🔍Key events

The cryptocurrency market opened the week with a deep decline against the backdrop of a global withdrawal of investors from risky assets. The two main negative drivers were the escalation of political tensions in the USA and a record outflow of funds from exchange-traded funds (ETFs). Traders' concerns are heightened by the risk of a new government shutdown in the USA at the end of the week, undermining stability and forcing investors to reassess their positions in crypto assets.

📈 Key Indicators

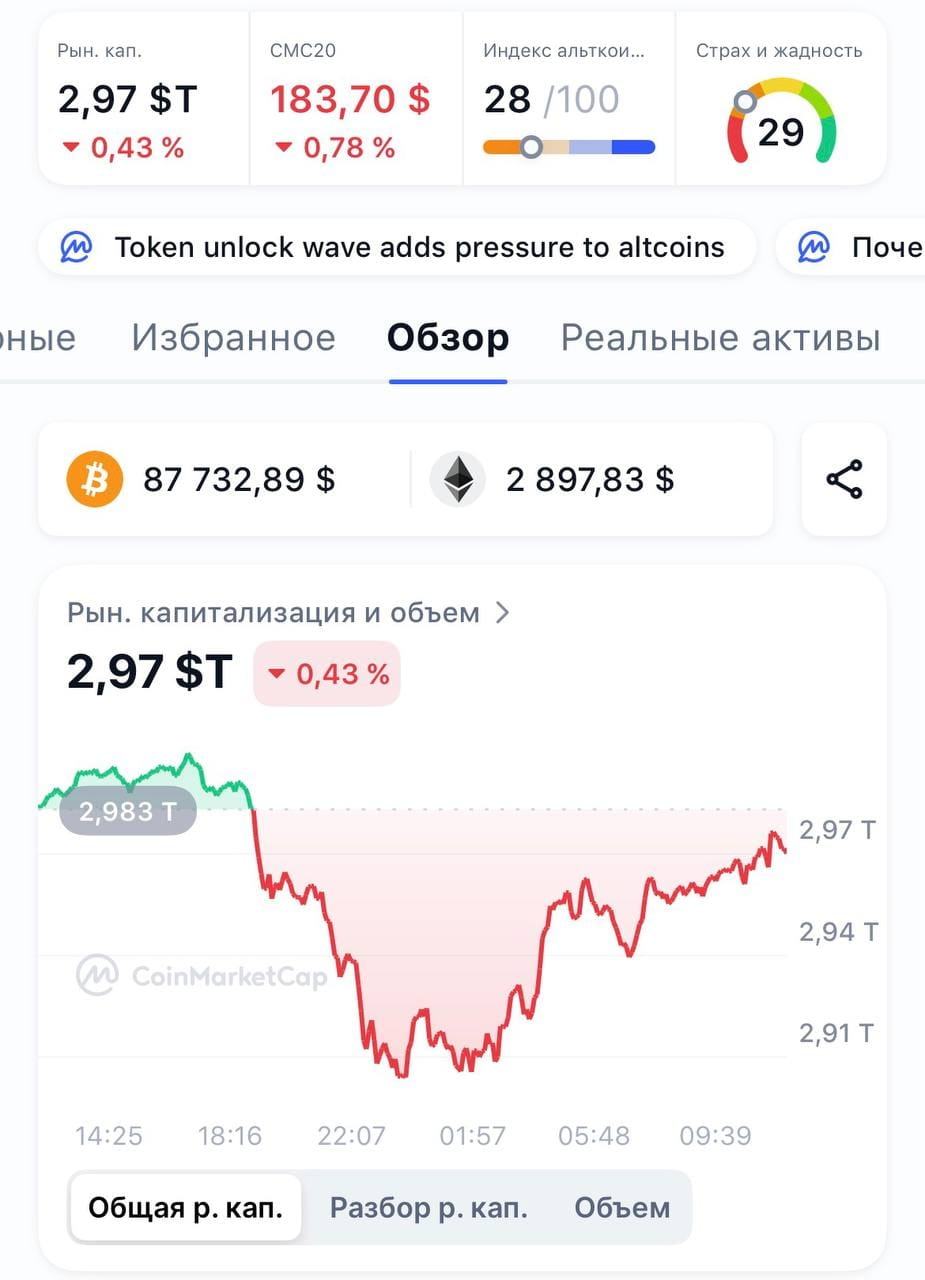

Bitcoin: Updated its minimum since December 19, 2025, falling to $86,000 in the morning session. By 11:00 MSK, the price recovered to $87,800, showing a decrease of 1% over the day and 5% over the week.

Ethereum: Dropped to $2,780, but regained part of the decline to $2,890. The decrease over the day was 1.5%, and nearly 10% over the week.

Total market capitalization: Once again fell below the psychologically important mark of $3 trillion, amounting to approximately $2.97 trillion (-1% over 24 hours).

Top losers: Among the top 10, Solana (SOL) (-3%) was the hardest hit. Other notable assets include Monero (XMR), Dash (DASH) (down 5%) and World Liberty Financial (WLFI) token (down 6%).

🏛️Unique Macroeconomic Indicators

Mass liquidations: Over the past day, positions worth $678 million were forcibly closed, with more than 88% of losses incurred by traders expecting a rise. During a four-hour period at the peak of the decline, the liquidation amount reached $315 million.

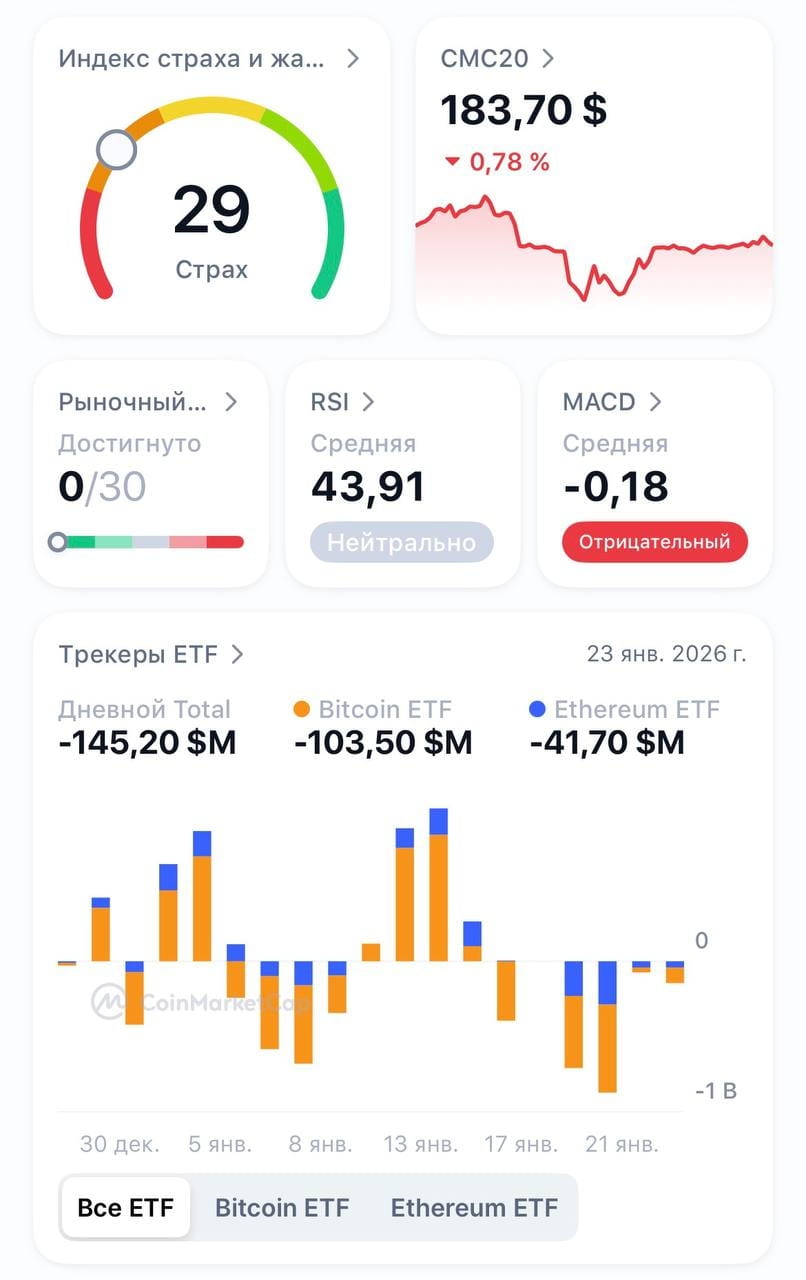

Record outflow from ETFs: U.S. spot Bitcoin ETFs recorded a weekly outflow of $1.33 billion — the second largest in their history. $611 million was withdrawn from Ethereum ETFs.

Market Sentiment: The fear and greed index dropped to 29 points, entering the 'fear' zone, indicating a high probability of panic selling.

Contrast with gold: While the crypto market was falling, gold continued to reach historical highs, closely approaching $5,000 per ounce, highlighting the current preference of investors for traditional safe-haven assets.

💎Market Insights

The market is demonstrating a classic reaction to macroeconomic uncertainty and a loss of risk appetite. The drop to the level of $86,000 for Bitcoin is testing an important support zone. A key factor for stabilization will be the rhetoric of the Federal Reserve following the meeting on January 28, which will determine expectations for monetary policy. As long as the fear index remains in the extreme zone and outflows from ETFs continue, pressure on prices may persist. However, this current correction, according to several experts, does not signify the onset of a 'crypto winter' but reflects the maturation and structural changes of the market, which is increasingly integrating into the global financial system.

$BTC $ETH $SOL #XMR #DASH #WLFI