If you’ve been in the space for even a half decade or more, you learn to temper your enthusiasm for promises that seem too good to be true and trust is certainly an ephemeral thing within the space. Most blockchains promise trust as part of their solution stack, while few actually design for trust itself. And that brings us to the incentive model that governs the world of Dusk, particularly within the opening few months of 2026 itself.

Dusk Network has been working towards this moment over the last few years. Although the team announced the details of its mainnet in June of 2024, followed by a launch towards the end of the year, they spent a significant portion of the next year working on their infrastructure. By January of 2026, they had developed EVM compatibility, expanded their staking options, and strengthened their layers of privacy, all while keeping compliance a priority. This is a system where incentives align towards truthful behavior, not speculation.

And at the center of that system, as a part of that system, is going to be the DUSK token. Now, a simple way of saying that is that, effectively, once again, from a conceptual standpoint, that token will be akin to fuel in this system, as well as a security deposit. So, in other words, as a part of this system, in order for a device, a node, a validator, in this context, in order for that device to, in essence, play in this system, a measure of that device, of that node, of that validator, will require a quantity of that token so that, if that device, that node, that validator acts in a dishonest fashion, that device, that node, that validator will, in truth, lose a measure of that, a measure of that token. This, again, is a reasonably well-known model, with a quite.

That long schedule of emissions is important because it prevents shocks to the inflation rate or promotes long-term as opposed to short-term farming. It also represents a form of design in an environment in which is often an emphasis on speed or on having instant results.

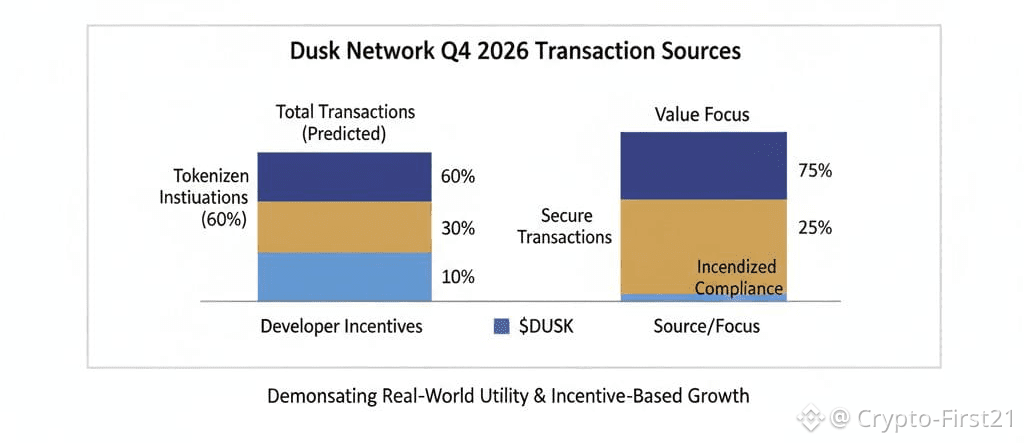

What makes this incentive system so interesting is its relation to the compliance aspect. Most blockchains centered around privacy struggle to find interest among financial investors due to their need for transparency in systems. Yet Dusk's approach to being a ‘private by default and accountable when needed’ model has begun to create interest among real-world asset-based projects and financial systems looking to achieve efficiency through their use of a blockchain while avoiding compliance regulations altogether.

The tokenized real-world asset market has already gone past 6.6 billion dollars by mid-2024, with predictions indicating it will go towards trillions in 2030. Dusk's incentive system was created to facilitate just that.

What’s perhaps important from a trader’s perspective is how the actual behavior in the markets is responding to these decisions evidently. In early Jan 2026, DUSK had an increase in its prices by over 120 percent as capital moved from traditional privacy coins to those supporting emerging regulations. Following this, before the weeks ended, the price actually touched the 30 cent mark, boasting a daily trade value of over 120 million dollars. This wasn’t an indicator of mere hype events. It actually followed the launch of EVM compatibility tools, as well as speculations relating to an institutional pilot in Europe.

Still, even the price action does not shed light on the large narrative. The actual value lies with the incentives as they pertain to alignment with specific long-term behaviors. At the core of the reward structure are the incentivized rewards for node runners not only for running nodes but for running nodes with proper uptime, transacting data accurately, and being honest. Similarly, developers are incentivized with grants to develop applications that are actually useful within the realm of regulated finance as opposed to speculation. Further still, users are incentivized as well with predictable costs.

A problem that often does not see enough consideration in terms of incentives lies in the complexity of making incentives for privacy. Typically, everything is transparent in every blockchain. Therefore, bad actors in this industry are always easy to identify. For Dusk, this becomes important in the way it handles accountability through zero-knowledge proof to validate that it is being done in an appropriate way without compromising privacy. It is like presenting proof that everything that is being done is right without having to show what that right thing actually is. At this point, it becomes easy to see the importance of incentives and how Dusk’s incentive structure excels.

From my own observation of markets and projects over time, I believe that those which have survived multiple market cycles share a rather singular aspect in that they all have a clear use case for their token, it secures, it coordinates behavior towards efficiency, and it drives real-world economics forward. DUSK is one of those projects that fits this criteria much more than most projects out there. Rather than trying to maximize numbers through speed or attempting to drive viral growth through memes, DUSK instead opts for slow growth. That may not necessarily create overnight hype, but it does tend to create long-lasting value.

Moving forward, the test facing Dusk in the near future will be how it performs in the real world. These institutions in the European financial space, as well as tokenized platforms, have already begun work with Dusk. Moreover, the incentive system by DUSK could be the benchmark to how blockchains integrate in the regulated space come 2026.

Ultimately, trust is not built through sloganeering or whitepapers, but through incentives where lying is costly and helping is smart. Dusk's tokenization is indeed built from this philosophy. Whether the world recognizes its full worth remains to be seen, but as the ecosystem is still figuring out how to grow up, this simple and understated philosophy may be its greatest strength yet.