[2026 Regulatory Storm] Why did Coinbase "flip" late at night? Unveiling the interest rate war behind the U.S. stablecoin bill

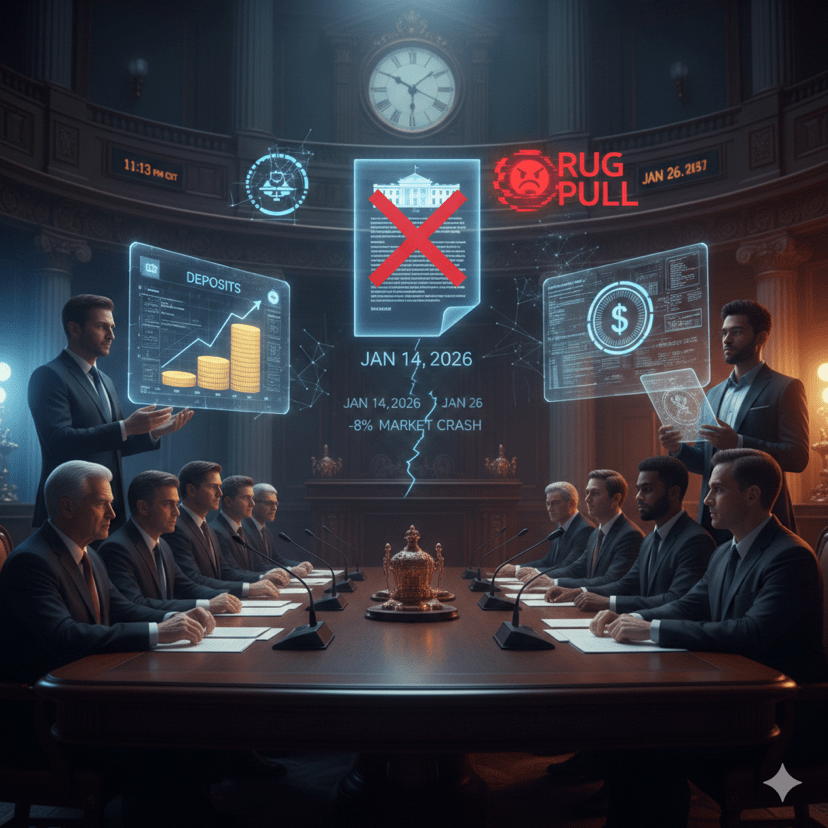

In mid-January 2026, the global cryptocurrency market experienced a thrilling "Washington Shock." The Clarity Act, which was originally seen as a savior for the industry, was unexpectedly withdrawn by Coinbase at the last moment, triggering a market crash and a furious response from the White House.

Behind this storm, it is not just a controversy over legal provisions, but a survival game between traditional banking and the cryptocurrency industry regarding the "5 trillion dollar deposits."

1. Starting point of the event: Brian Armstrong's late-night tweet

On January 14, 2026, Coinbase CEO Brian Armstrong dropped a bombshell on the X platform, announcing the withdrawal of support for the (Clarity Act). He stated: 'I would rather have no bill for now than a bad bill that stifles innovation.'

This move directly caused Coinbase's stock price to fluctuate and put the previously expected bill into an 'emergency pause' state. White House officials even privately described Coinbase's temporary reversal as a 'Rug Pull'.

2. Why does Coinbase want to flip the table? The three major 'poisons' in the bill

According to the latest revised draft of the bill, the banking lobby successfully inserted several provisions that could destroy the stablecoin ecosystem:

* 'Yield prohibition': The bill stipulates that exchanges and issuers cannot pay interest solely because users 'hold' stablecoins. This directly impacts the USDC reward mechanism that Coinbase and Circle cooperate on (currently yielding about 3.5% to 5% annually).

* 'Tokenization restrictions': The bill essentially restricts the trading of RWA (real-world assets, such as US stocks and government bonds) on public chains, which is a fatal blow to crypto institutions that have been laying out RWA for years.

* 'DeFi's joint liability law': Although the bill provides some protection for pure code developers, there remains significant regulatory space for the front-end and service providers of decentralized protocols, which could lead to a de facto 'de-Americanization' of DeFi.

3. The truth behind: The 'spread war' of traditional banks

The essence of this game is a battle for deposits.

The current survival logic of the banking industry is: absorb user deposits at a low interest rate of 0.5%, and then purchase government bonds at a 4.5% interest rate to earn the spread. However, stablecoins (like USDC) transparently return government bond earnings to users, which threatens the banks.

Research from the Federal Reserve shows that if stablecoin yields are legalized, the US banking system could face a deposit outflow of 26% (about $5 trillion). Therefore, the banking group is fighting to block 'stablecoin interest' in the bill.

4. Latest developments: The game at the negotiating table

As of January 21, the fires of conflict have not yet subsided:

* White House attitude: From anger to pragmatism. White House advisor David Sacks is in intensive negotiations with Coinbase, asking them to submit a 'revised plan' before the end of January.

* Compromise proposal: The current negotiation direction is reported to be: 'passive holding' with no yield, but 'active behavior' with rewards. This means users must stake, provide liquidity, or pay transfer fees to earn stablecoin yields, distinguishing them from bank deposits.

* Market impact: Due to delays in the legislative schedule, market sentiment in the first half of 2026 will be highly influenced by Washington's policy direction.

5. Summary: This is a showdown between algorithms and traditional banks

Although Coinbase's choice caused market turmoil in the short term, in the long run, this is about defending the 'definition right' of the crypto industry. As Brian Armstrong said, if a neutered version of the bill is accepted, stablecoins will forever become 'employees' of the banks.

Key observations for readers:

* End of January amendment: Will Coinbase propose a compensation mechanism that satisfies the banks?

* Geopolitical arbitrage: If the US bill is too harsh, will funds accelerate to Hong Kong or Singapore, where the system is more complete?