Japan now represents half of the total holdings of non-American companies in Bitcoin.

Metaplanet's treasury balance reached 35102 Bitcoin after a purchase of 4200 Bitcoin in the fourth quarter.

Japanese companies use Bitcoin as a hedge against the structural weakness of the yen.

Corporate holdings of Bitcoin in Japan have surged from nearly zero to tens of thousands.

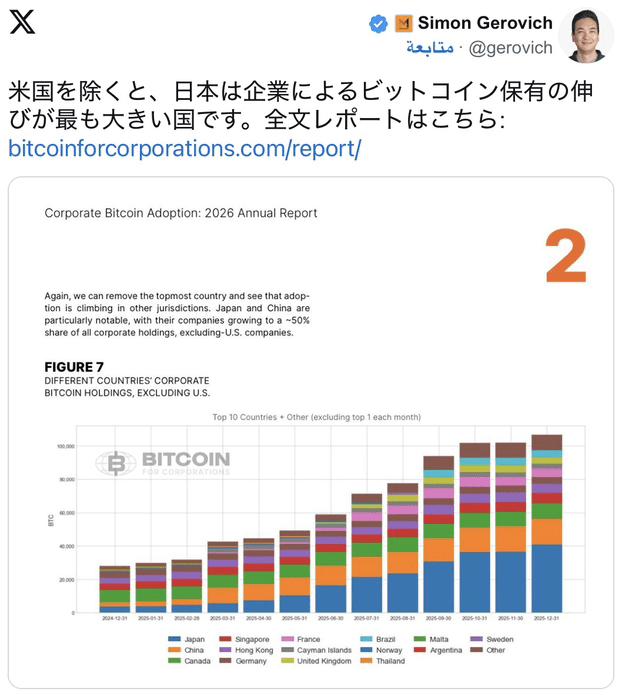

The report shows that outside the United States, Japan is now recording the largest increase in corporate holdings of $BTC . In fact, Japan accounts for nearly half of the total Bitcoins held by non-American companies on their balance sheets. This reflects a significant shift in the outlook of Asian companies toward digital assets. The data also indicates a growing trend, where companies are moving beyond speculation and treating Bitcoin as part of a long-term capital strategy.

Metaplanet leads Japan's momentum

Metaplanet stands at the heart of this transformation. The Tokyo-listed company was one of the first in Japan to widely embrace Bitcoin. It publicly adopted a strategy inspired by American corporate vaults. By late 2025, Metaplanet owned 35,102 Bitcoins. The company built this position gradually, executing several large purchases over the past year. In the fourth quarter of 2025 alone, it added more than 4,200 Bitcoins.

Simon Gurevich often says that Metaplanet's goal is simple. To protect value and build long-term capital using $BTC instead of fiat currencies that lose their strength. Thanks to this clear strategy, other Japanese companies have started exploring similar paths. Gurevich noted that many local companies are now asking how Bitcoin vaults work and how they can get started. Indeed, Metaplanet has become a reference point in Japan after proving that holding Bitcoin is not limited to tech companies. As a result, traditional companies have realized they can follow the same approach.

Jumping from near-zero levels to tens of thousands

The report highlights the speed of this transformation. By late 2024, Japanese corporate holdings of Bitcoin were almost nonexistent. By early 2026, they rose to tens of thousands of Bitcoin units. This surge places Japan at the forefront of non-American countries. China remains close, but Japan has begun to match or even surpass it in terms of growth rate. Several factors help explain this trend. The weakness of the yen makes dollar-denominated assets, like Bitcoin, more attractive. At the same time, the regulatory framework in Japan has become clearer and more supportive of digital assets.

Companies are also facing pressure to protect their reserves. With inflation concerns and declining real returns, Bitcoin provides an alternative as a store of value. The report categorizes companies into tiers. The largest holdings are concentrated in a small upper tier. In contrast, the rapidly growing 'long tail' includes smaller companies like Metaplanet and Semler Scientific. This collectively shows that including Bitcoin in balance sheets has become more commonplace.

Community interaction and the global context

Simon Gurevich's post has been praised by supporters who credited Metaplanet with leading this transformation. Many said the company has helped educate Japanese firms and demonstrated that Bitcoin strategies can succeed in public markets. Globally, the report shows that some corporate strategies in Bitcoin are successfully expanding, while others are failing. The key difference lies in discipline. Companies that buy with a long-term mindset tend to perform better than those chasing the hype. Outside the United States, Japan is now in a leadership position. It illustrates how Bitcoin adoption can spread when a single company proves the model's viability.

Japan's growing role in corporate Bitcoin

Japan's rise represents a turning point. It is no longer just a follower of American trends. It has now begun shaping the use of $BTC among companies in its region. If this trajectory continues, more Asian companies may adopt similar strategies. Weak fiat currencies and changing treasury models may push this trend forward. For now, Simon Gurevich's message seems clear: Japan is no longer watching from the sidelines. It has become a key player in corporate Bitcoin adoption.

#BinanceSquareBTC #BinanceSquareFamily #BinanceSquare #NewsAboutCrypto #news