@Vanarchain Mass adoption in crypto is usually framed as a technical finish line, but the longer you watch products launch and stall, the more it looks like a human problem. People don’t wake up wanting a new settlement layer. They’re not asking for a new system to learn. They want something that feels safe, easy to understand, and normal enough to use right away. Familiarity is the quiet ingredient that turns “interesting” into “everyday,” and without it, most blockchain projects never break out of the enthusiast circle.

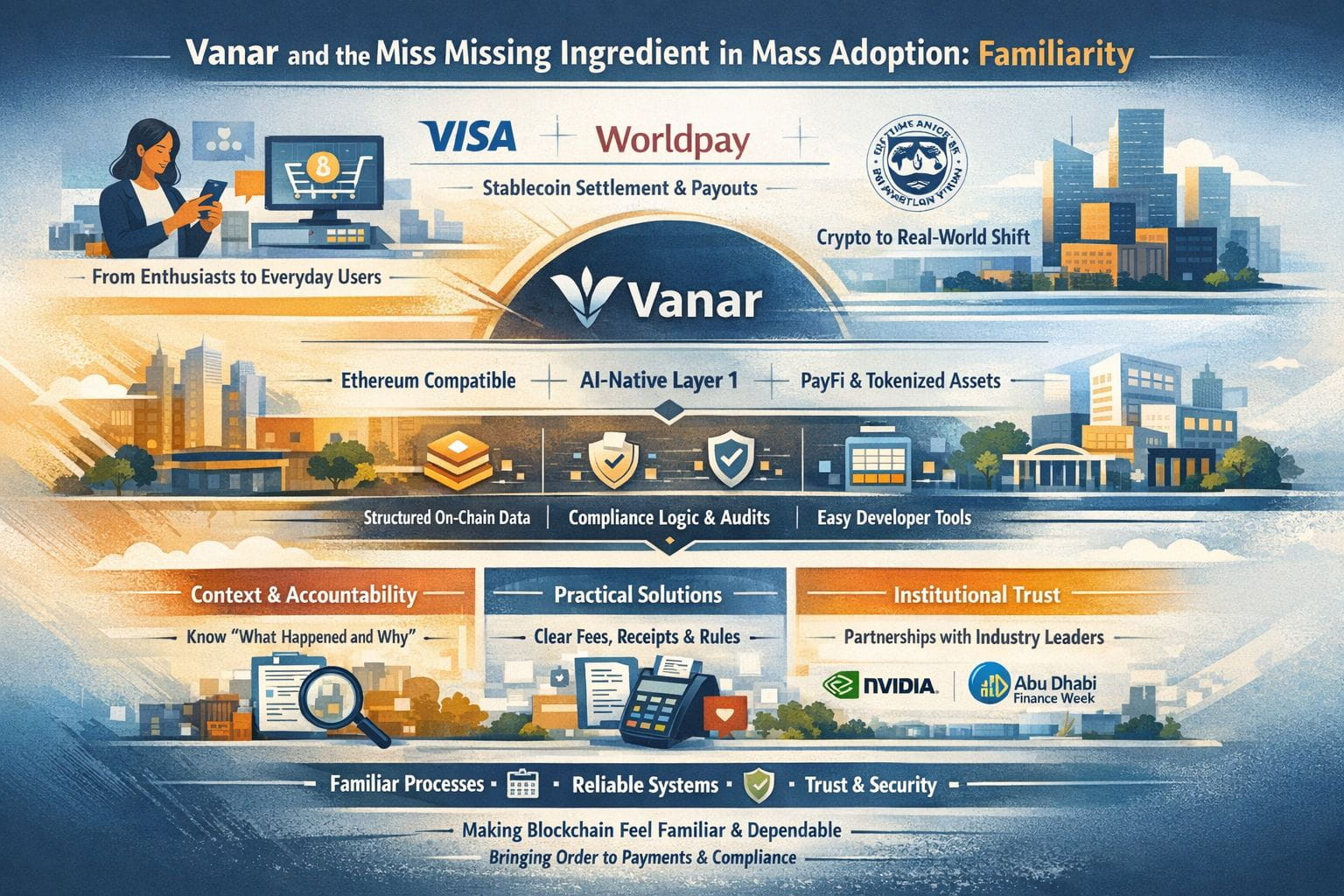

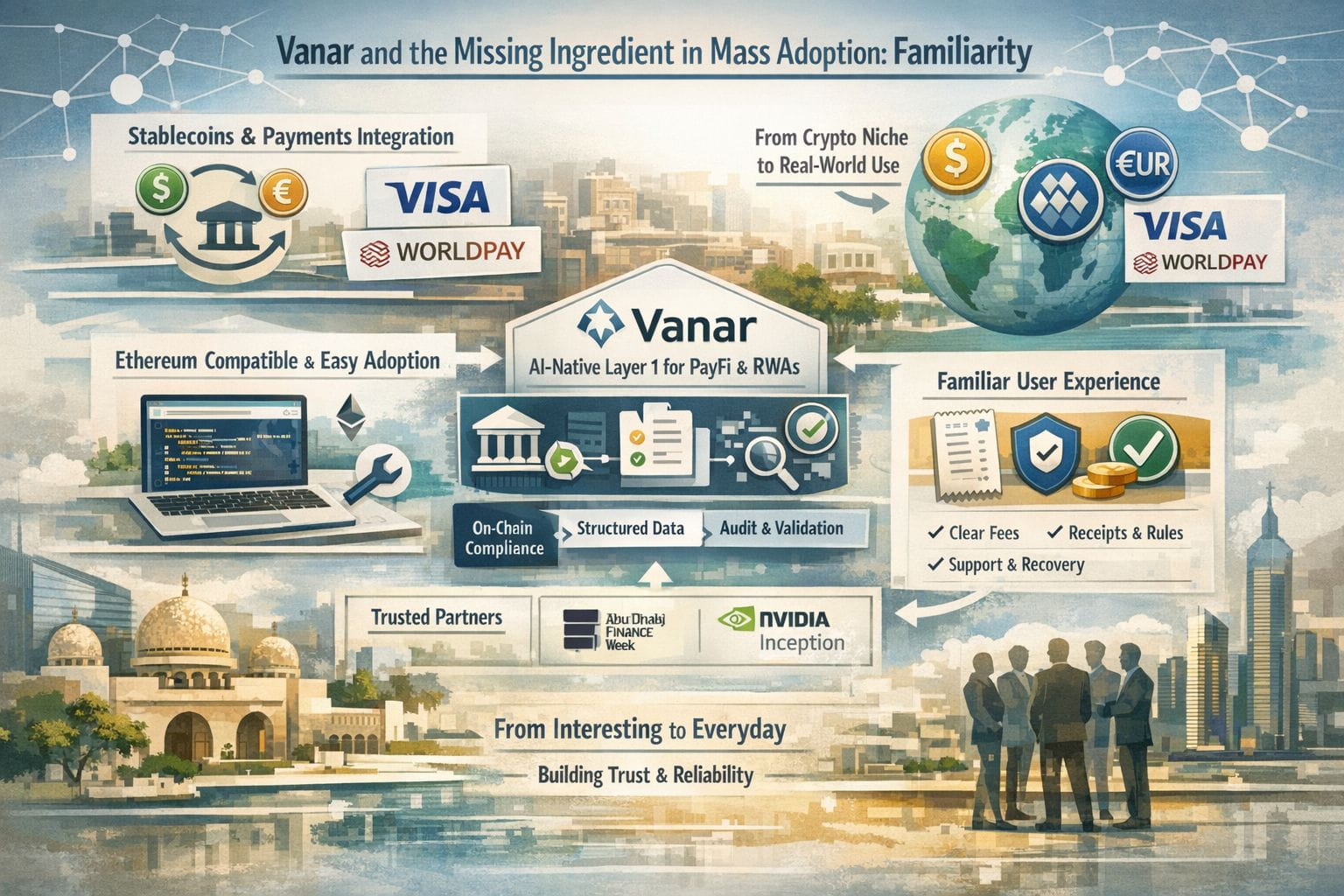

This is also why the conversation has sharpened recently. Over the last year or so, stablecoins have been pulled out of the “trading only” box and pushed into more practical lanes like payouts, settlement, and cross-border flows. That shift is not just vibes; large incumbents have started to treat stablecoin rails as something that can plug into the machinery they already run. Visa’s stablecoin settlement pilots and Worldpay’s work enabling stablecoin payouts are good examples of that direction of travel. At the same time, institutions like the IMF still point out that the dominant use case remains linked to crypto markets, even as payments are growing. That tension—real progress, but not a full pivot yet—is exactly where “familiarity” starts to matter.

Vanar is interesting in this moment because it explicitly tries to design for the parts of finance that demand predictability. On its own materials, it positions itself as an “AI-native” Layer 1 aimed at PayFi and tokenized real-world assets, and it describes a stack that isn’t only about moving tokens from A to B, but also about storing and validating richer context on-chain. It’s not hard to see the thesis: if payments and asset flows are going to be taken seriously by merchants and institutions, the chain can’t behave like a thin receipt printer. It has to carry enough structure for audits, rules, and accountability without forcing every application to reinvent that work from scratch.

Where familiarity becomes more than a slogan is in the specific choices Vanar says it’s making. It talks about structured data storage on-chain and an on-chain logic layer for checks and validation, including compliance-style constraints. In plain terms, it’s trying to make “what happened and why” easier to prove later, which is the kind of boring requirement that mainstream finance quietly lives and dies on. If you’ve ever tried to unwind a payment dispute, you know the pain is rarely the transfer itself. The pain is reconstructing the context: what was agreed, what was delivered, what rules applied, and who is responsible now. Vanar’s pitch is that some of this context can live closer to the transaction, rather than being scattered across private databases and screenshots.

It also helps that the project seems to understand how conservative builders are. Vanar describes itself as an Ethereum-compatible environment and leans into the idea of “easy adoption” through familiar tools. That might sound unglamorous, but it’s one of the few patterns in crypto that reliably correlates with real usage: make it easy for existing developers to ship, test, and maintain. Every unfamiliar toolchain is another reason a team sticks with what they already know, or ships once and never comes back to patch the thing.

Familiarity also shows up in who you choose to stand beside. Vanar’s appearance with Worldpay at Abu Dhabi Finance Week to discuss “agentic payments” is not proof of adoption on its own, and it shouldn’t be treated that way. But it does suggest the project is trying to show up where payments people deal with the real headaches—reconciliation, disputes, regulatory pressure, and the day-to-day risk that can’t be hand-waved away. That is the opposite of a demo built only to impress crypto Twitter for a weekend. Vanar’s participation in NVIDIA Inception sits in the same category: not a guarantee, but a deliberate attempt to borrow a kind of institutional familiarity that matters when you’re asking others to trust your infrastructure.

Even the identity cleanup matters more than people admit. The shift from TVK to VANRY, framed as a rebrand and token swap, is a reminder that adoption has a branding component too. People don’t trust what they can’t name consistently. Markets don’t integrate what they can’t categorize cleanly. A coherent identity is not the product, but messy identity work can slow everything else down.

The harder question is whether Vanar can translate these choices into experiences that feel normal to non-crypto users. The chains that win mainstream usage will probably feel almost boring from the outside. Fees are clear before you tap. Receipts look official. Recovery and support paths exist. Limits and rules are visible, not hidden behind jargon. If Vanar can reduce the pain of compliance, bring order to record-keeping, and make “what happened and why” easy to verify later, it lines up perfectly with the point of the title. Familiarity isn’t about making the new look old—it’s about making it feel dependable in ways people already recognize.

@Vanarchain #vanar $VANRY #Vanar