Author: Debao, first published on Binance Square.

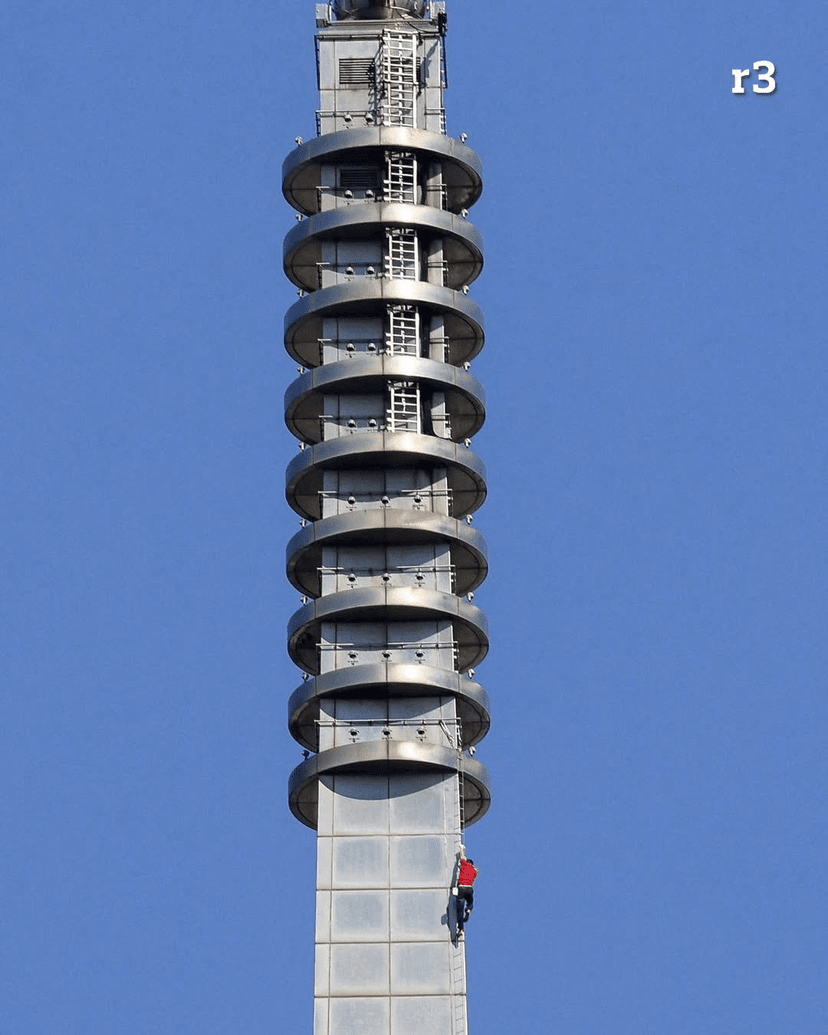

Recently, Alex Honnold successfully climbed the Taipei 101 building unprotected, causing a huge sensation worldwide; with no protection, on the top floor building ravaged by strong winds, he cannot make a single mistake, which is very similar to when we trade.

Sometimes one step down is an abyss.

What can we learn and gain from Alex's unprotected climbing that is related to trading, so that we can ultimately succeed in reaching the top?

Let's imagine, from Alex Honnold's perspective, when he stands at the bottom of Taipei 101, there is no passionate narrative.

There is neither the passion for 'taking a gamble' nor the fantasy of 'what if it succeeds?'.

He only does one thing: judge whether he will die.

This is the cruelty of unprotected climbing.

Failure is not 'come back next time', not 'retreat', but directly going to zero.

Trading, essentially, is the same type of game.

The difference lies in the fact that most traders think they are playing a simulator.

Before truly unprotected climbing, Alex repeatedly practices the same route, down to every handhold, foothold, and center of gravity shift. He knows where he can rest, where he cannot hesitate, and where there is no room for remedy once a mistake is made.

He did not climb up relying on courage.

He climbs up by clearing uncertainties in advance.

And most traders, conversely, are the opposite.

They enter without knowing the risk boundaries, start looking for reasons temporarily when the market fluctuates, and pray for the market to 'give an opportunity' after losses widen. They pin their hopes on future uncertainties but have never asked themselves a cold question like Alex did in advance:

If this step goes wrong, will I die?

In trading, this question corresponds to:

If this trade is completely wrong, can I still stay at the table?

Alex never climbs when in a fuzzy state.

If the body is not right, the weather is unstable, and the mind fluctuates, he directly gives up.

This is not caution; it is professionalism.

And the most common self-deception of traders is:

"I feel I can", "should be about right", "let's wait and see".

Alex does not wait for 'feelings'.

He only accepts 'certainty'.

There’s another often overlooked detail.

Unprotected climbing is not continuous high risk.

The truly dangerous parts are only those few critical actions that must be completed continuously without stopping.

Alex knows clearly:

Risk is not evenly distributed; it is concentrated and explosive.

Excellent trading is the same.

What truly determines life and death is never the fluctuations you watch daily, but:

Whether following the trend in heavy positions.

Whether still holding on during liquidity exhaustion.

Was there an execution when leaving the scene?

These positions, once judged incorrectly, render all subsequent 'efforts' meaningless.

So Alex never pursues 'full thrill'.

He only ensures that he absolutely does not make mistakes at critical points.

The most scarce ability in trading is not prediction, but this point:

Knowing where absolutely cannot go wrong.

Unprotected climbing is not adventurism.

It is an extreme respect for the structure of risk.

If you take trading as a stage for excitement, comebacks, and proving yourself, you are destined to tremble on the edge of a cliff.

If you take trading as a path that must be walked countless times in advance, confirming the cost of each step, it may become a long-term behavior.

At the moment Alex climbs up, there is no ecstatic joy of victory.

There is only one kind of calm.

That kind of calm comes from a fact:

All possible mistakes that could kill him were eliminated long before starting.

This is also the only state worth pursuing in trading.

Finally, let's congratulate Alex Honnold once again for winning greatly.