@Plasma For years, crypto has chased the idea of the “everything chain.” One network that can power trading, games, social apps, identity—whatever shows up next. It’s a bold instinct, and you see it in the way new projects introduce themselves, almost like they’re trying to prove they’re not small. But stablecoins have been doing the unglamorous work in the background: people sending value, settling trades, moving money across borders. That kind of usage doesn’t need grand promises. It needs systems that are predictable and easy. Plasma is built with that in mind. It’s not trying to host the whole internet; it’s trying to make moving digital dollars feel straightforward.

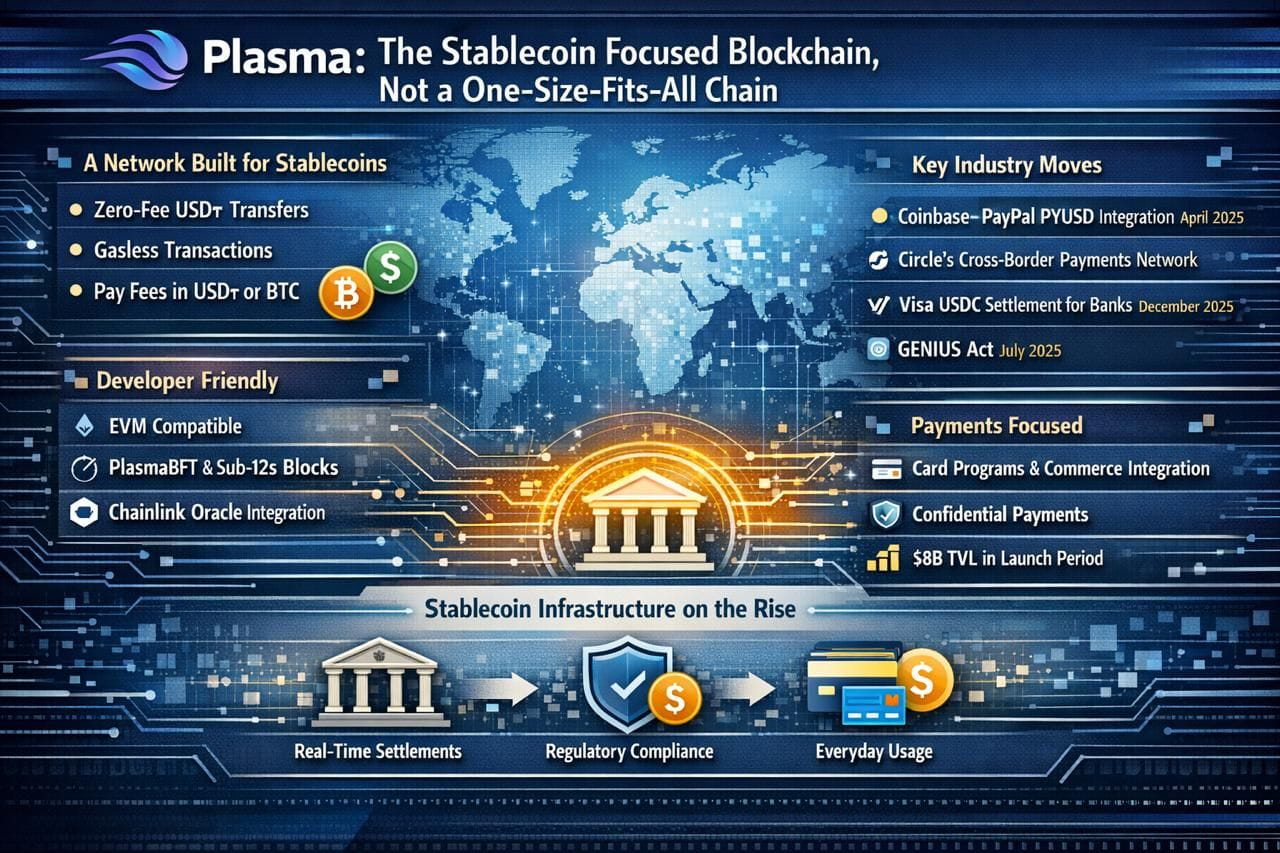

This focus is landing at a moment when stablecoins are turning into normal financial plumbing rather than a niche tool for traders. In April 2025, Coinbase removed fees for PayPal’s PYUSD and highlighted merchant-facing use cases, a small but telling step toward stablecoins being used for settlement rather than speculation. Circle, around the same time, announced a payments network aimed at real-time cross-border settlement using regulated stablecoins like USDC and EURC, which is the kind of infrastructure move you make when you expect businesses—not just crypto users—to care. Then, in December 2025, Visa announced USDC settlement for U.S. banks in its network, explicitly framing the benefit as faster funds movement and availability across weekends and holidays. Add in the U.S. GENIUS Act being signed into law in July 2025—creating a clearer regulatory framework for payment stablecoins—and you can see why “stablecoin infrastructure” has started to sound less like a crypto buzz phrase and more like a practical category.

Plasma’s most concrete design choice is to make basic USD₮ transfers feel closer to a normal payment than a blockchain ritual. The chain advertises “zero-fee” USD₮ transfers and a protocol-level paymaster approach so users don’t have to buy a separate token just to send a stablecoin. In plain terms, the network can cover the transaction cost on your behalf for certain stablecoin sends. Plasma’s own documentation goes further: it describes an API-managed relayer system for gasless USD₮ transfers, tightly scoped so it sponsors only direct transfers, with identity-aware controls and rate limits to reduce abuse. That last part matters more than it sounds. “Free” systems tend to get gamed, so the difference between a nice demo and a sustainable product is often the unglamorous policy layer.

If you’ve ever watched someone try to make their first stablecoin transfer on a typical chain, you’ve probably seen the same stall-out: they have $20 in a stablecoin, they hit send, and suddenly they’re told they need to acquire a different asset for gas. Plasma is, in effect, treating that moment as the enemy. I find that emotionally revealing, in a good way. It’s an admission that the biggest barrier to “crypto payments” isn’t cryptography; it’s the awkwardness of the user experience around fees, wallets, and unfamiliar steps.

Under the hood, Plasma tries to stay compatible with the developer world that already exists. It markets EVM compatibility, meaning Ethereum-style contracts can run without major rewrites, and it highlights PlasmaBFT—described as derived from Fast HotStuff—along with sub-12-second block times. The project also signals that not everything ships at once: it describes a mainnet beta that includes PlasmaBFT plus a modified Reth execution layer, while features like confidential transactions and a native Bitcoin bridge roll out incrementally. I appreciate that kind of sequencing because it’s closer to how real systems mature—core reliability first, fancy features when the base is sturdy.

Plasma’s “stablecoin-native” angle isn’t only about transfers, either. The chain promotes the idea of paying transaction fees in whitelisted assets like USD₮ or BTC (custom gas tokens), and it talks about confidential payments with compliance in mind, even if those arrive in phases. Whether those pieces become widely used will depend on the boring details—wallet support, audits, tooling, and the inevitability of edge cases—but the direction is consistent: make stablecoins feel like the default unit of account on the network, not an afterthought.

Ecosystem choices also show the same “payments first” thinking. Plasma announced it joined Chainlink Scale and adopted Chainlink as an official oracle provider, including services like data feeds and cross-chain messaging, which is the sort of integration DeFi developers look for before they take a new chain seriously. On liquidity and distribution, LayerZero’s published case study claimed Plasma drew about $8B in net deposits within three weeks of an early October 2025 launch window, quickly placing it among the larger chains by TVL. Those numbers are dramatic, and it’s fair to wonder how much is durable versus incentive-driven, but even a skeptical reading suggests strong initial demand for a chain that treats stablecoin movement as the primary job.

Finally, there’s the question of how any of this reaches people who don’t care about block times or consensus names. A January 2026 update from Rain describes integrating Plasma so builders can launch card programs that make stablecoin balances spendable in everyday commerce, which is a pragmatic route to distribution: meet users where they already are, at the point of purchase.

None of this magically removes the trade-offs. If you build a chain around stablecoins, you also inherit the baggage that comes with them: a lot of power sitting with the issuer, constant compliance pressure, and the real possibility that a policy change upstream ripples through everything downstream. And Plasma still has to prove itself in the plain, unromantic ways that matter most—staying online, being clear about how decisions get made, and holding up when markets are stressed and everyone’s watching. But as stablecoins keep sliding into mainstream settlement conversations, specialization starts to look less like a limitation and more like a design discipline: do one job, do it cleanly, and make it boring enough that people stop thinking about the chain at all.