Most blockchains discover regulation the hard way. They launch, grow fast, attract attention, and only later realize that financial markets do not operate in a legal vacuum. By the time that realization arrives, architecture is already locked in and compromises begin.

Dusk started from the opposite assumption.

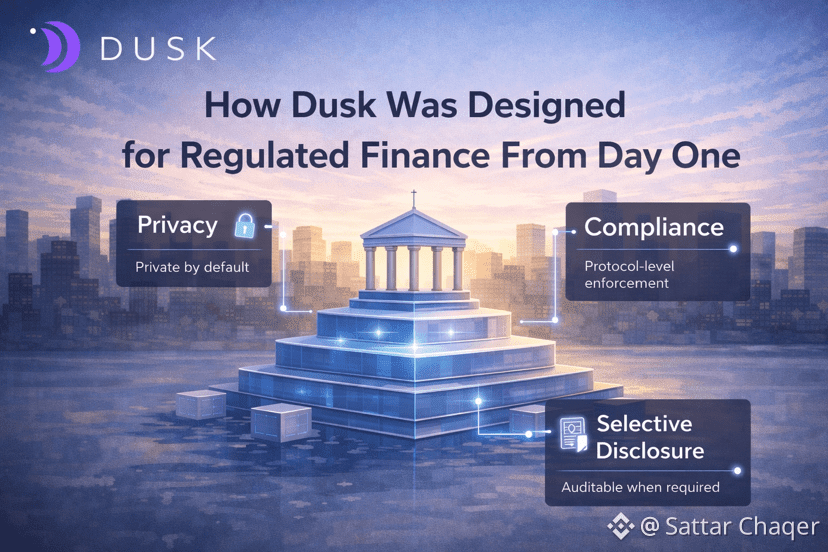

From the beginning, Dusk treated regulation as a fixed condition, not a temporary obstacle. The idea was simple but uncommon in crypto: real financial markets are shaped by law, disclosure rules, and accountability, and they are not going to abandon those structures just because new technology exists.

That assumption shows up everywhere in how Dusk is designed.

In traditional finance, privacy is not controversial. It is normal. Trade sizes are not public by default. Ownership structures are not broadcast in real time. Counterparty relationships are disclosed selectively, usually to auditors, regulators, or courts. This is not about secrecy. It is about preventing information leakage that can distort markets.

Public blockchains flipped this logic. Transparency became absolute. Everything visible, forever. That approach enabled experimentation, but it also made most blockchains unsuitable for regulated financial activity.

Dusk does not try to force regulated markets into that model. Instead, it adapts blockchain infrastructure to how finance already works.

Rather than publishing raw transaction data, Dusk relies on selective disclosure. Compliance can be proven without exposing sensitive information publicly. Audits can happen when required, without turning the network into a surveillance system. Privacy and accountability coexist, instead of competing.

This is where many projects struggle. Compliance is often added later, at the application level, layered on top of infrastructure that was never designed for it. Those systems work until they don’t. When rules live outside the protocol, they can be bypassed, misconfigured, or broken as the system evolves.

Dusk embeds these constraints directly into the network. That makes enforcement predictable rather than optional.

It also explains why Dusk feels slower than retail-oriented blockchains. Regulated finance does not reward rapid iteration or experimental governance. It rewards stability. Mistakes are expensive. Changes require justification. Infrastructure is expected to behave the same way tomorrow as it does today.

Dusk is built for that environment, not for hype cycles.

This is why it often goes unnoticed during speculative phases of the market. It is not designed to generate excitement. It is designed to survive scrutiny.

If regulated finance continues moving on-chain, the infrastructure that lasts will be the infrastructure that respected legal reality from the start. Dusk was built with that expectation, not as an afterthought, but as a foundation.