Key points:

Gold reaches a historic high of $5,110.50 per ounce

Silver continues to rise to $110.11

Platinum reaches a historic high of $2,918.80

According to analysts, the price of gold could reach $6,000 this year

By Swati Verma

Gold prices extended their record rally to surpass $5,100 on Monday, as central banks and investors sought refuge from geopolitical risks and market volatility induced by Trump.

Spot gold

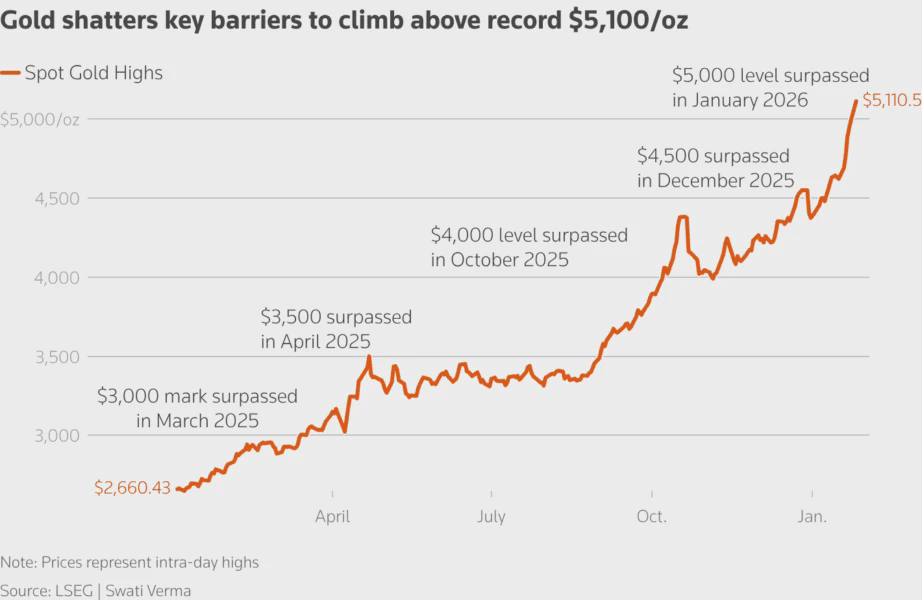

GOLD rose 2.2% to $5,091.61 an ounce at 1140 GMT after reaching a record $5,110.50. U.S. gold futures GOLD for February delivery gained the same amount to $5,089.90. Thomson ReutersGold shatters key barriers to climb above record $5,100/oz

Thomson ReutersGold shatters key barriers to climb above record $5,100/oz

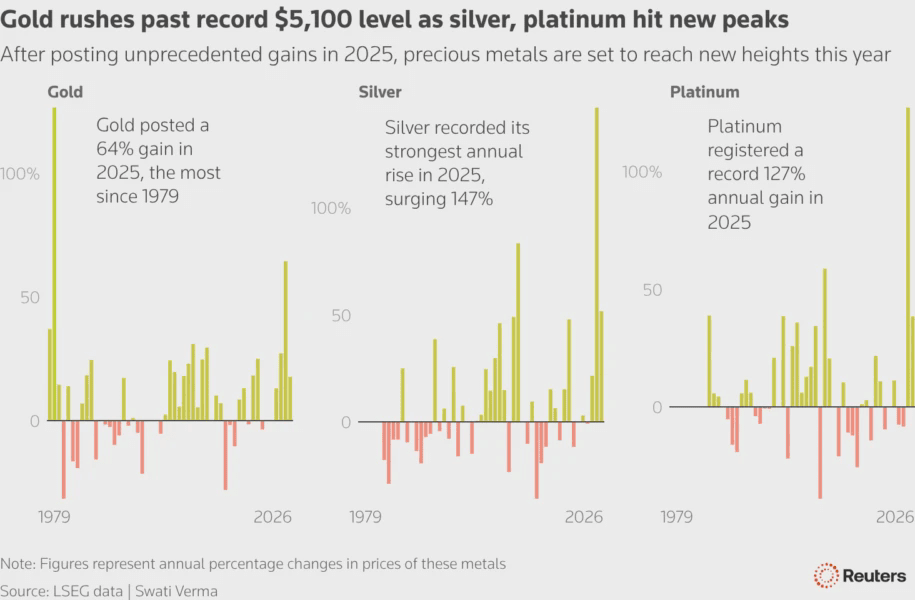

Gold surged 64% in 2025, its largest annual increase since 1979, breaking multiple records thanks to safe-haven demand, easing U.S. monetary policy, strong purchases by central banks, and record inflows into exchange-traded funds.

Prices have already risen nearly 18% since the beginning of the year.

Thomson ReutersGold rushes past record $5,100 level as silver, platinum hit new peaks

Thomson ReutersGold rushes past record $5,100 level as silver, platinum hit new peaks

U.S. President Donald Trump and the uncertainty he generates at multiple levels remain the main driver of the price rebound and the investor momentum driven by fear of missing out, said Ole Hansen, head of commodity strategy at Saxo Bank.

In his latest tariff threats, Trump said on Saturday that he would impose a 100% tariff on Canada if it proceeds with a trade agreement with China.

Meanwhile, the yen touched a two-month high against the dollar as speculation increased about possible intervention between the United States and Japan, while investors also unwound positions in dollars ahead of this week's Federal Reserve meeting and the potential announcement of a new Fed chair.

The dollar index DXY fell to four-month lows, indicating a weakness that makes metals priced in dollars more attractive to foreign buyers.

Analysts have stated that gold has more room to rise this year, potentially towards $6,000, due to increasing global tensions and strong demand from central banks and consumers.

Alexander Zumpfe, precious metals trader at Heraeus Metals Germany, stated that new increases cannot be ruled out in tense scenarios, especially if confidence in currencies or financial assets deteriorates further, and added that such movements could be accompanied by strong temporary corrections.

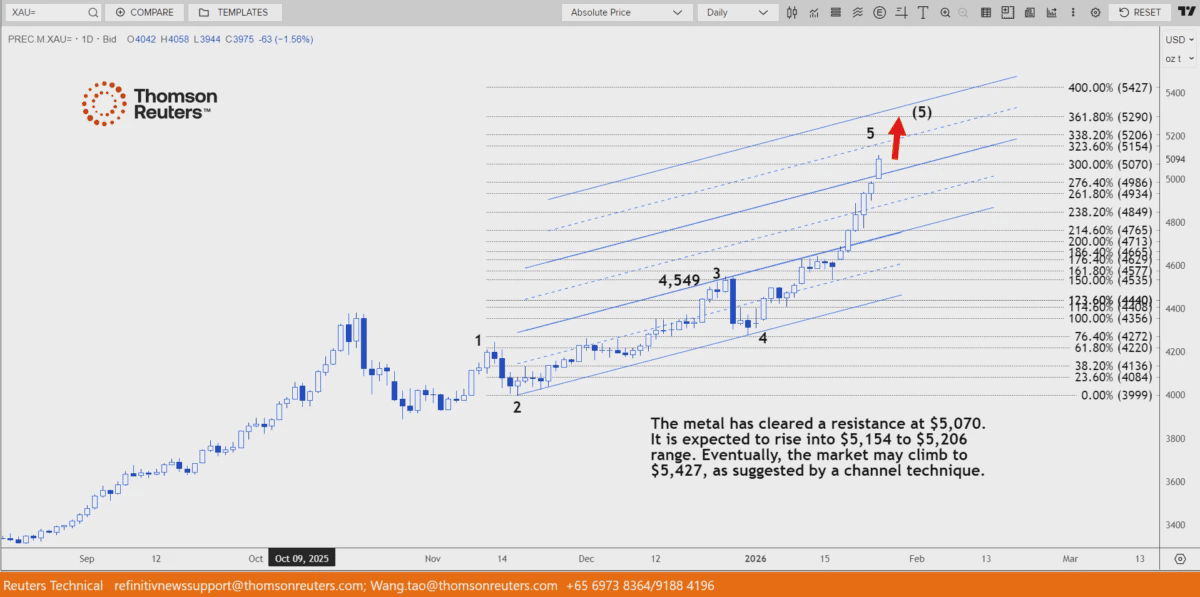

According to Wang Tao, technical analyst at Reuters, spot gold has surpassed the resistance of $5,070 and is expected to rise to a range between $5,154 and $5,206 an ounce.

Ultimately, it could rise to $5,427, he added.

Thomson Reutersxau extra

Thomson Reutersxau extra

Spot silver XAGUSD1! reached new highs at $110.11 an ounce and rose 5.8% to $108.92.

On Friday, silver surpassed $100 for the first time, exceeding its record rise of 147% from last year, as retail flows and momentum-driven purchases exacerbated a prolonged shortage in physical markets.

Spot platinum PL1! rose 4.4% to $2,888.51 an ounce after touching a record $2,918.80, while spot palladium XPDUSD1! rose 5.3% to $2,115.75 after registering a three-year high of $2,142.70.