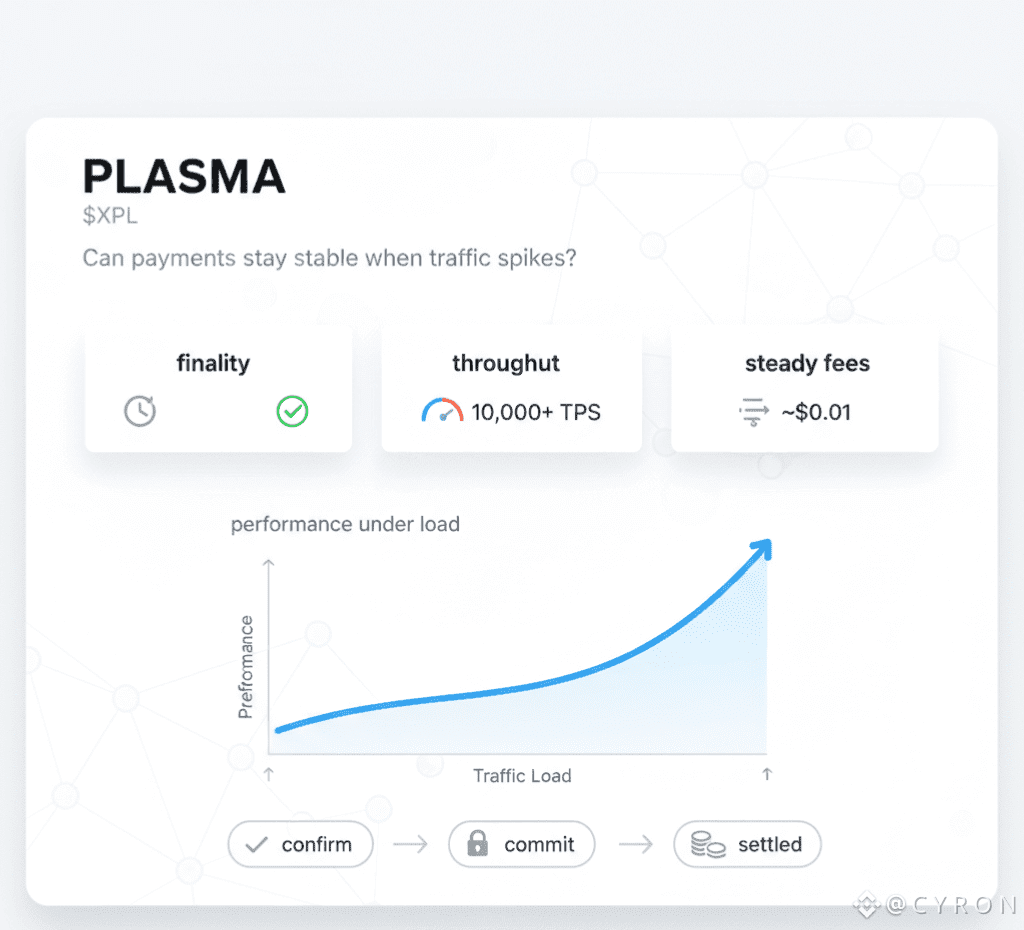

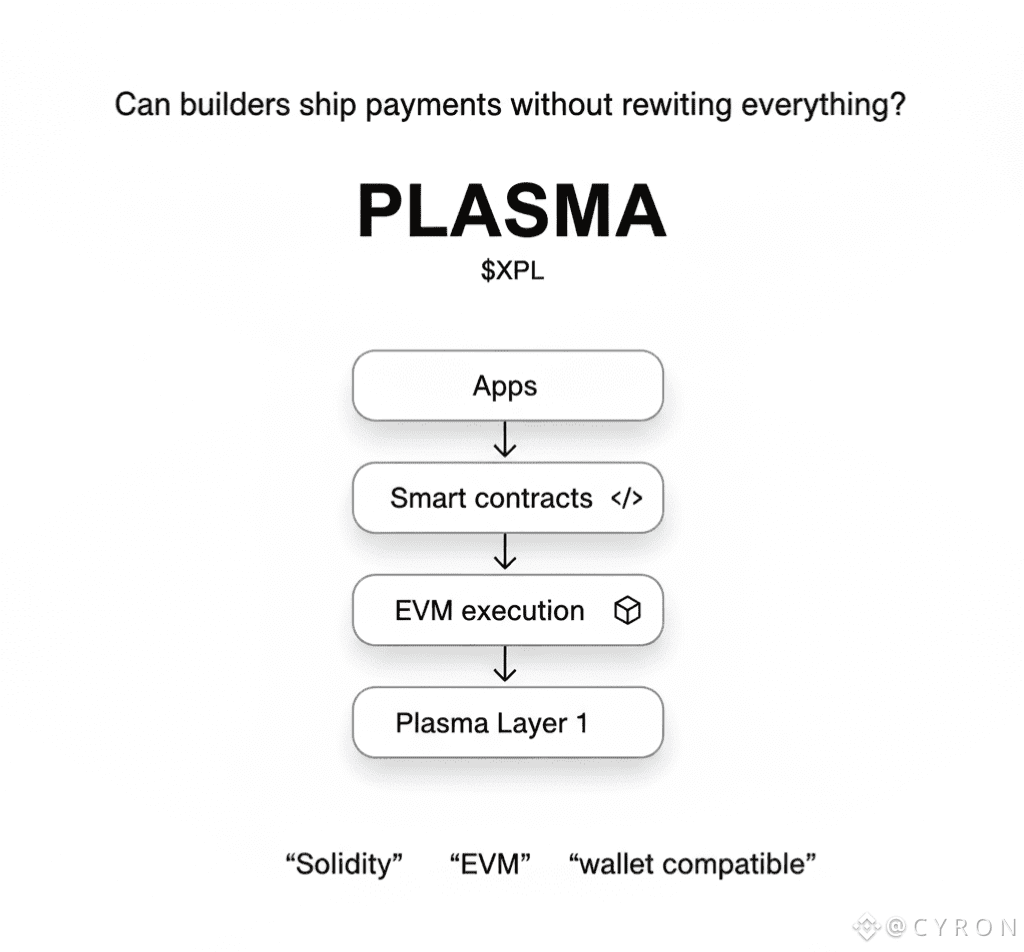

Let’s talk about the actual technology and positioning for a moment because this is where things get interesting at a deeper level.

Plasma was designed not just as a general‑purpose chain but specifically as a stablecoin‑centric infrastructure. That means its architecture is optimized for moving large volumes of dollars with minimal friction. And from day one, it supported fee‑free USDT transfers something that still differentiates it from many blockchains where transfer fees are a big pain point.

The chain combines multiple ideas that have been floating around the ecosystem for a while: it uses its own custom consensus model for throughput, it is fully EVM compatible, and it is built with high‑performance execution in mind. Because of that, developers can deploy smart contracts, integrators can build tools, and users can interact without having to juggle different languages or environments.

In many ways, this positions Plasma not just as another chain but as a specialized piece of money infrastructure, one that understands what markets actually use stable coins for: payments, liquidity provisioning, remittances, yield strategies, and cross‑chain capital movement.

Ecosystem Partnerships and Expansion

Another part of this story that often gets overlooked is how quickly Plasma plugged into existing systems. It didn’t wait to build everything in isolation. Instead, it connected to big pieces of the DeFi world and payments world almost immediately.

For example, major stablecoin networks like USDT0 are integrated with Plasma in significant ways. As of the latest updates, tens of billions of dollars in stablecoin value have flowed through cross‑chain activity involving Plasma’s network.

This isn’t just trivia, it’s evidence of real utility. When dollar liquidity moves through your chain, even if people aren’t always thinking about XPL directly, your chain becomes part of someone’s money infrastructure. And that’s exactly the kind of foundation that can support apps, services, remittances, and institutional flows.

At the same time, partners like major exchanges have been running campaigns to bring awareness and engagement to the ecosystem. One notable example from early 2026 was an initiative to reward content creators with millions of XPL just for driving conversation and educational output around the project.

Looking Ahead with Staking and Validator Tools

One of the most anticipated developments on the roadmap in early 2026 is the launch of staking and delegation tools for $XPL. This is huge because it finally unlocks one of the core utility components of the token, letting holders lock up tokens to help secure the network and earn rewards in return.

This matters for a couple of reasons:

One, it changes the supply dynamic by pulling tokens out of circulation and into staking. Two, it gets more people engaged in the health of the protocol rather than just trading. And three, it creates long‑term alignment between people who believe in the ecosystem and those who participate in securing it.

It’s also worth noting that the rollout of these features is being handled thoughtfully, with audits and testing being prioritized. That kind of care is exactly what you want to see in a chain that’s positioning itself as financial infrastructure rather than some quick throwaway project.

What About the Market Narrative?

It would be dishonest to ignore the fact that XPL experienced some pretty dramatic price swings after launch. Some critics have pointed to liquidity concerns or alleged selling pressure from market makers. These are the kinds of stories that get amplified on social platforms because they make for drama, but what matters most is separating sentiment from real adoption.

Yes, volatility is part of crypto. Yes, liquid markets can swing hard. The question for long‑term thinking is this: Is the underlying infrastructure being used? Are developers building? Are assets moving? Are users interacting?

In all of these categories, the answer right now is yes. Tokens chimed in, liquidity moved, people built integrations, and stablecoin flows routed through Plasma. That tells me that this is not just a dead chain with empty blocks.

Wallets, Accessibility, and Real World Usage

Another thing I want to highlight is that the ecosystem is still maturing at the accessibility layer. Not all wallets fully support Plasma network tokens yet, and this has caused a few moments of confusion when users tried to receive XPL in wallets that didn’t yet support native Plasma chain addresses.

That kind of friction is normal in the early stages of any blockchain ecosystem. What matters is that awareness around these issues is rising, and teams are gradually prioritizing broader support across wallets and tools.

This is the phase where utility starts to grow organically rather than just through exchange listings. It’s where you begin to see real peer‑to‑peer usage, payments, and integrations into everyday DeFi tools.

The Long Game

Here’s where I want to be clear with the community: In my view, Plasma is playing a long game. The focus always seemed to be on building real financial plumbing rather than chasing short term hype. And that shows in how the network has been engineered, how partnerships have evolved, and how the roadmap is unfolding.

The token metrics, ecosystem initiatives, cross‑chain usage, and staking roadmap all point to a chain that’s trying to grow into an infrastructure layer for stable value movement.

When you zoom out from the noise of price charts and look at activity, what you see is a project that has:

real live chains with billions in assets moving through them

integrations with major DeFi protocols and stablecoin networks

a growing user base of developers and liquidity providers

expanding tooling and staking systems that deepen engagement

broad distribution models that avoid concentration in a few hands

That’s the kind of foundation that usually precedes deeper adoption, and that is why I keep my eyes on this one even when the markets go quiet.

Final Thoughts

So if you’re in this community with me, here’s the takeaway: XPL and Plasma are not just another project riding a wave. They are staking a claim in the narrative that real world money movement on blockchain matters. And they are doing it with infrastructure, integrations, liquidity, and tools not just pretty marketing.

I know there have been bumps. Crazy price swings, market skepticism, wallet support quirks that’s all part of the ride. But what I see beneath that is work being done.

And to me, that is the kind of story worth watching closely.

As always, stay curious, stay critical, and let’s see where this journey takes us together.