The real test for any new blockchain is not just attracting crypto native users. It is about building something that does not feel foreign to the world of traditional finance, a world governed by audit trails, cost predictability, and operational security. After reviewing Plasma's documentation and their steady stream of technical announcements, what stands out to me is a design philosophy that seems to engineer out the very frictions that keep institutional players on the sidelines. This is not merely another smart contract platform. It is a Layer 1 built with a specific settlement layer in mind, and its features read like a direct response to legacy finance pain points.

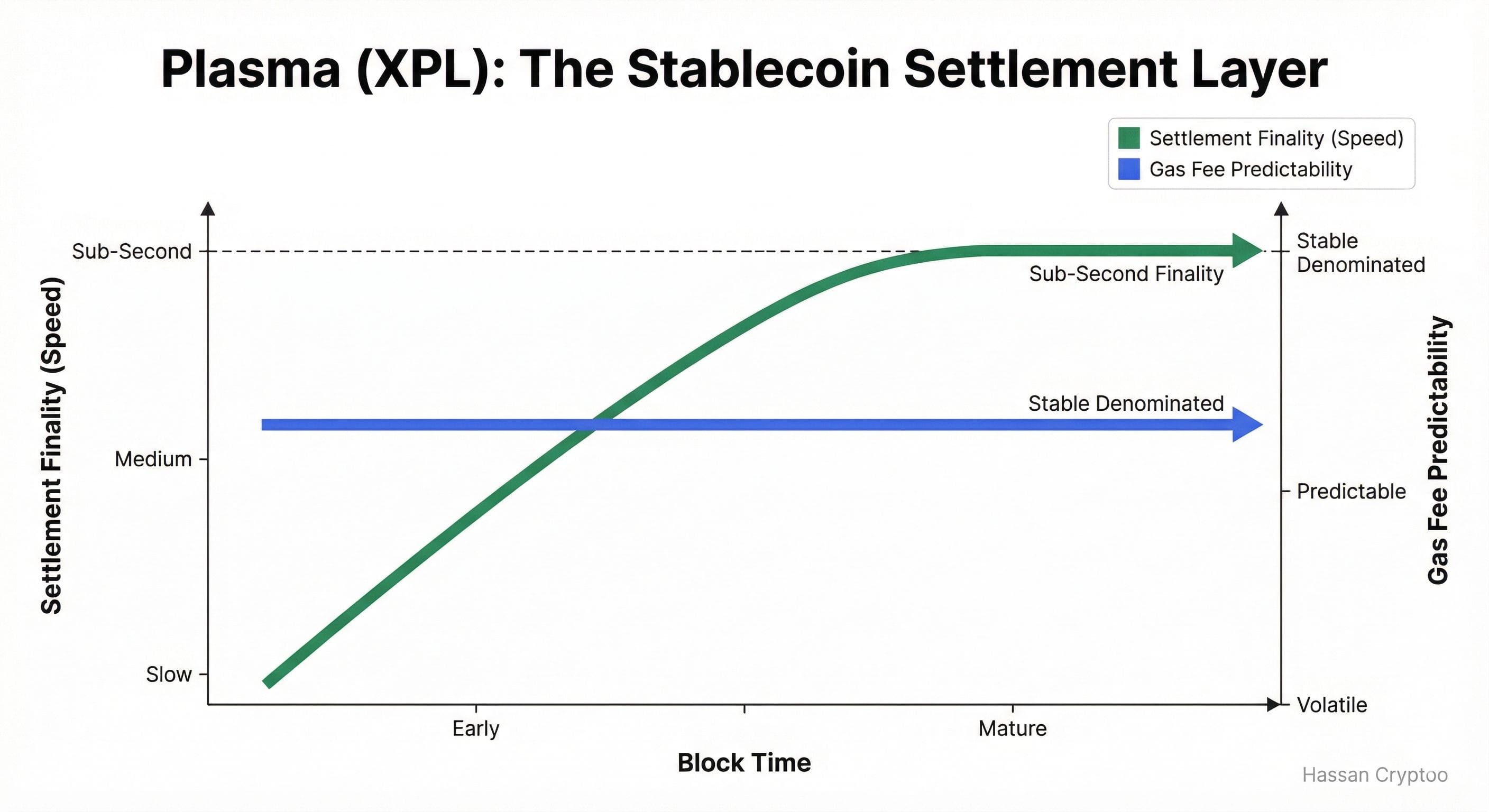

Let us start with the core proposition. Plasma labels itself a blockchain "tailored for stablecoin settlement." That word, tailored, is crucial. It implies intentional design choices rather than generic capability. The foundation uses a modified Avalanche consensus, which they call PlasmaBFT, to achieve sub second finality. For an institution moving value, finality is not a technical nicety. It is the moment settlement risk disappears. Waiting minutes for confirmations, as on some legacy chains, creates a window of operational uncertainty that treasury managers simply will not tolerate. Plasma's timeframe aligns with the expectations of modern digital finance.

The most telling features, however, are in the economic layer. Plasma introduces the concept of "stablecoin first gas." In practice, this means users can pay transaction fees in the same stablecoin they are transferring, like USDT or USDC. If you are moving USDT, you pay for gas in USDT. This eliminates the constant hedging and management of a separate, volatile native token solely for fees. It creates a closed loop, predictable cost environment. I see this as a fundamental reduction in cognitive and operational overhead for a business. You can forecast transaction costs in the dollar denominated asset you actually care about, not in a crypto asset whose value fluctuates independently.

Building on this is the "gasless USDT transfer" feature. It allows senders to initiate USDT transfers without holding any XPL for gas at all. The cost for transaction fees can be covered by a different entity or integrated directly into an application's framework. Although this concept exists elsewhere in the decentralized web, its central role in Plasma's architecture underscores a commitment to streamlining the user journey for widespread use. For a financial entity testing a new payment system, it eliminates a major potential risk. The requirement for personnel or operational setups to consistently hold a separate gas token is eliminated. The transaction settles seamlessly. This kind of abstraction is what makes technology fade into the background, which is precisely what finance needs.

Security often gets discussed in terms of cryptographic hacking, but for institutions, neutrality and censorship resistance are equally critical components of security. Plasma's approach here is distinctive, Bitcoin anchored security. Their consensus mechanism saves checkpoints to the Bitcoin blockchain at regular intervals. This is not about using Bitcoin for smart contracts. It is about leveraging Bitcoin's unparalleled decentralized security and neutrality as a judicial layer. A transaction finalized on Plasma gains the immutable backing of Bitcoin's proof of work over time. In a landscape where regulatory scrutiny can pressure validators on other chains, this anchor to a maximally neutral settlement layer is a powerful statement. It aims to provide a credible, external guarantee that the ledger's history cannot be arbitrarily rewritten, addressing a deep seated institutional concern about sovereign risk within a single blockchain's validator set.

A review of their most recent blog indicates the project is involved in a technology-focused development stage. Current improvements center on bringing validators into the network, offering comprehensive explanations of their agreement framework, and demonstrating progress in moving to a mainnet without permissions. This progress is fueled not by speculative hype or partnership announcements, but by a series of deliberate, measurable technical feats. This method of communication might not capture fleeting social media trends, but it exemplifies the language of core infrastructure development. It is precisely what builders and technically-minded leaders in finance look for: evidence of relentless, committed forward momentum. The promise of gasless stablecoin transfers and Bitcoin backed security transitions from whitepaper concept to testnet reality and, soon, to mainnet utility.

This brings us to compatibility. Plasma offers full Ethereum Virtual Machine compatibility, built on the Reth execution client. This is a pragmatic, not just a technical, choice. It means the vast arsenal of Ethereum's tooling, from MetaMask to smart contract libraries like OpenZeppelin, works out of the box. Developers from TradFi fintechs exploring blockchain do not need to learn an entirely new language. They can port Solidity code and use familiar frameworks. The learning curve flattens dramatically. It turns Plasma into a specialized settlement rail that does not require rebuilding the entire wheel of developer knowledge. Their website and documentation consistently emphasize this developer friendly, EVM native path.

An analysis of their latest blog shows that project engaged in a technically-driven development phase. Recent updates focus on integrating validators, providing detailed breakdowns of their consensus model, and showing advancement toward a permissionless mainnet. This story is propelled not by speculation or partnership news, but by steady, gradual technical achievements. This method of communication might not capture fleeting social media trends, but it exemplifies the language of core infrastructure development. It is precisely what builders and technically-minded leaders in finance look for: evidence of relentless, committed forward momentum. The promise of gasless stablecoin transfers and Bitcoin backed security transitions from whitepaper concept to testnet reality and, soon, to mainnet utility.

The ultimate question for a chain like Plasma is not whether it can process transactions cheaply and fast. Many chains now claim that. The question is whether its specific choices around fee economics, finality speed, security inheritance, and developer familiarity coalesce into a platform that feels viable for regulated entities. It is attempting to build a bridge not just between blockchains, but between the discrete, risk managed world of institutional finance and the open, programmable world of crypto. By making the stablecoin the primary economic unit of both value transfer and network fee, and by anchoring its security in Bitcoin, Plasma is crafting an answer. It remains an answer in development, but its architectural blueprint is uniquely aligned with the compliance, predictability, and security demands that have long been non negotiable for traditional finance.

by Hassan Cryptoo