▌ Solana in 2026 feels less like an upgrade and more like a transformation. It is already a paradise for retail investors and meme coins, but that’s not enough. Its ambition is to become the Nasdaq of the blockchain, attracting real capital markets to participate.

To achieve this, it must be compared to top centralized exchanges on three aspects: speed, liquidity, and fairness of trading. Its newly released roadmap is almost a direct attack on these three items. It is clear that this time it is serious.

1. Heart surgery on the consensus layer: Alpenglow

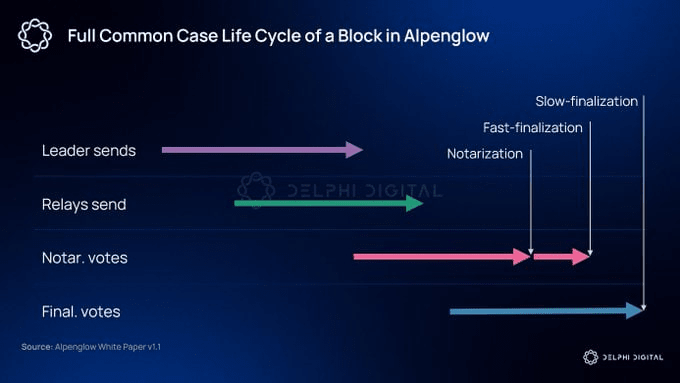

If previous optimizations were just patchwork, Alpenglow is a complete change of heart. It reconstructs the underlying logic of consensus and dissemination with two systems: Votor and Rotor.

Votor: Simplifying complexity. Compressing multi-round voting into one or two rounds, theoretical confirmation time is reduced from seconds to milliseconds. If there are enough votes, it passes directly; if not, it asks for another round, both fast and stable.

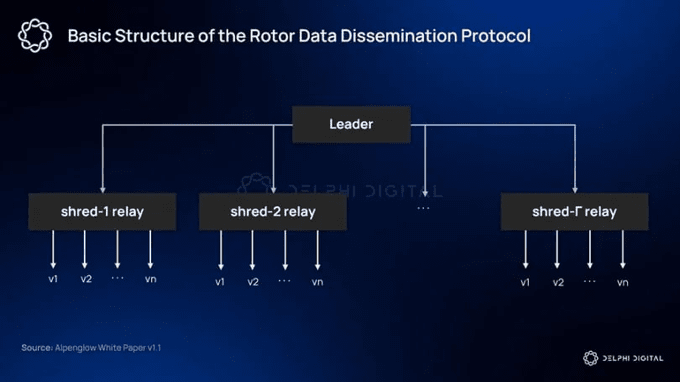

Rotor: Built a VIP channel. It allows important nodes to communicate directly, reducing information detours and speeding up communication.

This system also has a 20+20 elastic model, which means that even if some nodes encounter issues, the network will still function.

This upgrade subtly downplayed Solana's past signature technology PoH (Proof of History) and shifted towards more deterministic scheduling, marking a low-key technical pivot.

Two, The Dual-Wing Era of Clients: Firedancer and the Competitive Ecology

Solana is bidding farewell to the era of going solo and entering a more stable dual-wing mode.

Previously, the entire network mainly relied on a single client (Agave) to operate. Although this was simple, if it had vulnerabilities, the entire system could be affected.

Now, the Firedancer client developed by Jump Crypto has arrived. It is not just a new version written in C++; more importantly, it adds a layer of backup to the network. The two clients compete and promote each other, significantly accelerating the iteration speed.

Currently, there is a transitional solution called Frankendancer, which, as the name suggests, blends components of the two clients to make the upgrade process smoother and safer.

In a nutshell: from relying on one engine to having two mutually backing and competing engines, Solana is becoming more resilient.

Three, The Invisible Financial-Level Track: DoubleZero

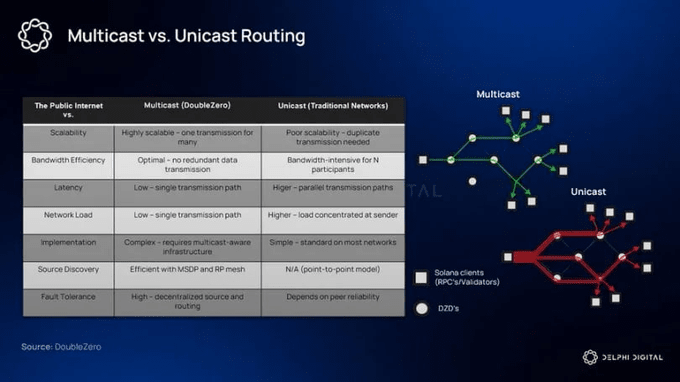

No matter how good the technology is, if it operates on the public internet, it is always difficult to control latency fluctuations. The introduction of DoubleZero directly addresses this pain point; it is essentially a coverage network based on dedicated fiber optics, similar to the underlying infrastructure used by traditional exchanges like NASDAQ and CME.

Its significance lies not only in speed but also in uniformity. As the number of validator nodes increases, network propagation can easily become uneven. DoubleZero narrows the communication gap between nodes through multicast and optimal path routing, allowing consensus mechanisms like Alpenglow to operate more stably and effectively. This can be seen as a key step for Solana to align with financial infrastructure on a physical level.

Four, Fair Trading and Market Structure: BAM and Harmonic

If performance improves but the trading environment is unfair, ordinary users can easily be harvested by quantitative bots. The BAM (Block Assembly Market) launched by Jito adds a privacy sorting layer based on a trusted execution environment (TEE) before trades are executed, similar to sealing an envelope before a transaction arrives, making behaviors like front-running and sandwiching difficult to implement.

Harmonic goes a step further, allowing validators to select the optimal block from a batch, introducing competition, resulting in more open and efficient block generation. One protects users at a micro level, while the other optimizes the market at a macro level, combining to create fairer trading and a healthier chain.

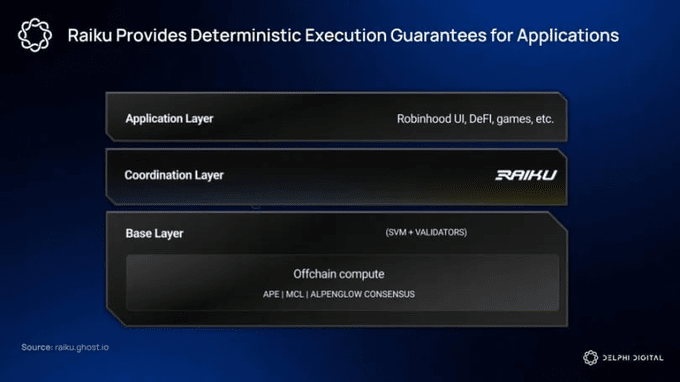

Five, The Final Link of Determinism: Raiku

Having an average speed is not enough, especially in scenarios like high-frequency trading and on-chain order books. What they need is stable and predictable execution assurance, completing tasks exactly when promised.

This is what Raiku does. It does not alter the underlying consensus but adds a scheduling layer, allowing applications to lock in execution resources in advance, like booking a taxi or rushing to a fast lane. It essentially paves a fast and stable exclusive channel for professional financial applications.

Six, Solana's ambitions go far beyond crypto-native

Look at these upgrades; it has long ceased to be just a faster public chain. It is systematically filling the following gaps:

Approaching exchange-level confirmation speed and network determinism through Alpenglow and DoubleZero;

Achieving client diversification through Firedancer to enhance the network's risk resistance;

Constructing an application layer environment that balances fairness, openness, and deterministic execution through BAM, Harmonic, and Raiku.

This path is not lonely. Projects like xStocks have begun to bring real-world assets into Solana, and new native perpetual contract exchanges are also launching one after another. All of this points in the same direction: Solana aims not only to be the preferred chain for crypto trading but also to become the underlying protocol for the next generation of digital capital markets.

Of course, while technological advancements are rapid, challenges will not be few. However, looking at its development trajectory, Solana is not just focusing on other public chains, but also on those massive and stable systems in traditional finance. By 2026, we may witness how a blockchain truly enters the mainstream financial stage through technology and ecology.