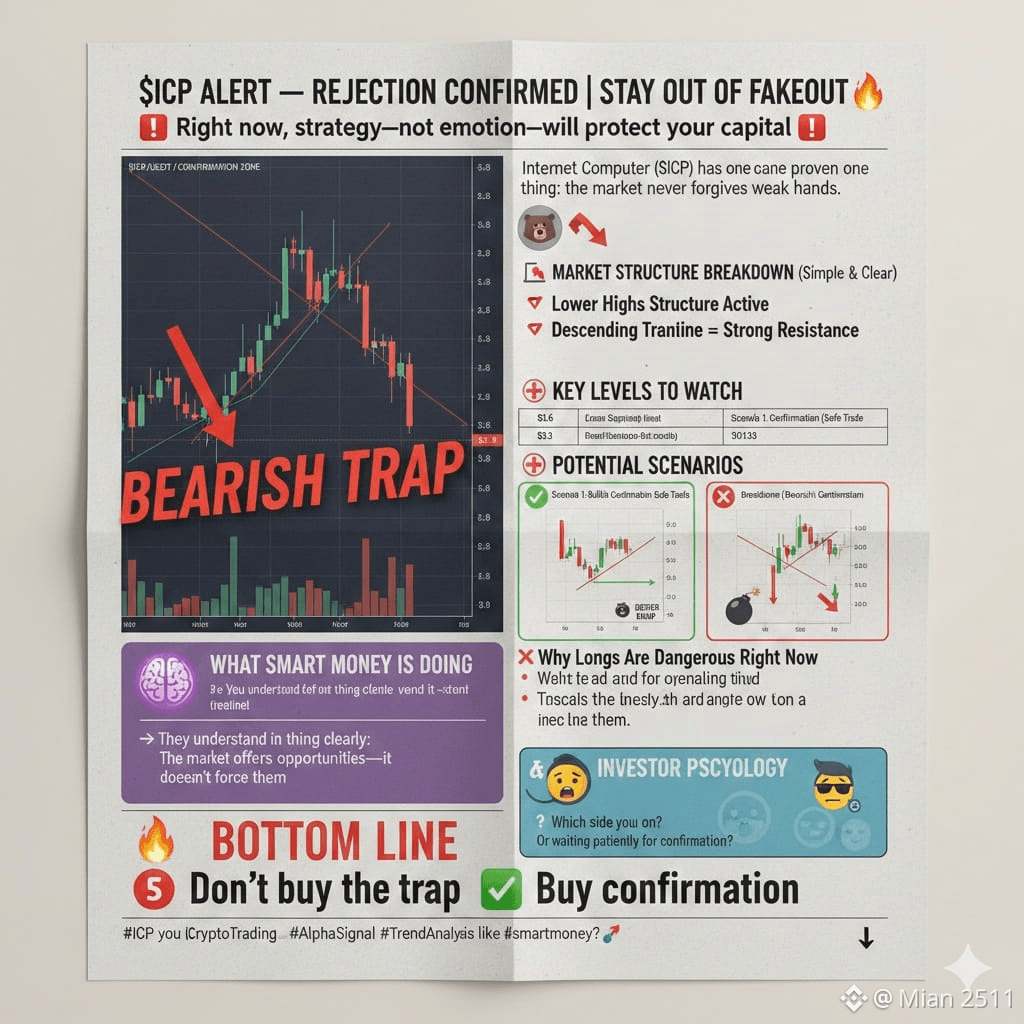

CRYPTO WORLD NEWS — Internet Computer ($ICP) has encountered a significant technical rejection, signaling a "classic bearish trap" that has left many retail traders vulnerable. As the asset struggles to maintain momentum, market analysts are urging caution, emphasizing strategy over emotion in a volatile landscape.

Technical Breakdown: The Bearish Grip

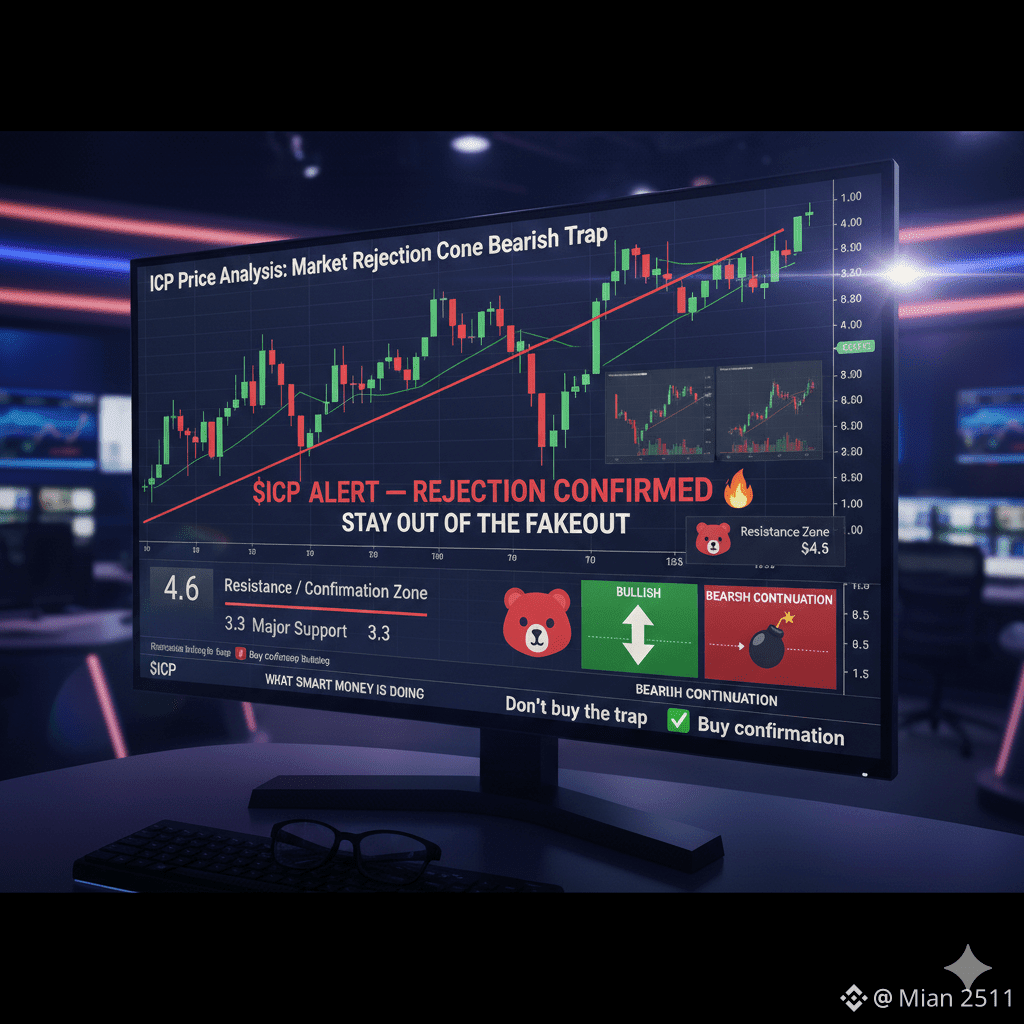

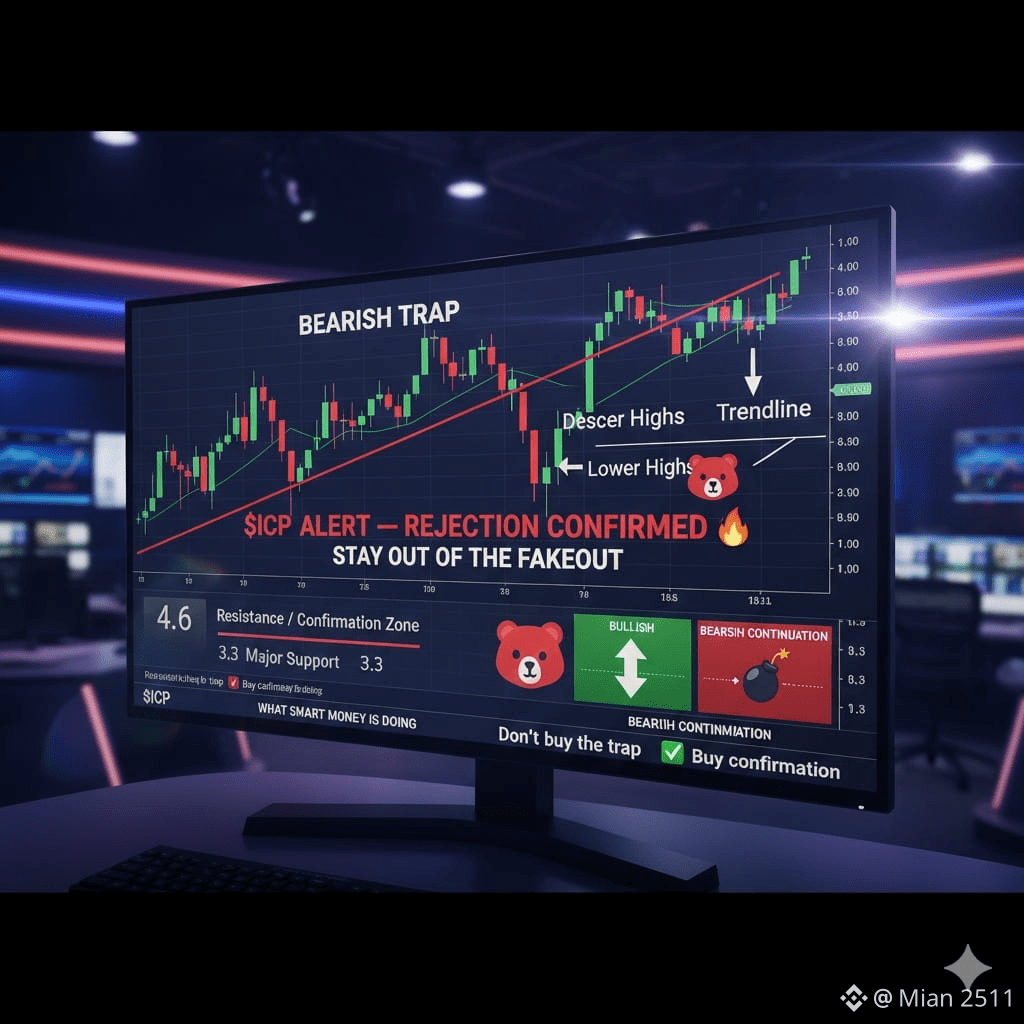

The current market structure for $ICP reveals a persistent pattern of lower highs, a definitive signal that sellers are regaining aggression during every attempted price bounce. Despite brief rallies, buyers have failed to reclaim control, keeping the asset pinned beneath a formidable descending trendline.

According to recent data, the bears remain firmly in the driver's seat. Market experts suggest that entering long positions at this stage is premature and carries a high risk of capital loss.

Key Levels to Watch

For traders looking to navigate this "fakeout," two specific price points have been identified as the battlegrounds for $ICP’s next move:

Potential Scenarios: Patience vs. Panic

Market analysts have outlined two primary paths for $ICP in the coming days:

The Bullish Confirmation (The "Safe" Trade): For a trend reversal to be validated, $ICP

must secure a Daily or 4-hour candle close above the $4.6 resistance. This move must be followed by a clean retest and hold of that level as new support before a long entry is considered viable.

The Bearish Continuation: If the $3.3 support level fails to hold, a liquidity flush is likely. This scenario would trigger panic selling among retail holders while "Smart Money" prepares to accumulate at significantly lower entries.