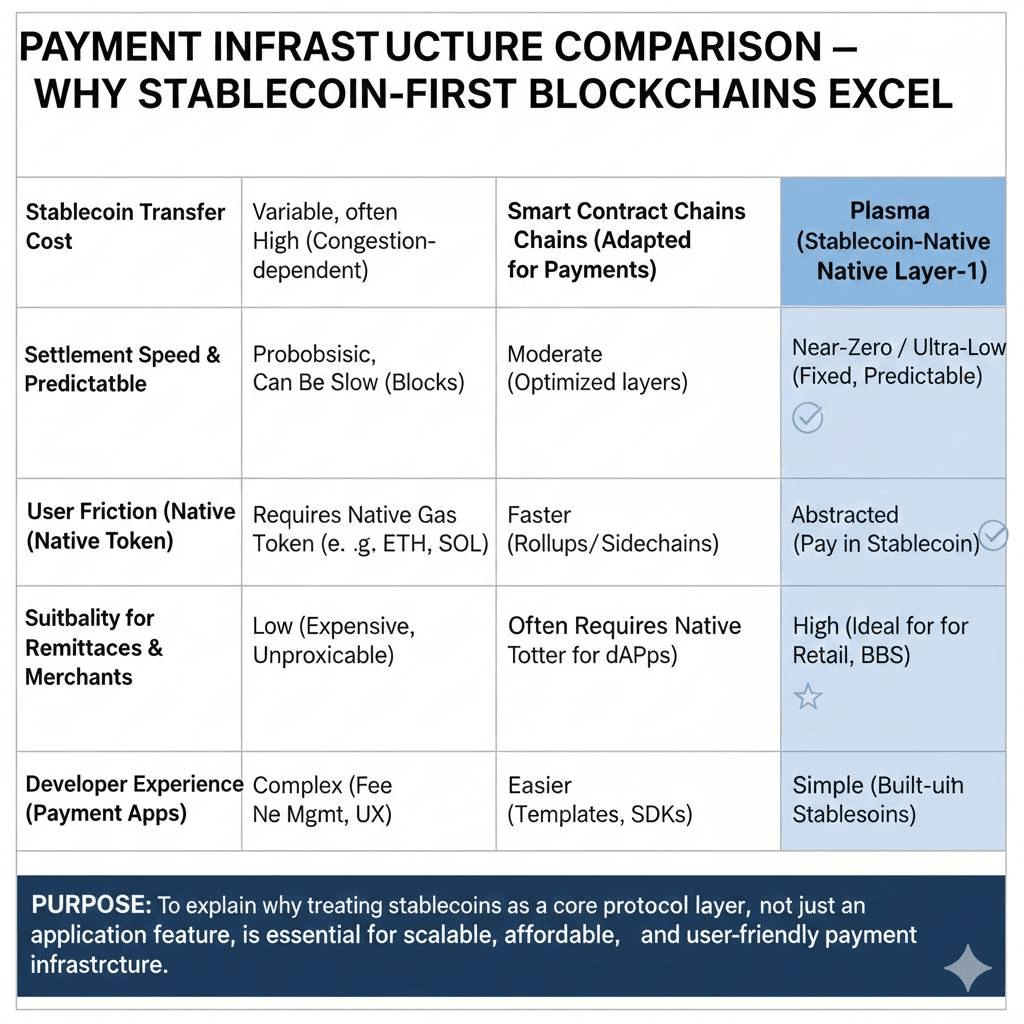

In crypto, if we look honestly, the most real usage is of stablecoins. People use stablecoins more for transfers, settlements, and remittances, and less for NFTs or DeFi. The problem is that most blockchains treat stablecoins as an 'extra feature' rather than as a core layer.

Plasma starts from here.

Plasma is a Layer-1 blockchain designed for stablecoin movement from day one. The goal is simple: to move digital dollars like USDT as data moves over the internet — fast, cheap, and without unnecessary friction.

Why Plasma's Approach Seems Different

A common pattern nowadays is: a chain launches, then claims 'we will do everything.' Plasma is not in this race.

Its design is optimized for situations where:

stablecoins are the main asset

fees matter

speed and reliability are more important than speculation

For this reason, Plasma:

tries to handle stablecoin transfers at zero or near-zero cost

keeps settlement smooth with high throughput

remains EVM compatible, so developers do not have to learn a new ecosystem

This is not a clone of traditional payment systems, but an attempt to fix their inefficiencies through blockchain.

How the Network Works Internally

The Plasma tech stack isn't flashy, but it is practical.

Consensus Layer

The network uses a custom BFT-based consensus that provides fast finality and predictable behavior. This is very important in the context of payments — no one wants to wait for a settlement.

Execution Layer

Plasma is fully EVM compatible. Solidity contracts run without any workarounds, which is quite helpful for developer adoption.

Gas Abstraction

Here, Plasma has a strong UX advantage. Users are not required to hold XPL for simple stablecoin transfers. Fees are abstracted on the backend, making the experience feel more natural for non-crypto users.

Bitcoin Integration (Future Plan)

The roadmap mentions features like Bitcoin anchoring and trust-minimized bridges that could expand interoperability in the future.

$XPL Not Just a Token, It's the Backbone

$XPL Plasma's native token, but its role is not limited to trading.

XPL is used for:

for staking and network security of validators

for smart contract execution and complex transactions

for validator rewards and ecosystem incentives

for future governance participation

In daily stablecoin transfers, the end user may not have to use XPL directly, but the health and decentralization of the network depend on XPL.

Total supply is 10 billion XPL, which is distributed among ecosystem, public allocation, team, and investors with vesting to reduce short-term dumping pressure.

A Simple View of the Market

Currently, Plasma (XPL) is actively trading in the market and the price moves within the range of typical infrastructure tokens. The circulating supply is around 1.8 billion.

Short-term price movements always create noise, but the real evaluation of infrastructure chains comes from usage and adoption, not charts.

Where Plasma Naturally Fits

Plasma makes the most sense in areas where stablecoins are already dominant:

cross-border transfers and remittances

merchant settlements where fees are critical

DeFi protocols where stablecoin liquidity is higher

programmable money flows via smart contracts

The objective is to make bringing real-world value to blockchain not complicated.

Closing Thought

Plasma (XPL) is not a loud project. Instead of generating hype, it focuses quietly on solving a specific problem. Stablecoins have become the base layer of the crypto economy, and Plasma is building dedicated rails for them.

If stablecoin adoption continues to grow — which seems quite likely — focused networks like Plasma could become significantly important without making a lot of noise.