The global financial landscape sits at a pivotal crossroads. While stablecoins have exploded to represent over $299 billion in market capitalization and trillions in monthly transfer volume, the infrastructure supporting these digital dollars remains fundamentally broken. Transactions that should take seconds drag on for minutes. Fees that should cost pennies consume meaningful percentages of transfers. The rails carrying tomorrow's money were built for yesterday's problems.

The global financial landscape sits at a pivotal crossroads. While stablecoins have exploded to represent over $299 billion in market capitalization and trillions in monthly transfer volume, the infrastructure supporting these digital dollars remains fundamentally broken. Transactions that should take seconds drag on for minutes. Fees that should cost pennies consume meaningful percentages of transfers. The rails carrying tomorrow's money were built for yesterday's problems.

Enter Plasma, a Layer 1 blockchain that dared to ask a simple question: what if we stopped retrofitting general-purpose chains and built something specifically for stablecoins?

The answer materialized on September 25, 2025, when Plasma's mainnet beta launched with a staggering $2 billion in stablecoin liquidity on day one. Within a week, that figure had ballooned past $5.5 billion in total value locked. These numbers tell a story of pent-up demand meeting purpose-built supply.

Traditional blockchains emerged before stablecoins gained meaningful traction. Ethereum was designed for smart contracts, Solana for speed, Bitcoin for sound money. None were architected with digital dollars as the primary consideration. This mismatch creates friction everywhere: high transaction fees, slow settlement times, and clunky user experiences requiring native tokens just to move money.

Plasma flips this equation entirely. The network enables zero-fee USDT transfers through an innovative protocol-managed paymaster system. Users can send stablecoins without ever touching the native XPL token, removing perhaps the biggest barrier preventing mainstream adoption. This isn't a promotional gimmick it's baked into the protocol's DNA.

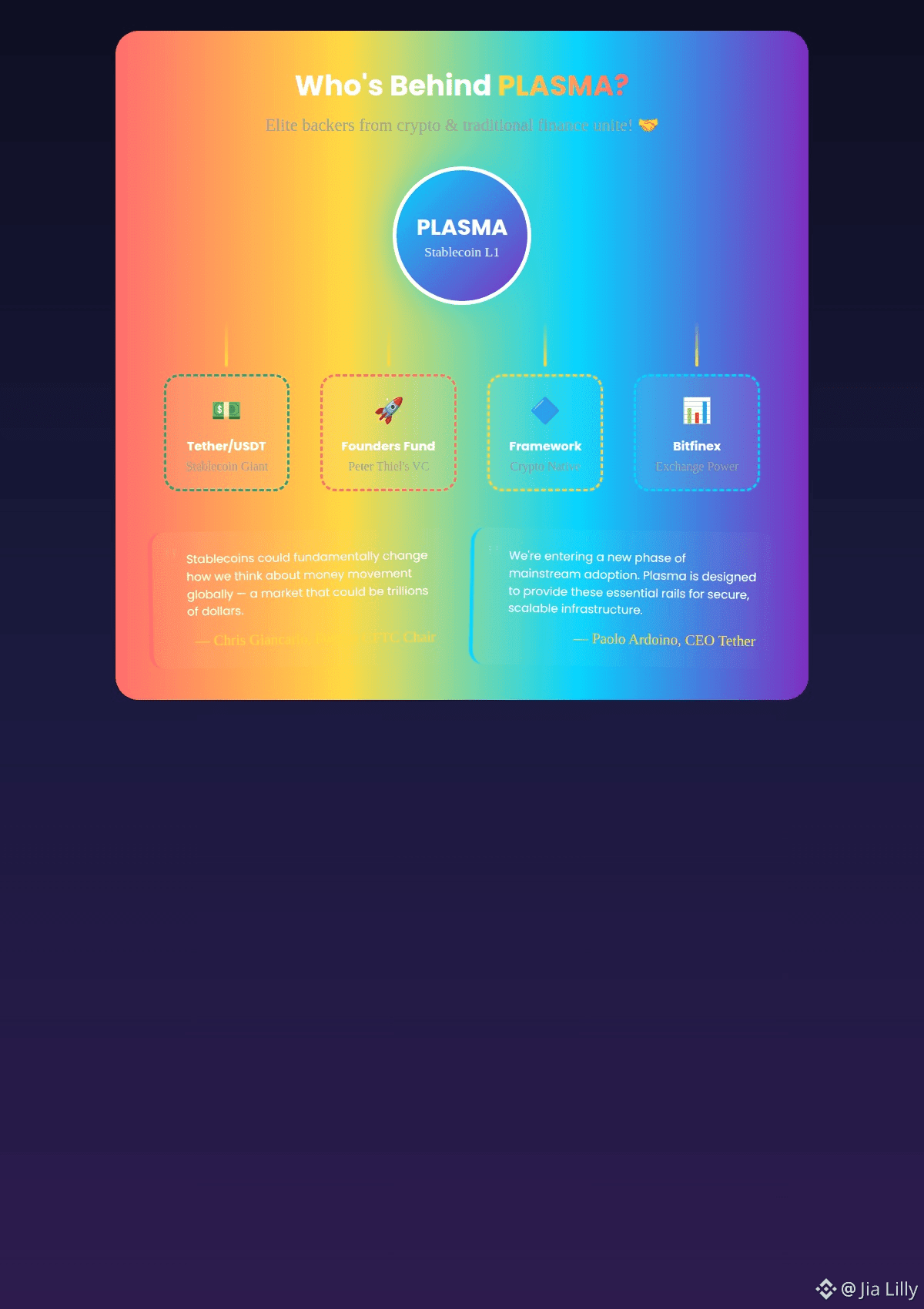

The backing tells its own story. Tether CEO Paolo Ardoino has publicly championed the project, stating that secure and scalable infrastructure is essential as stablecoin adoption enters mainstream territory. Peter Thiel's Founders Fund led investment alongside Framework Ventures, Bitfinex, Flow Traders, and DRW. This coalition represents heavyweights from both crypto native and traditional finance circles.

The timing proves impeccable. U.S. Treasury Secretary Scott Bessent has identified stablecoins as crucial for maintaining dollar dominance globally. David Sacks, appointed as Crypto and AI Czar, envisions stablecoins creating trillions in demand for U.S. Treasuries. Former CFTC Chairman Chris Giancarlo describes a potential multi-trillion dollar market that could fundamentally change global money movement.

Plasma positions itself as the infrastructure layer for this transformation. Not another blockchain competing for speculative trading volume or NFT launches, but dedicated rails for moving value at internet speed. The network processes over 1,000 transactions per second with sub-second block times, specifications engineered specifically for payment applications rather than generalized computation.

The stablecoin market has searched for its native home. Plasma appears ready to provide it.