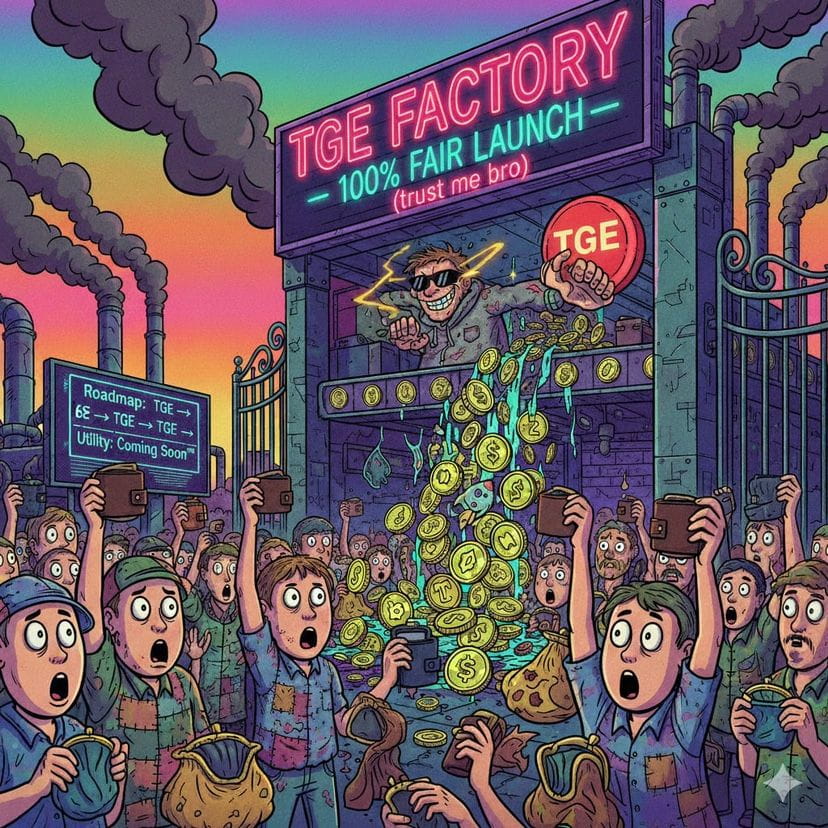

IS TGE BEING MISUSED – THE MARKET IS NOT THE MAIN ISSUE, THE CORE LIES IN THE THINKING OF APPLICATION

Just looking directly at reality, most crypto projects today – especially those with "BIG" VC backing – are launching TGE in a way that is extremely misaligned with true value. Tokens are released with sky-high valuations, while the product is still unfinished, and PMF is nowhere to be found. User growth mainly relies on incentives and airdrops, the data looks good but is empty.

The consequences are all too familiar: as soon as it lists, the token dumps without brakes, prices plummet, and holders get stuck providing liquidity for those who entered early. This is not a 'bad market', but rather a TGE model being used at the wrong time.

In my opinion, TGE should only exist in two clearly defined extremes:

First, issuing extremely early – almost from the moment the idea is formed. Tokens at this point can be seen as a kind of ICM: very low valuation, extremely high risk. This is a playground for degen, builders to experiment quickly, living on fees or narratives, while participants accept a '0 or 100' probability. Everything is transparent: there is nothing beyond the idea, and anyone who plays must bear the consequences.

Secondly, TGE is at a stage that has matured. The project has a working product, real users, has cash flow, or at least a clear operating model. Only then does TGE truly resemble an IPO: creating liquidity, raising additional capital for expansion, and rewarding those who have been with it from the start.

The problem lies in the middle – where many projects are placing themselves in the position of 'future unicorns' while in reality still struggling to find PMF. An early TGE without intrinsic strength results in tokens lacking natural demand. Reduced incentives lead to user disappearance, price decreases cause trust to vanish, and ultimately the community becomes the only remaining source of revenue.

The market needs to be correctly segmented for proper roles. Ideas should remain in the experimental corner, with degen playing with degen. Meanwhile, projects backed by VCs should learn to operate systematically like Web2: build the product first, prove the value first, then consider the token issuance. VCs may not like it because capital is locked up longer, but in the current context, there are plenty of tools to exit early positions like the secondary market or equity tokenization.

Looking back at the series of failed TGEs in the past, it is clear: continuing to pump those tokens with imaginary valuations, lacking intrinsic value into an already overloaded market will not resolve anything, other than further eroding trust.

On the side of investors, the advice remains the same but is always correct: don't rush in just because you see a big VC logo. Look to see if the project is selling a 'future story' or if it has real value in hand. If there is 'meat', then eat; otherwise, it is easy to become someone who pays for someone else's dream.