1. Pain points of Web3 payments

Before 2025, wanting to buy a cup of coffee with USDT seems like a fantasy, because the Gas fee might be more expensive than the coffee. But @Plasma has emerged, completely solving this problem.

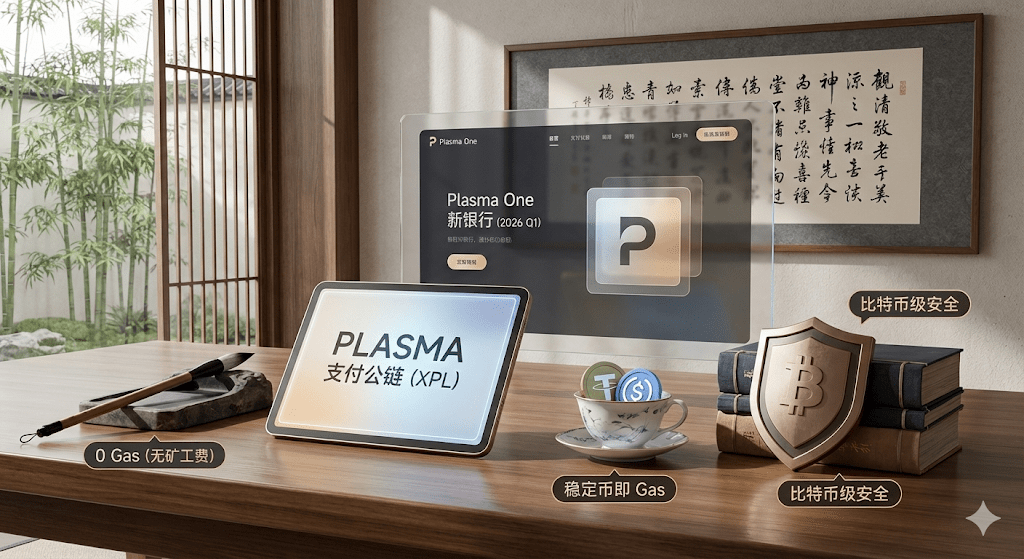

2. Hardcore technology: Born for stablecoins

Unlike Ethereum's general-purpose design, Plasma is optimized as Layer 1 specifically for 'stablecoin settlement'.

0 Gas mechanism: Through the innovative Paymaster system, users can transfer USDT completely free of charge.

Stablecoin-as-Gas: Even for complex on-chain interactions, you can directly use USDT to pay miner fees without needing to hold the native token $XPL

XPLUSDTPerp0.1279+6.14%

XPLUSDTPerp0.1279+6.14%Fast Confirmation: Based on the PlasmaBFT consensus algorithm, achieving sub-second transaction confirmations, as fast as using a credit card.

3. Ecological Explosion: Plasma One Neobank

The most anticipated event in Q1 2026 is the launch of Plasma One. This is not just a simple wallet, but a new on-chain bank. It will support up to 4% cashback on spending and high-yield savings accounts. This means Plasma is bridging the last mile between Crypto and the real world.

4. Why pay attention to $XPL now?

Although the current Layer 1 track is crowded, there are not many focused on the 'payment vertical.' Plasma is backed by the security of the Bitcoin network (through state anchoring) while having EVM compatibility. During the Binance CreatorPad event, due to significant token incentives (3,500,000 XPL), community interest is rapidly rising.

5. Conclusion

While other public chains are still competing for TPS, Plasma has taken 'user experience' to the extreme. If you believe in the future of Web3 payments, then Plasma is an essential asset you cannot ignore.