In financial systems, reliability is not defined by how a transaction behaves once. It is defined by how it behaves every time the same conditions occur. Repeatability is the property that turns infrastructure into something organizations can depend on rather than constantly supervise.

Stablecoins are now used in environments where repetition is unavoidable. Payroll runs weekly. Treasury sweeps execute daily. Internal transfers follow fixed schedules. In these contexts, the question is not whether a transaction can succeed, but whether it will succeed in the same way each time it is executed. Variance is what creates friction.

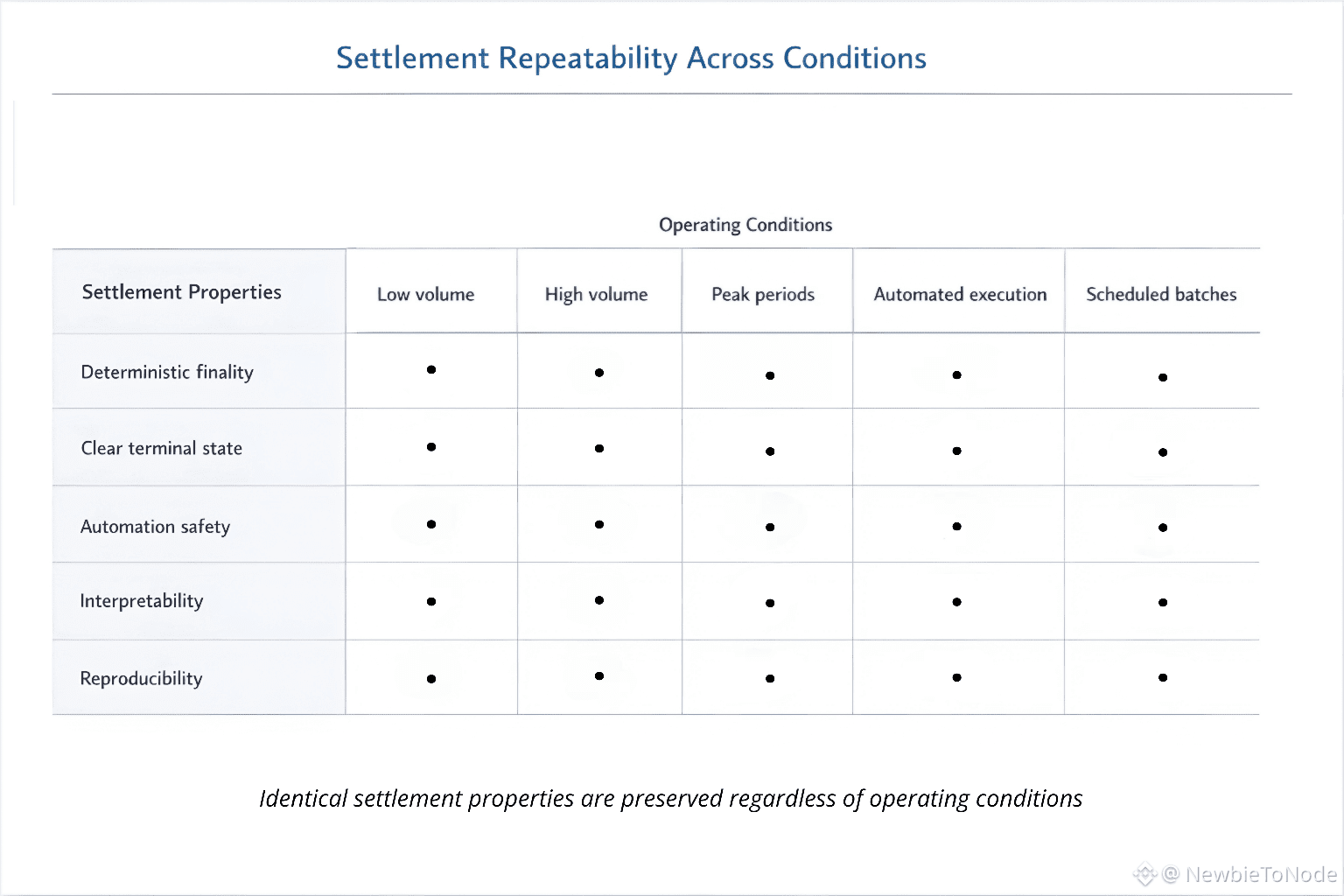

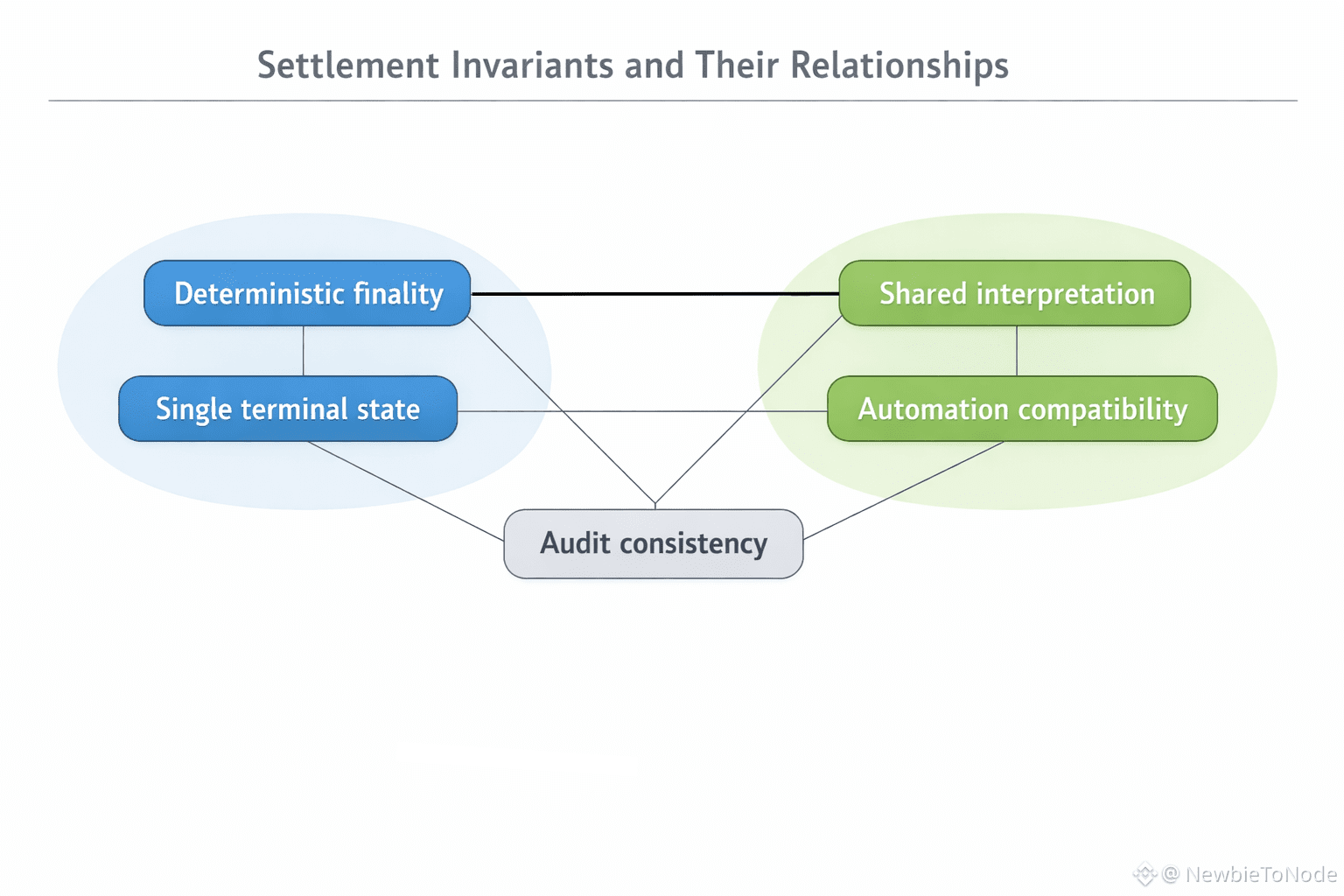

Plasma’s approach to stablecoin settlement centers on this idea of repeatable outcomes. Instead of treating each transaction as an isolated event, it treats settlement as a rule-governed process. Deterministic finality through PlasmaBFT is designed to ensure that identical inputs lead to identical conclusions. Once finality is reached, the resulting state is intended to be stable, unambiguous, and reusable as a reference.

This matters because systems scale through reuse, not novelty. When outcomes are predictable, workflows can be codified. Automation becomes safer because it relies on invariants rather than heuristics. Reporting pipelines can assume consistent behavior instead of guarding against edge cases. Over time, this reduces the need for human intervention and exception handling.

A stablecoin-first architecture reinforces this repeatability. By prioritizing stablecoins as the primary settlement asset, Plasma minimizes conditional logic around asset behavior. Integrators do not need to treat stablecoin transfers as special cases or adapt their systems dynamically based on context. The same settlement rules apply across use cases, which simplifies integration and testing.

Repeatability also improves system confidence indirectly. Teams are more willing to rely on automation when they can anticipate outcomes. Decisions move closer to real time not because systems are faster, but because they are more trustworthy. This trust is built through consistency, not speed alone.

As usage grows, systems that lack repeatable behavior tend to accumulate compensating mechanisms. Additional checks, fallback paths, and manual reviews appear to handle variance. These mechanisms increase operational cost and make systems harder to reason about. By contrast, systems that enforce consistent settlement behavior reduce the need for these layers.

Plasma’s design choices reflect an understanding that mature financial infrastructure must support repetition at scale. Deterministic settlement provides a stable foundation on which workflows can be repeated safely and efficiently. This allows complexity to remain localized rather than spreading across applications and teams.

As stablecoins continue to evolve from experimental tools into core financial primitives, the ability to produce repeatable outcomes will matter more than isolated performance metrics. Infrastructure that behaves consistently under the same conditions earns trust quietly. Plasma’s focus on deterministic settlement positions it as a system built not just for speed, but for reliability through repetition.