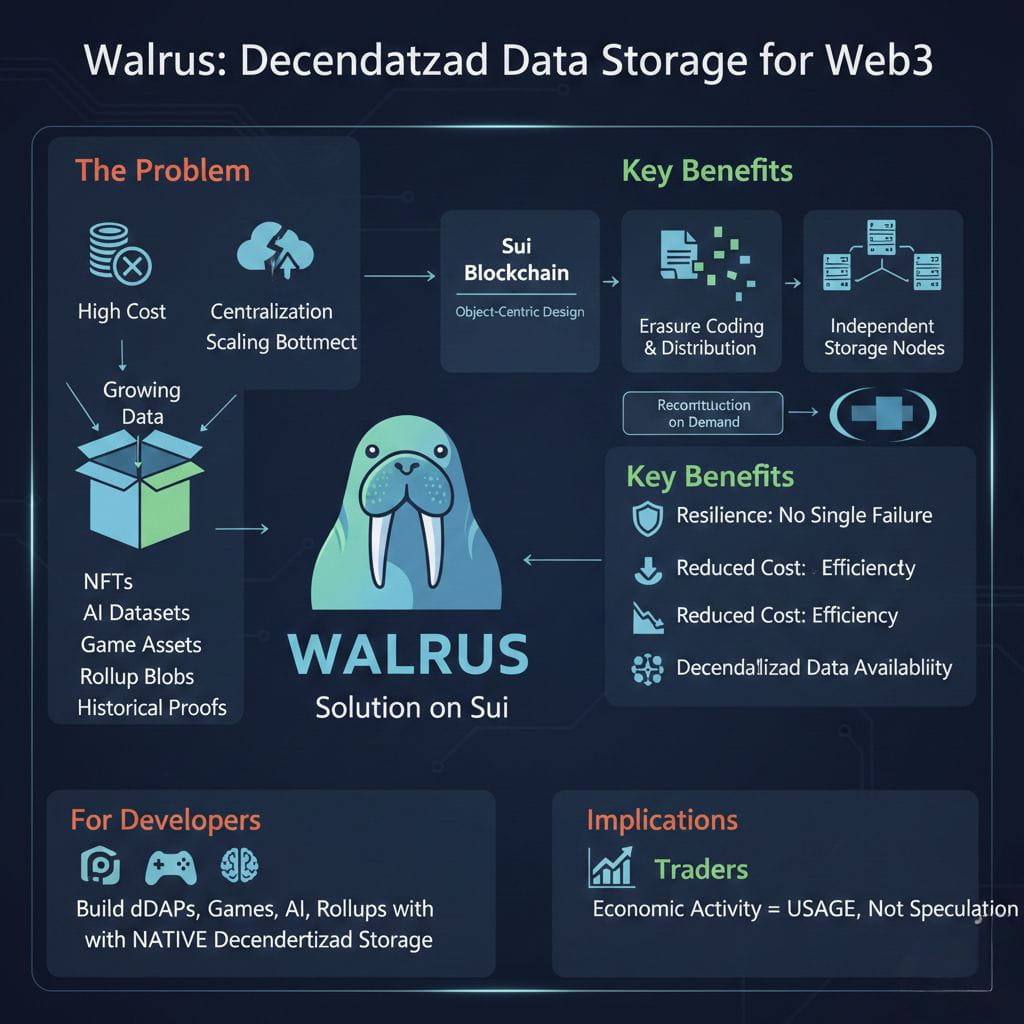

Walrus didn’t arrive with hype. It arrived with a problem to solve. As blockchains scaled, something fundamental started breaking down: data. Not transactions, not smart contracts, but the raw storage layer that everything else depends on. NFTs, AI datasets, game assets, rollup blobs, historical proofs all of it kept growing heavier, more expensive, and increasingly centralized behind cloud providers. Walrus was built to attack that weakness directly, and its recent progress shows it is no longer theoretical infrastructure. It is live, used, and quietly becoming part of how data moves in Web3.

Running natively on Sui, Walrus leverages Sui’s object-centric design to handle large-scale storage in a way most blockchains simply cannot. Instead of treating data as an afterthought, Walrus treats it as a first-class citizen. Files are split using erasure coding, distributed across independent storage nodes, and reconstructed on demand. This means no single node holds full files, no single failure breaks availability, and costs drop dramatically compared to replication-heavy models. Recent network upgrades refined blob handling, reduced retrieval latency, and improved node incentives, making the system more resilient under real load rather than testnet assumptions.

For developers, this changes how applications are designed. Instead of pushing heavy assets off-chain and trusting centralized providers, they can now build dApps, games, AI pipelines, and rollups that natively reference decentralized blobs with predictable costs. For traders, this matters because infrastructure adoption precedes narratives. Storage demand scales with usage, not speculation. As more applications rely on Walrus for real data availability, the network’s economic activity becomes structurally linked to usage rather than hype cycles.

The numbers tell a quiet but important story. Walrus storage nodes are actively staking WAL to participate, aligning long-term operators instead of short-term yield chasers. Staked WAL acts as both a security bond and a governance weight, meaning operators are financially exposed to network health. Storage capacity continues to expand as more nodes come online, while blob usage grows alongside Sui’s broader ecosystem activity. WAL transaction volume tends to spike during periods of network usage rather than pure market volatility, a signal infrastructure traders pay close attention to.

The numbers tell a quiet but important story. Walrus storage nodes are actively staking WAL to participate, aligning long-term operators instead of short-term yield chasers. Staked WAL acts as both a security bond and a governance weight, meaning operators are financially exposed to network health. Storage capacity continues to expand as more nodes come online, while blob usage grows alongside Sui’s broader ecosystem activity. WAL transaction volume tends to spike during periods of network usage rather than pure market volatility, a signal infrastructure traders pay close attention to.

Architecturally, Walrus sits at an interesting intersection. It is not an L2 trying to scale execution, nor a generic file system detached from blockchain logic. It is a purpose-built storage layer optimized for Sui’s high-throughput environment, capable of serving rollups, WASM-based applications, and data-heavy consumer products. By separating execution from storage while keeping cryptographic guarantees intact, Walrus reduces gas overhead and improves user experience without compromising decentralization.

The WAL token is woven directly into this system. It is used for staking by storage providers, governance decisions around protocol parameters, and economic penalties when availability or integrity guarantees are violated. This is not passive utility. WAL actively enforces behavior. Operators who act honestly earn rewards tied to real usage, while bad actors face slashing. Over time, this creates a self-regulating storage economy rather than a subsidy-driven one.

Traction is also visible through integrations. Builders within the Sui ecosystem increasingly reference Walrus for blob storage, especially for NFTs, gaming assets, and AI-related data. Community participation around WAL governance proposals shows an operator-heavy voter base, another sign the network is attracting infrastructure participants rather than purely speculative holders. This kind of community composition tends to correlate with longevity, not short-lived hype.

For Binance ecosystem traders, Walrus represents a familiar pattern. Early infrastructure tokens often trade quietly while usage compounds underneath. Liquidity events, ecosystem incentives, or broader Sui adoption can rapidly reprice these assets once demand becomes obvious. WAL sits at the intersection of storage, AI data growth, and modular blockchain design three narratives Binance traders already track closely.

Walrus is not trying to be loud. It is trying to be necessary. As blockchains push toward real-world scale, decentralized storage stops being optional and starts becoming foundational. The question worth debating now is simple: when data becomes the bottleneck of Web3 growth, which networks are positioned to own that layer and will traders recognize it early enough?