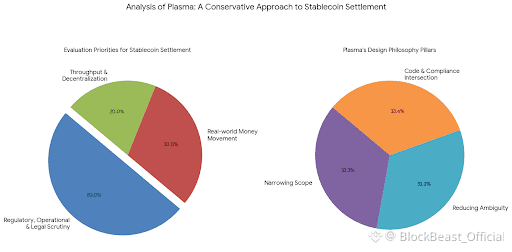

When evaluating a blockchain intended for stablecoin settlement, the first question is rarely about throughput or theoretical decentralization. It is about whether the system behaves predictably under scrutiny—regulatory, operational, and legal—and whether its design choices reflect an understanding of how money actually moves in the real world. Plasma, as described, reads less like an attempt to reinvent financial rails and more like an effort to narrow scope, reduce ambiguity, and accept that stablecoins already sit at the intersection of code and compliance.

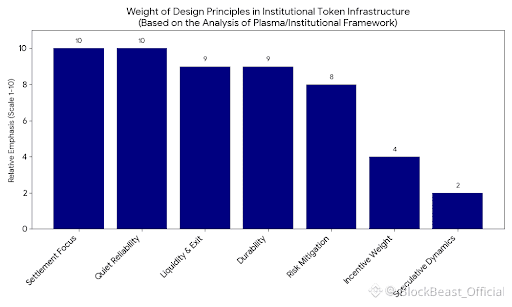

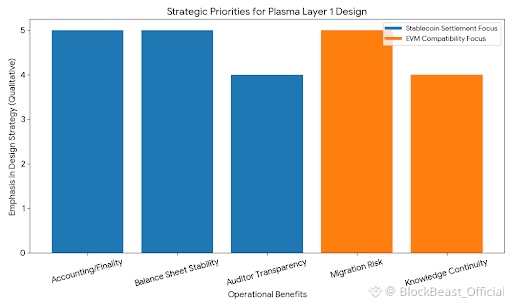

The decision to focus on stablecoin settlement as a primary use case is revealing. Stablecoins are not experimental instruments; they are operational tools used daily by payment processors, remittance providers, and increasingly by regulated institutions. Designing a Layer 1 around this reality forces early confrontation with issues that more generalized blockchains often defer: transaction finality that aligns with accounting needs, gas mechanics that do not introduce balance sheet volatility, and system behavior that can be explained to auditors without caveats. Gasless USDT transfers and stablecoin-first gas are not consumer-facing flourishes so much as acknowledgments that, in production environments, friction and unpredictability are liabilities.

Full EVM compatibility via Reth suggests a conservative posture toward developer adoption. Rather than introducing novel execution environments or bespoke virtual machines, Plasma appears to prioritize continuity with existing tooling. This is not an attempt to court experimentation but to reduce migration risk. In regulated environments, the cost of retraining teams, rewriting contracts, or re-auditing unfamiliar stacks is often prohibitive. Compatibility is less about attracting developers in the abstract and more about allowing existing operational knowledge to transfer with minimal reinterpretation.

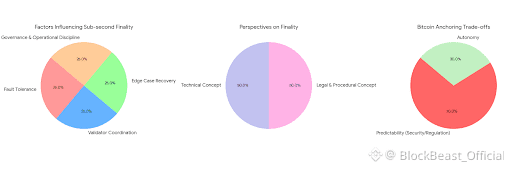

Sub-second finality through PlasmaBFT raises more nuanced considerations. Finality is attractive, but only insofar as it is reliable and understandable. In financial operations, finality is as much a legal and procedural concept as a technical one. Faster consensus mechanisms introduce questions about fault tolerance, validator coordination, and recovery from edge cases. The choice to pursue sub-second finality suggests an intent to align on-chain settlement more closely with real-time payment expectations, but it also implies careful governance around validator behavior, upgrades, and incident response. These are not problems solved by code alone; they require operational discipline.

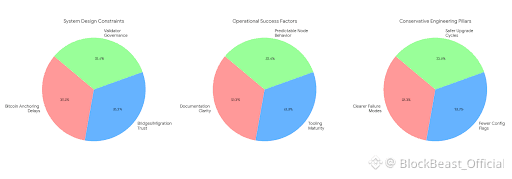

The use of Bitcoin anchoring as a security reference point reflects a particular philosophy of neutrality. Anchoring to Bitcoin does not eliminate trust assumptions, but it externalizes some security guarantees to a system with a long operational history and a relatively clear regulatory posture. This choice trades autonomy for predictability. It may introduce settlement latency or dependency on external chain conditions, but it also provides a reference frame that regulators and institutions already understand. In practice, such anchoring can serve as a conservative hedge against governance disputes or censorship concerns, even if it complicates the mental model.

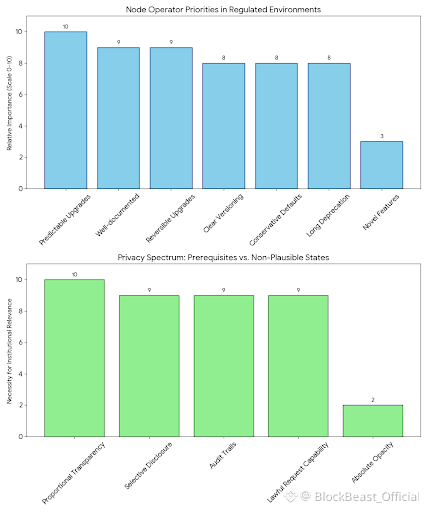

Privacy, in this context, is best understood as graduated rather than binary. Stablecoin systems that aspire to institutional relevance cannot plausibly offer absolute opacity. Selective disclosure, audit trails, and the ability to respond to lawful requests are not concessions but prerequisites. Designing for privacy as a spectrum allows different participants—retail users in high-adoption markets and institutions with reporting obligations—to coexist on the same infrastructure without pretending their needs are identical. The challenge is not maximizing secrecy but enabling proportional transparency without embedding arbitrary surveillance.

Modularity and separation of concerns—between consensus, execution, and settlement anchoring—are similarly pragmatic choices. Modular systems age better because they localize failure and simplify upgrades. In regulated environments, the ability to upgrade components without system-wide disruption is critical. Node operators care less about architectural elegance than about whether upgrades are predictable, well-documented, and reversible. Clear versioning, conservative defaults, and long deprecation timelines matter more than novel features when systems are expected to run continuously.

Acknowledging limitations is part of credible system design. Bitcoin anchoring introduces delays that may not align with every use case. Bridges and migration paths carry trust assumptions that cannot be fully abstracted away. Validator sets, no matter how designed, require governance processes that can be messy under stress. These constraints affect deployment decisions and should inform how the system is used, not be framed as temporary inconveniences. Institutions plan around limitations; they do not ignore them.

Operational details often determine whether a blockchain survives contact with production. Documentation clarity, tooling maturity, and predictable node behavior are unglamorous, but they are what allow compliance teams to sign off and operations teams to sleep at night. A system that requires constant interpretation or manual intervention accumulates hidden risk. Conservative engineering—fewer configuration flags, clearer failure modes, slower but safer upgrade cycles—tends to outperform more ambitious designs over time.

Token design, when viewed through an institutional lens, is less about incentives and more about liquidity and exit optionality. Participants need to understand how value moves in and out of the system without distorting core operations. A token that introduces speculative dynamics into a settlement-focused network can undermine its primary purpose. Restraint here signals an understanding that infrastructure tokens are liabilities as much as assets, especially when counterparties are regulated entities with strict risk frameworks.

Taken together, Plasma appears oriented toward durability rather than differentiation. Its choices suggest familiarity with audits, regulatory reviews, and the slow accumulation of trust that accompanies real-world financial integration. Success in this context is unlikely to be loud. It will be measured in years of uneventful operation, in systems that continue to clear transactions during market stress, and in the absence of surprises during examinations. For infrastructure meant to handle money at scale, quiet reliability is not a marketing failure—it is the point.