Most discussions about blockchain performance get stuck on consensus. Finality times, validator counts, TPS these are the usual metrics. But the engine that actually processes your transaction, the execution client, often operates in the background. For a chain like $XPL | Plasma, which is built not for general speculation but for the specific, high volume reality of stablecoin settlement, this engine is not a background detail. It is the core of the user experience. Choosing Reth, the Rust language implementation of the Ethereum execution client, was not just a technical preference for them, it was a foundational decision for a chain where latency and cost predictability directly translate to usability. My review of their technical documentation and ecosystem announcements suggests this choice is central to their value proposition for developers and end users.

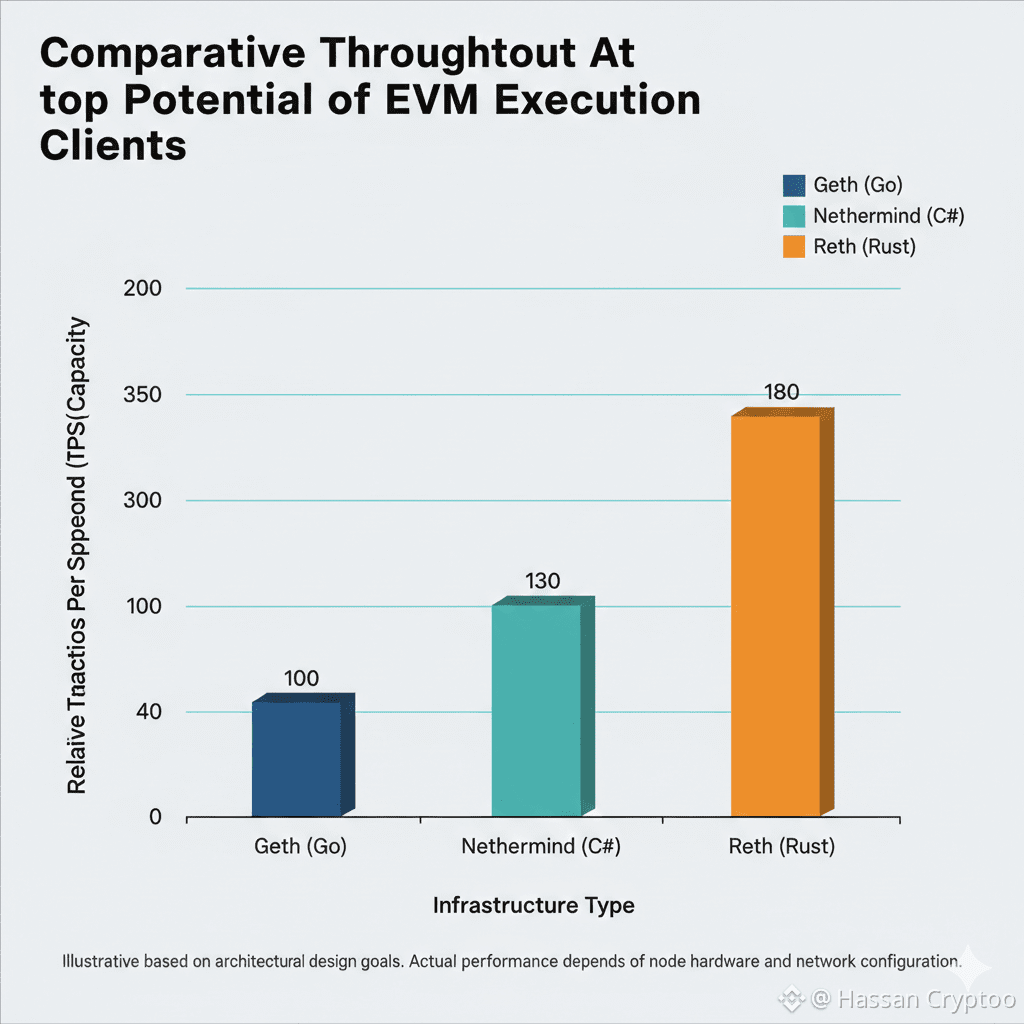

To understand why, you have to look at what Reth is designed to do. Created by Paradigm, its primary goal is maximal performance and modularity. It is built for speed from the ground up, leveraging Rust's efficiency to outpace older clients like Geth in synchronization and block processing. For Plasma, adopting Reth as the base for its EVM compatible execution layer means inheriting this performance ceiling. The chain's stated sub second finality, powered by its PlasmaBFT consensus, would be bottlenecked by a slower execution engine. Reth removes that bottleneck. It allows the chain to handle the throughput demanded by payment settlements and DeFi operations without the execution layer becoming a lagging component. This is not about hypothetical scale, it is about aligning every layer of the stack with a single performance oriented goal.

The benefits cascade into tangible features. Plasma's introduction of gasless USDT transfers and stablecoin first gas mechanics are ambitious usability leaps. These features require incredibly efficient state handling and transaction processing to be economically viable. A bloated or slow execution client would make the subsidy costs of gasless transactions prohibitive or create unpredictable latency. Reth's architecture, which emphasizes clean state management and rapid execution, provides the technical foundation that makes these user centric features sustainable. When you can process and finalize a stablecoin transfer quickly and at near zero cost to the sender, you move from replicating Ethereum's model to creating something genuinely tailored for money movement. The April 2024 announcement on their X account highlighting their "EVM+ performance" directly ties this Reth based capability to their mainnet objectives.

This focus on a streamlined execution layer also complements Plasma's other key differentiator, Bitcoin anchored security. The security model, which aims to leverage Bitcoin's neutrality, deals with consensus and Data availability. The execution layer, powered by Reth, handles the computation. This separation is intentional. It lets each layer specialize. Reth handles the complex, high speed world of EVM smart contracts and token transfers with efficiency, while the security is derived from a separate, battle tested source. For institutions or payment providers, this creates a compelling profile, execution speed and compatibility they are familiar with, underpinned by a security model that aims for strong censorship resistance.

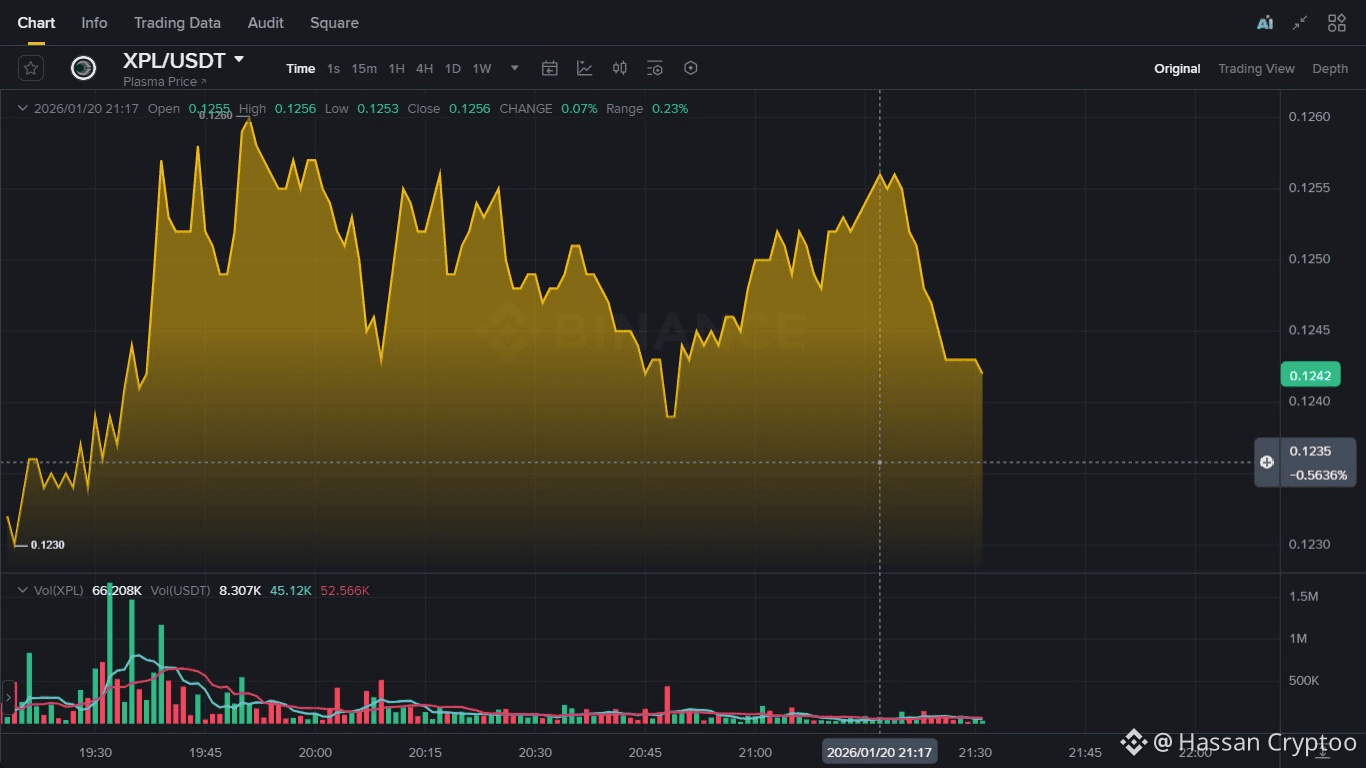

Looking at the current token metrics, with XPL trading around $0.1139 and a market cap near $215.3 million, the market is clearly valuing this as a very early stage infrastructure bet. The token's role within this Reth powered ecosystem is designed to secure the network and govern its parameters. Its value accrual is intrinsically linked to the adoption of the chain itself, to whether developers and users choose Plasma for its stablecoin settlement capabilities. The technical choice of Reth is a large part of that value proposition. It is a commitment to providing a development environment that is not only compatible with Ethereum's vast tooling but also performance competitive with newer L1s.

Ultimately, Plasma's decision to build on Reth is a signal of intent. It moves beyond the common narrative of simply offering "lower fees than Ethereum". It involves designing a blockchain where every element, from its consensus mechanism to execution layer, is chosen to optimally support a particular application. For developers aiming to build applications natively for stablecoins, blending Reth's velocity with Plasma's customized economic attributes, such as fee-free transfers, establishes a unique ecosystem. Success will be judged not merely by transactions per second, but by its ability to make transacting digital dollars feel effortless and unavoidable. This is the core challenge for any payment-oriented blockchain, and Plasma's technical groundwork is precisely engineered to address it.

by Hassan Cryptoo