Plasma does not present itself as a loud breakthrough, and that is exactly why it stands out. From the first time I looked closely at how the chain behaves, how decisions are made, and how the roadmap is structured, I felt amazing. Not excited in a speculative way, but calm and confident. Plasma feels like infrastructure designed by people who understand money flows, settlement psychology, and the quiet mechanics that actually move global finance.

At its foundation, Plasma is a Layer 1 built specifically for stablecoin settlement, and that focus changes everything. Instead of trying to be a general-purpose playground, Plasma treats stablecoins as first-class citizens. Gasless USDT transfers and stablecoin-first gas are not marketing features. They are acknowledgements of how people already use crypto today. Most real economic activity happens in stablecoins, especially in high-adoption regions where speed, predictability, and cost matter more than ideology.

The technical design reinforces this clarity. Full EVM compatibility through Reth means developers do not need to relearn anything to build on Plasma. Sub-second finality via PlasmaBFT changes the user experience at a psychological level. When transactions feel instant, trust increases. When trust increases, usage becomes habitual. That habit formation is where real network value is created, not in temporary transaction spikes.

What truly shifts the market narrative is Plasma’s relationship with Bitcoin. Bitcoin-anchored security adds a layer of neutrality that most chains quietly struggle to achieve. This anchoring is not about marketing alignment with Bitcoin culture. It is about credibility. It signals that Plasma understands the importance of censorship resistance and long-term settlement guarantees, especially for institutions and payment providers who think in decades, not cycles.

From a trading psychology perspective, Plasma introduces a different mental model. Traders are used to narratives driven by velocity, hype, and volatility. Plasma replaces that with predictability and reliability. Stablecoin settlement infrastructure does not create emotional price swings. It creates steady usage growth. Over time, that reshapes how market participants anchor value and manage risk, favoring longer horizons and lower emotional stress.

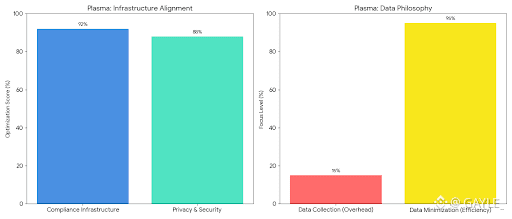

I am consistently impressed by how Plasma treats its core users. Retail users in emerging and high-adoption markets get what they actually need: fast transfers, low costs, and simplicity. Institutions get settlement guarantees, compliance-friendly architecture, and infrastructure that feels mature rather than experimental. This dual alignment is rare, and it explains why Plasma feels composed rather than reactive.

Plasma also builds a new layer of narrative intelligence into crypto. It reframes stablecoins from being passive instruments into active infrastructure drivers. When stablecoins become the default unit of account on-chain, market behavior changes. Liquidity becomes stickier. Volatility becomes more contained. Trading strategies evolve from pure speculation to yield, flow, and settlement efficiency.

Another subtle strength is how Plasma reduces cognitive friction. Gasless transfers remove a major psychological barrier for users. Stablecoin-first gas removes confusion around fee management. These design choices may look small, but at scale they dramatically increase retention. Retention is the invisible metric that separates chains that spike from chains that endure.

What I appreciate most is Plasma’s restraint. It does not try to capture every narrative at once. It stays focused on doing one thing exceptionally well. That discipline signals confidence. In crypto, confidence built through execution is far more powerful than confidence projected through marketing.

Every time I revisit Plasma, I feel the same thing. It feels amazing to watch infrastructure mature in real time. Plasma is not trying to redefine money. It is quietly making money work better on-chain. And as markets grow more serious, that kind of quiet excellence is exactly what reshapes narratives, trader psychology, and the long-term architecture of crypto itself.