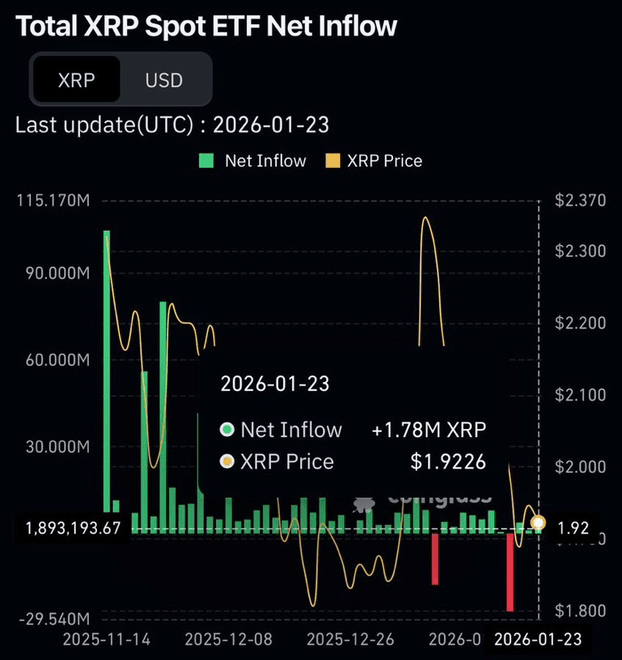

The Bitwise XRP ETF was the sole contributor to the cash inflow on Friday, amounting to $3.43 million.

The total net assets of the XRP spot ETFs now stand at $1.36 billion.

Institutional demand for XRP remains positive despite outflows of BTC/ETH exceeding $700 million.

Bitwise's historical net cash inflows reached $319 million after the last session.

Exchange-traded $XRP funds recorded new flows on January 23. Data showed that cash XRP funds in the United States attracted a total of $3.43 million in one day. This came at a time when the broader cryptocurrency market remained shrouded in uncertainty. Most flows were concentrated in the Bitwise XRP ETF, which alone added $3.43 million. In contrast, the rest of the XRP funds saw stable flows without significant redemptions.

Trading activity remained stable, with daily trading volume nearing $15.7 million. These figures indicate growing interest in gaining exposure to XRP through regulated products. It seems that investors are willing to add XRP even amid varying demand for Bitcoin and Ethereum ETFs.

The Bitwise fund leads the move

The Bitwise XRP ETF played the leading role in flows that day. Its net assets rose to about $301.5 million after recent additions. The fund's price also recorded a slight increase during the session. In contrast, other XRP funds, including Franklin, Canary, Grayscale, and 21Shares products, did not register significant flows or outflows, and their balances remained stable.

Thus, cash XRP funds in the United States currently hold about $1.36 billion in net total assets. This is equivalent to approximately 1.17% of XRP's market capitalization. Cumulative net flows into XRP funds reached about $1.23 billion. This ongoing accumulation reflects institutional and long-term investors' reliance on ETFs as their preferred means of gaining exposure to XRP.

Variation with Bitcoin and Ethereum trends

Flows $XRP are following a different pattern than Bitcoin and Ethereum funds. In recent sessions, BTC and ETH funds recorded notable outflows as traders reduced risk and awaited clearer signals from the market. In contrast, XRP funds recorded two consecutive days of positive flows. On January 22, XRP funds added approximately $2.09 million, followed by an addition of $3.43 million on January 23.

This shift indicates that some investors are redirecting their funds towards selected altcoins instead of exiting the cryptocurrency market entirely. It seems that XRP is one of the main beneficiaries of this move. Some analysts point to improved regulatory clarity surrounding XRP, while others note that its current price is below its previous peaks, making it attractive for accumulation. Despite ongoing price volatility, ETF flows provide clearer insights into institutional behavior.

What does this mean for XRP's future

ETF flows are often seen as a sign of confidence. When money flows into these funds, it reflects investors' desire to gain exposure to the asset without holding the tokens directly. For $XRP , two consecutive days of flows indicate renewed interest, led by the Bitwise fund. This does not necessarily mean an immediate price increase, but it shows that selling pressure is not dominating within the ETF products. If this trend continues, XRP may receive stronger support during market downturns and may attract more interest from asset managers and traders seeking alternatives to Bitcoin and Ethereum.

In contrast, risks remain. General market conditions continue to influence cryptocurrency prices. Any sharp decline in Bitcoin could also impact XRP. So far, the data tells a clear story: money continues to flow into XRP, with the Bitwise fund leading this momentum.